- Bitcoin miners may promote as decreased mining rewards and transaction charges decrease revenues.

- A possible sell-off by miners may dramatically influence the cryptocurrency market.

Bitcoin [BTC] continues to carry vital worth, buying and selling above $60,000 regardless of a 2.3% lower over the previous day.

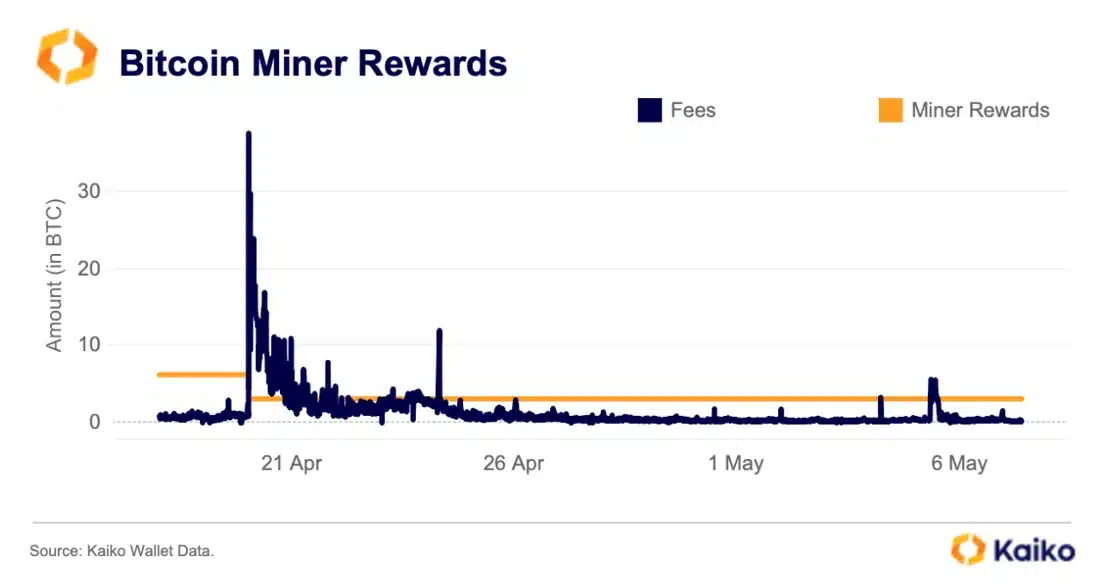

This resilience in value comes amid a difficult interval for Bitcoin miners, whose revenues have plummeted following the latest halving occasion, in response to knowledge from Kaiko.

Pressures on Bitcoin miners intensify

Bitcoin miners are dealing with rising strain to promote their holdings on account of diminishing revenues.

The current halving, which lowered mining rewards from 6.25 BTC to three.125 BTC, has considerably impacted their revenue.

This drop in income is compounded by falling transaction charges, which haven’t recovered for the reason that preliminary surge following the halving.

Kaiko’s report highlights that miners’ twin revenue streams—mining rewards and transaction charges—are yielding decrease returns.

That is forcing miners to think about offloading their BTC to cowl operational prices. Kaiko analysts famous,

“The halving has typically been a selling event for Bitcoin miners as the process of creating new blocks incurs significant costs, forcing miners to sell to cover costs.”

The potential for a Bitcoin sell-off by miners may have profound results on the cryptocurrency market, particularly given the present low liquidity.

Mining giants like Marathon Digital, which holds over $1.1 billion in Bitcoin, may set off vital market actions in the event that they determine to promote even a small portion of their holdings.

Kaiko’s report explains.

“Bitcoin miners typically classify their BTC holdings as current assets due to their ability to liquidate these holdings to fund operating expenses.”

With main gamers like Marathon Digital and Riot Platforms holding substantial quantities of Bitcoin, any pressured gross sales may result in notable market impacts.

