- New Bitcoin pockets creations have fallen dramatically, reaching ranges final seen in 2018.

- Regardless of the drop, technical analyses counsel a possible upcoming rally post-Bitcoin halving.

Bitcoin [BTC], the main cryptocurrency, has been experiencing a stagnant section, struggling to surpass the $67,000 resistance degree.

Not too long ago, it achieved a 24-hour excessive of $67,697 however then noticed a slight retreat, now buying and selling at round $66,886.

This minor fluctuation comes at a time when Bitcoin’s ecosystem is displaying indicators of decreased exercise, notably within the creation of recent addresses.

Simply six months in the past, the Bitcoin community was buzzing with exercise, partly fueled by pleasure over spot Bitcoin ETFs, developments like Ordinals, and anticipation of the upcoming halving occasion.

This led the typical weekly variety of new Bitcoin addresses to almost attain the height ranges final seen in December 2017. Nonetheless, latest information signifies a big downturn on this development.

Dramatic drop in community participation

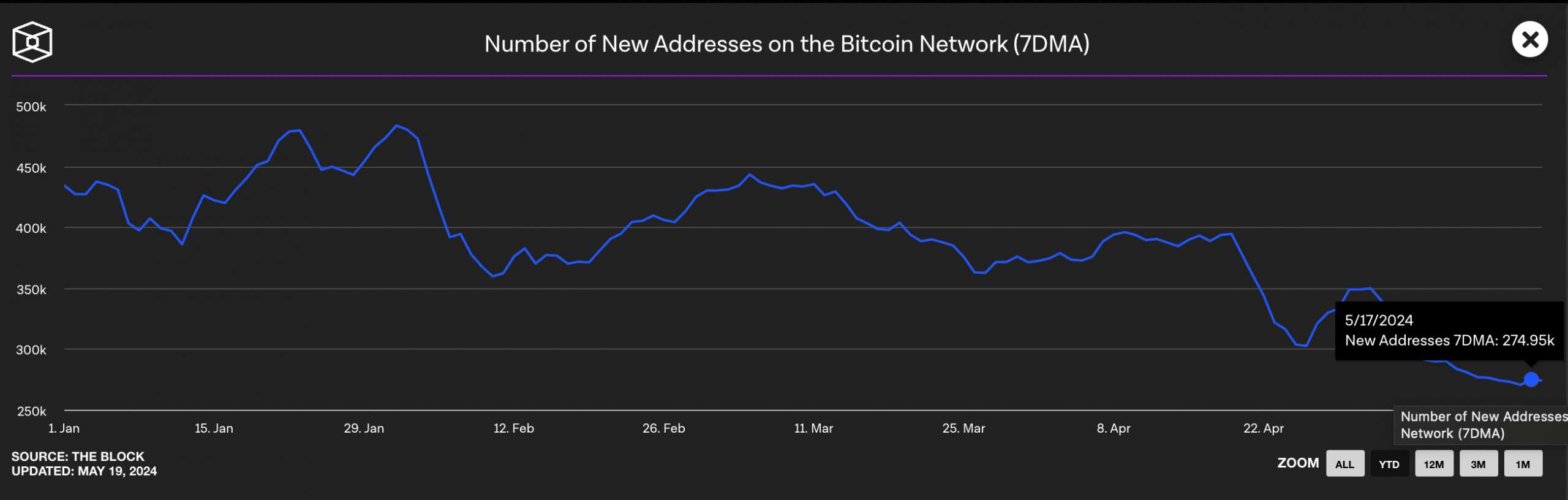

The seven-day transferring common variety of new addresses on the Bitcoin community has plummeted to ranges not seen since 2018.

Particularly, there was a lower from 625,000 new addresses per day six months in the past to only 274,000 at press time, in response to The Block’s information.

This decline in new tackle creation mirrored the scenario in early 2018, when curiosity in becoming a member of the Bitcoin community equally waned after a interval of heightened enthusiasm.

