- Bitcoin’s whole charges have dropped to a three-month low.

- Attributable to this, miners’ income derived from charges has declined.

Bitcoin [BTC] community charges have fallen to a report low because the Layer 1 (L1) transaction quantity continues to say no.

In a submit on X (previously Twitter), on-chain information supplier IntoTheBlock famous that transaction charges on the Bitcoin community plunged to their lowest degree in three months this week.

Recording a weekly transaction price totaling $12 million, the community noticed a forty five% decline from the earlier week.

State of the community

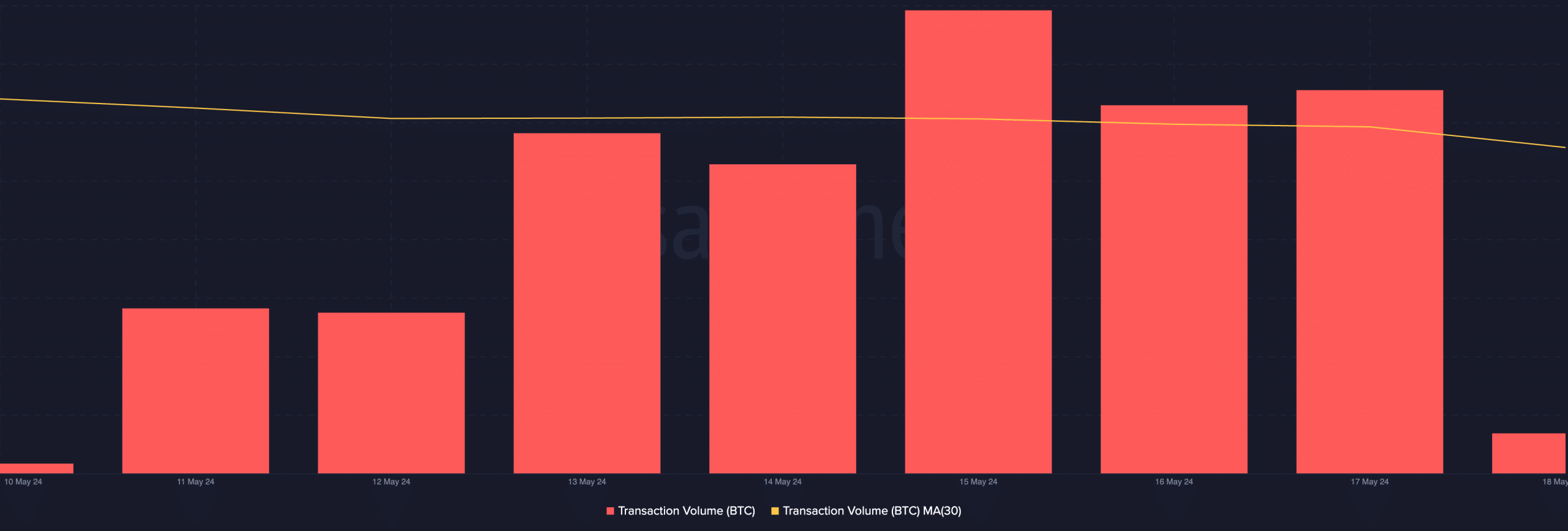

This week’s decline within the Bitcoin community’s price is because of the lower in its transaction quantity.

Based on Santiment’s information, the mixture quantity of BTC throughout all transactions accomplished on the community fell steadily through the week.

Between the eleventh and the seventeenth of Might, Bitcoin’s transaction quantity plummeted by 5%.

The common price paid per transaction dropped because the community noticed a decline in demand. Based on Messari, this decreased by 17% through the interval beneath evaluation.

At press time, the typical price of executing a transaction on the Bitcoin community was $2.56.

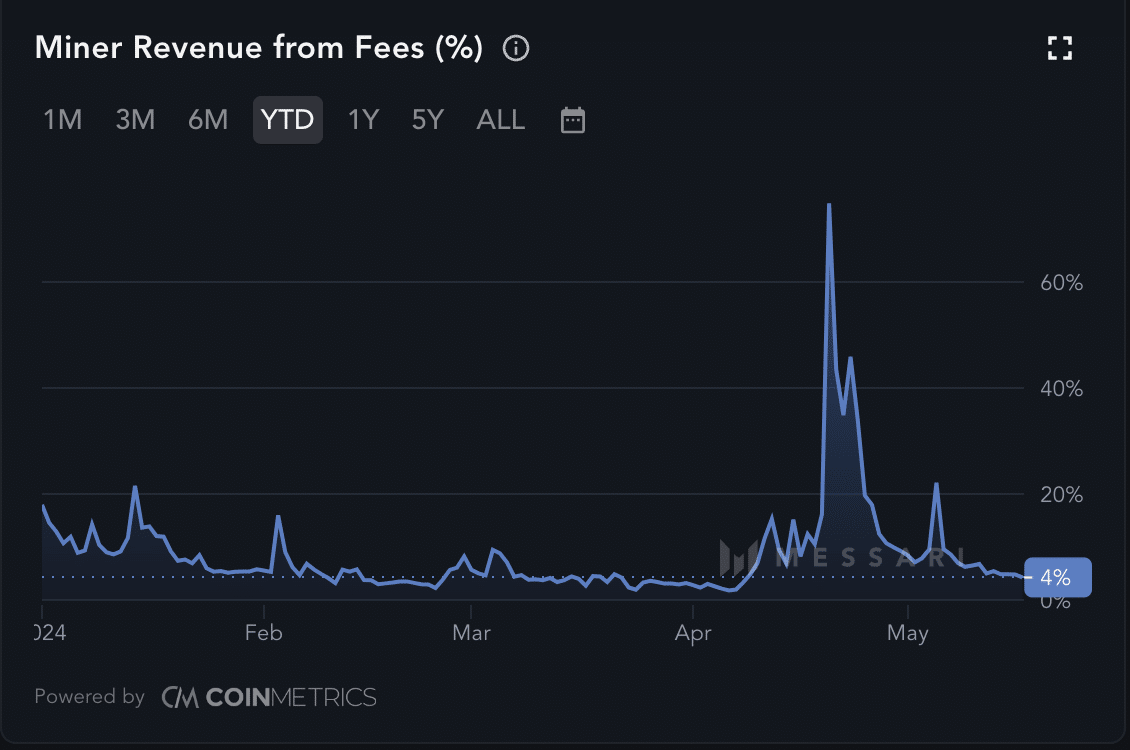

The miners on Bitcoin’s community are the first victims of its low community charges.

After the share of miner income derived from transaction charges rallied to a year-to-date excessive of 75% on the twentieth of April, post-halving occasion, it has since declined considerably.

As of this writing, solely 4% of miner income is derived from the charges paid by Bitcoin’s customers. This marked a 95% decline from the YTD excessive, per Messari’s information.

Miners offload cash to forestall losses

Low income and BTC’s latest worth troubles have compelled some miners to promote their holdings.

AMBCrypto assessed Bitcoin’s Miner Provide Ratio and located that it has fallen by 0.21% because the halving occasion.

This metric measures miners’ BTC holdings relative to the coin’s whole provide. When it declines this fashion, miners are promoting a bigger portion of their mined cash.

That is typically as a result of capitulation from excessive operational prices, the need to take revenue, or a insecurity within the coin’s worth.