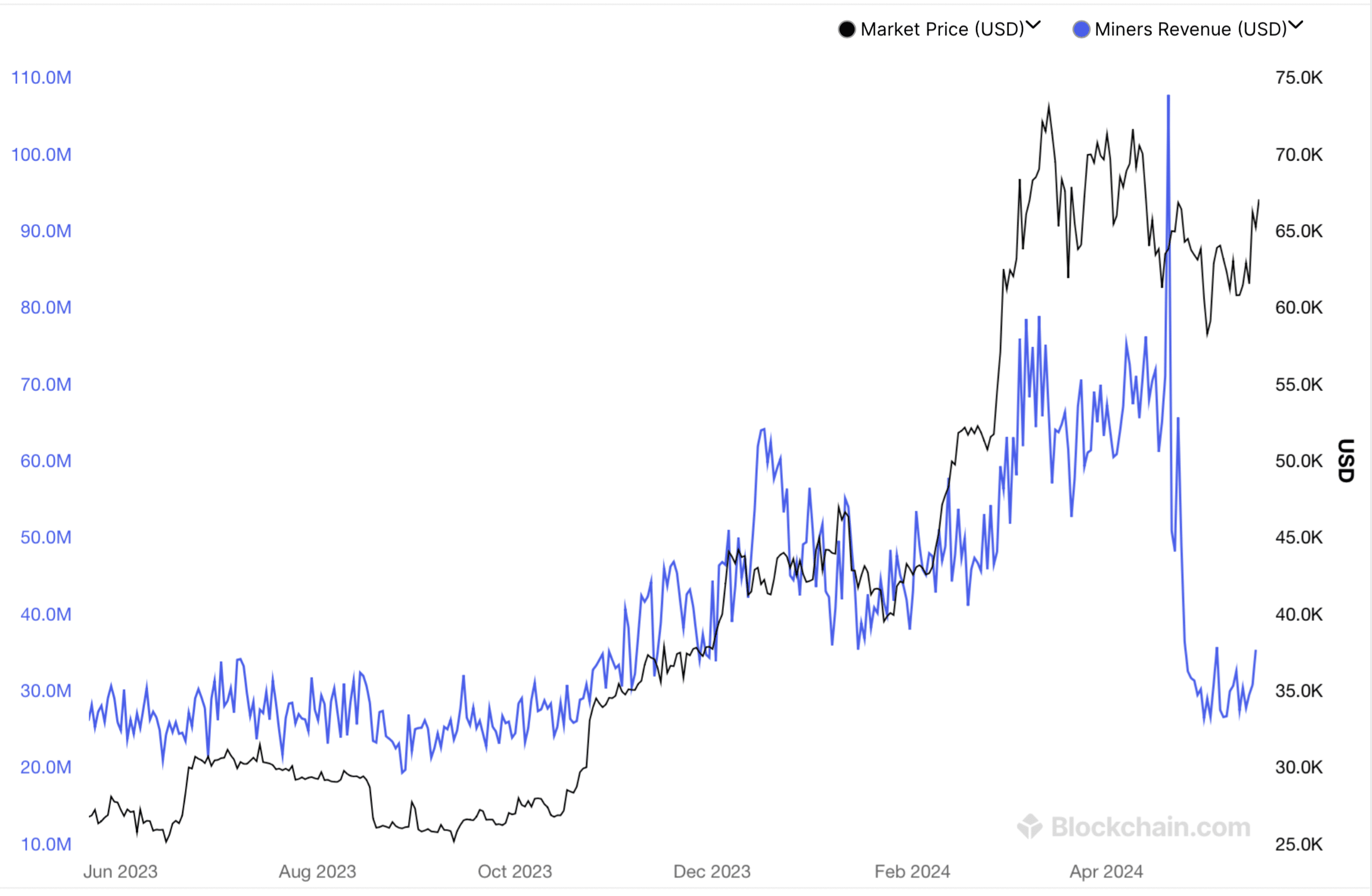

Different key metrics have additionally proven a downturn. For example, miner income and hash price, crucial indicators of the well being and safety of the Bitcoin community, have reached report lows.