Is your portfolio inexperienced? Take a look at the BTC Revenue Calculator

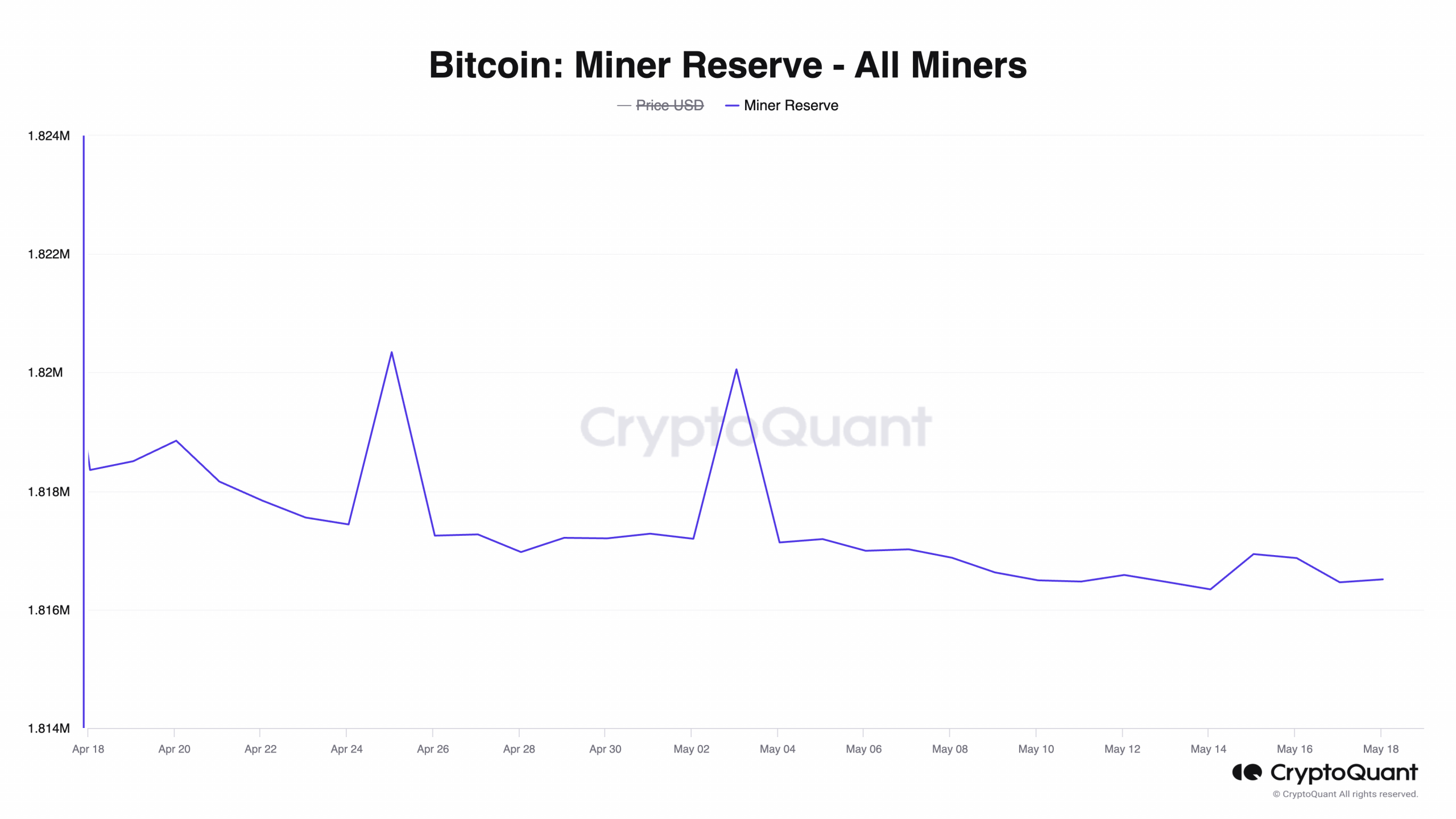

BTC sell-offs amongst miners on its community have led to a depletion of the coin’s Miner Reserve. This measures the quantity of cash held in miners’ wallets inside a specified interval.

Based on CryptoQuant’s information, BTC’s Miner Reserve, at 1.81 million at press time, has dropped by 1% because the twenty fifth of April.