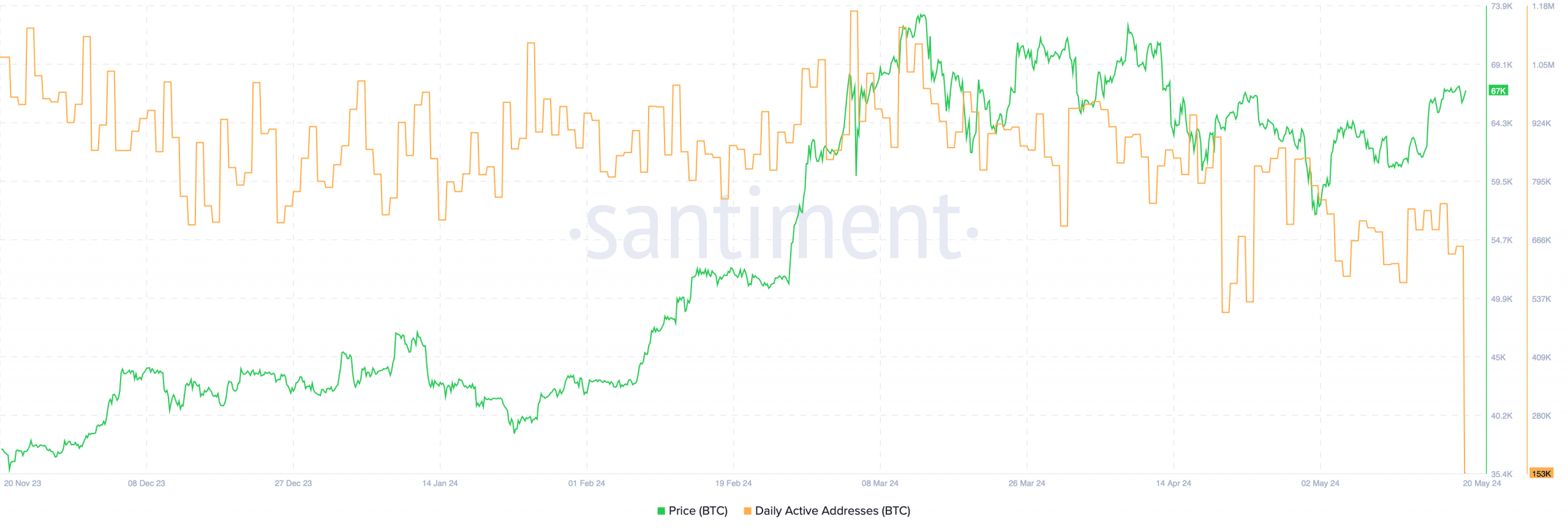

Day by day energetic addresses have adopted swimsuit, dropping from highs of over 73,000 in early March to underneath 20,000 on the time of writing, primarily based on information from Santiment.

Bitcoin: Market outlook amid declining metrics

Whereas the decline in these metrics might sound damaging, it’s important to know the broader context.

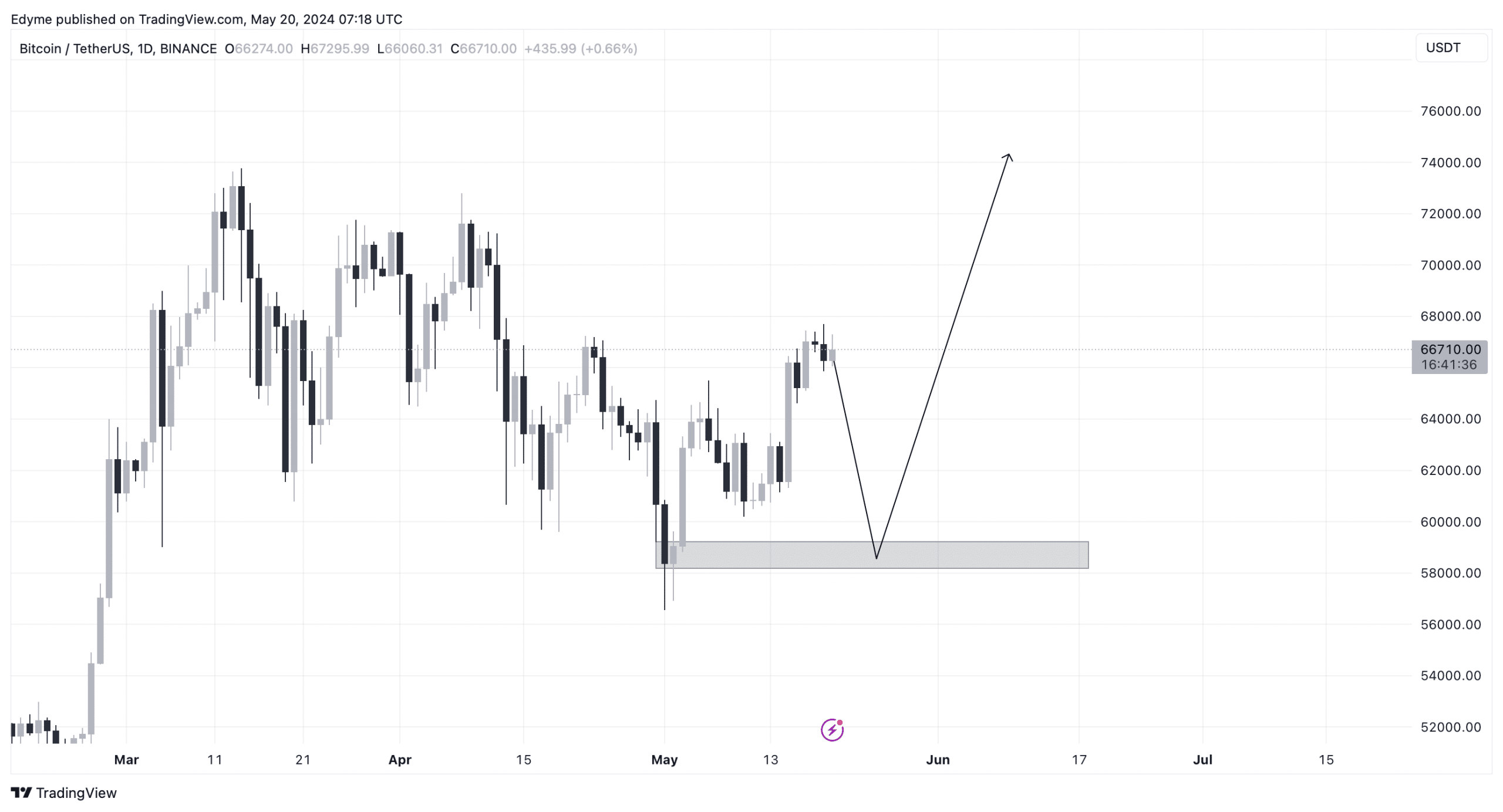

Historic information means that Bitcoin typically undergoes vital corrections earlier than a serious rally, particularly post-halving.

Technical analyses point out that Bitcoin might drop to round $60,000, a degree seen as essential for gathering the liquidity wanted to gasoline a big uptrend following the halving.

That is echoed by AMBCrypto’s latest technical evaluation on BTC’s every day chart, displaying that Bitcoin was testing resistance on the $67.3k degree and remained above its 20-day Exponential Shifting Common (EMA).

Is your portfolio inexperienced? Try the BTC Revenue Calculator

The Relative Energy Index (RSI) famous an uptick, hinting that Bitcoin may quickly convert its present resistance into help, indicating a bullish short-term outlook.

Nonetheless, the Chaikin Cash Move (CMF) prompt a possible value correction might be imminent.