Bitcoin’s community exercise declines

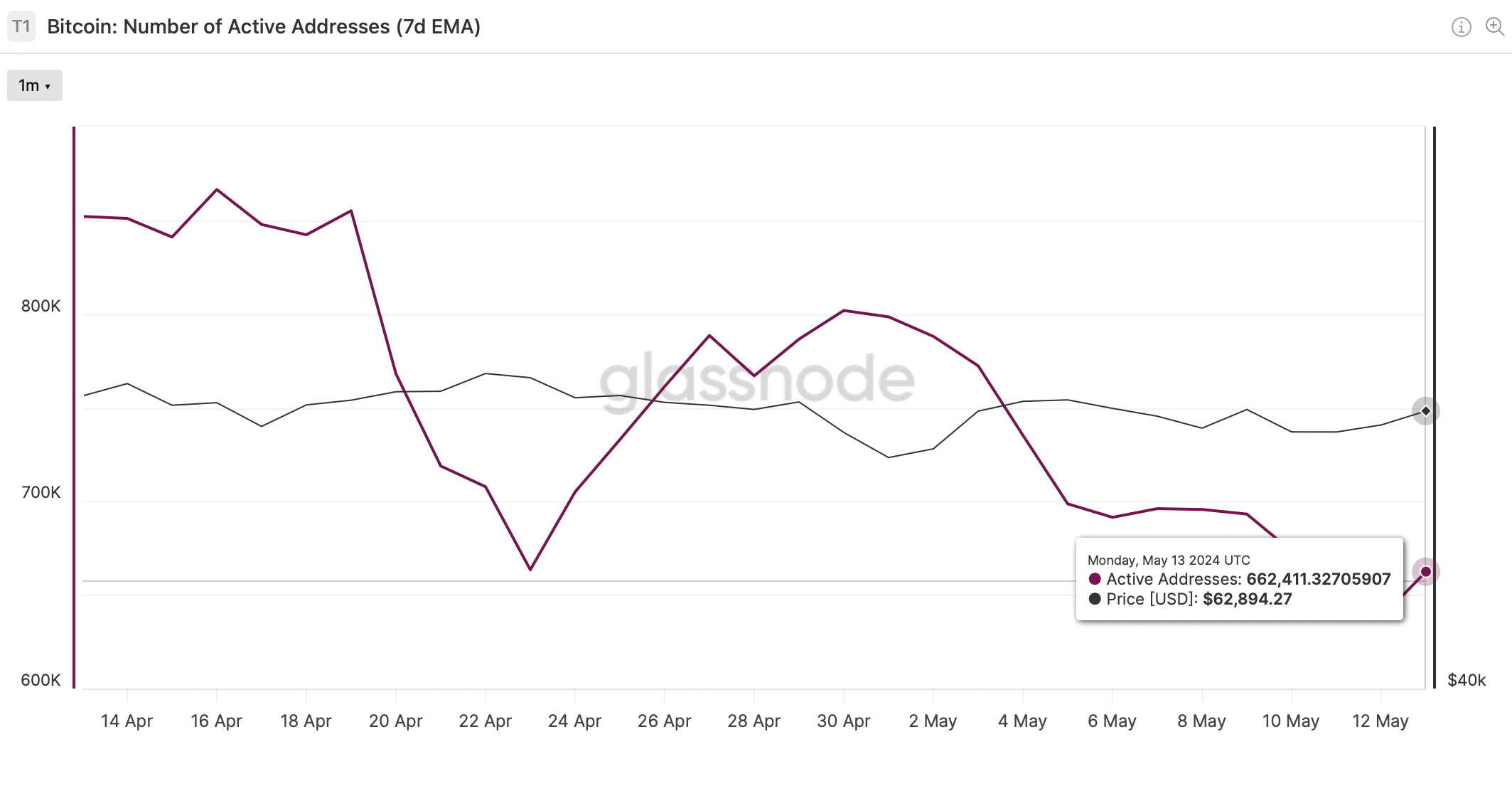

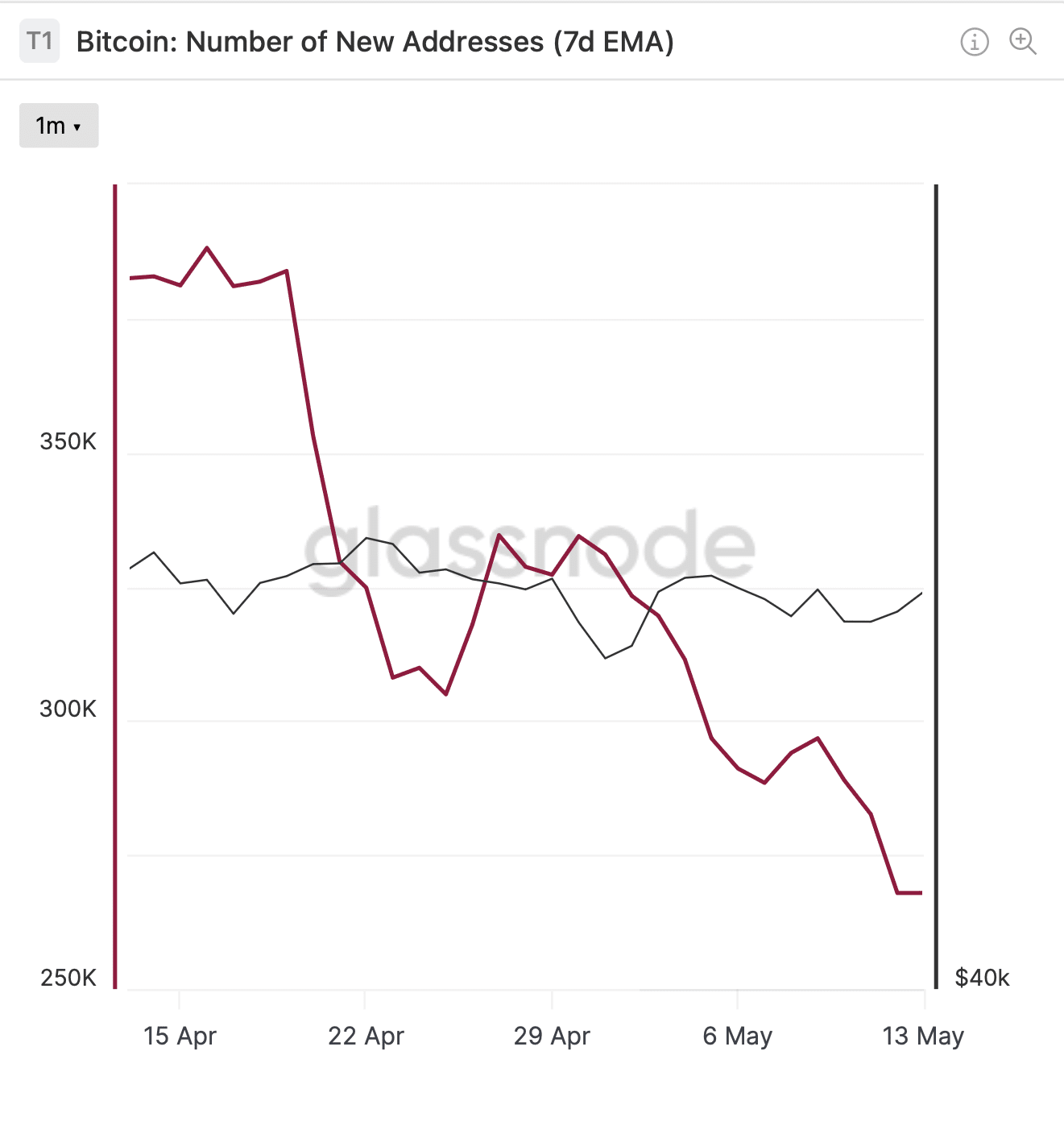

In the meantime, Bitcoin’s community exercise is exhibiting indicators of slowing down.

Glassnode’s knowledge reveals that the variety of lively Bitcoin addresses (7d EMA) has fallen from over 800,000 to under 700,000 in current weeks.

Equally, the variety of new addresses (7d EMA) has decreased from round 388,158 to 267,925, indicating a attainable decline in consumer engagement and curiosity.

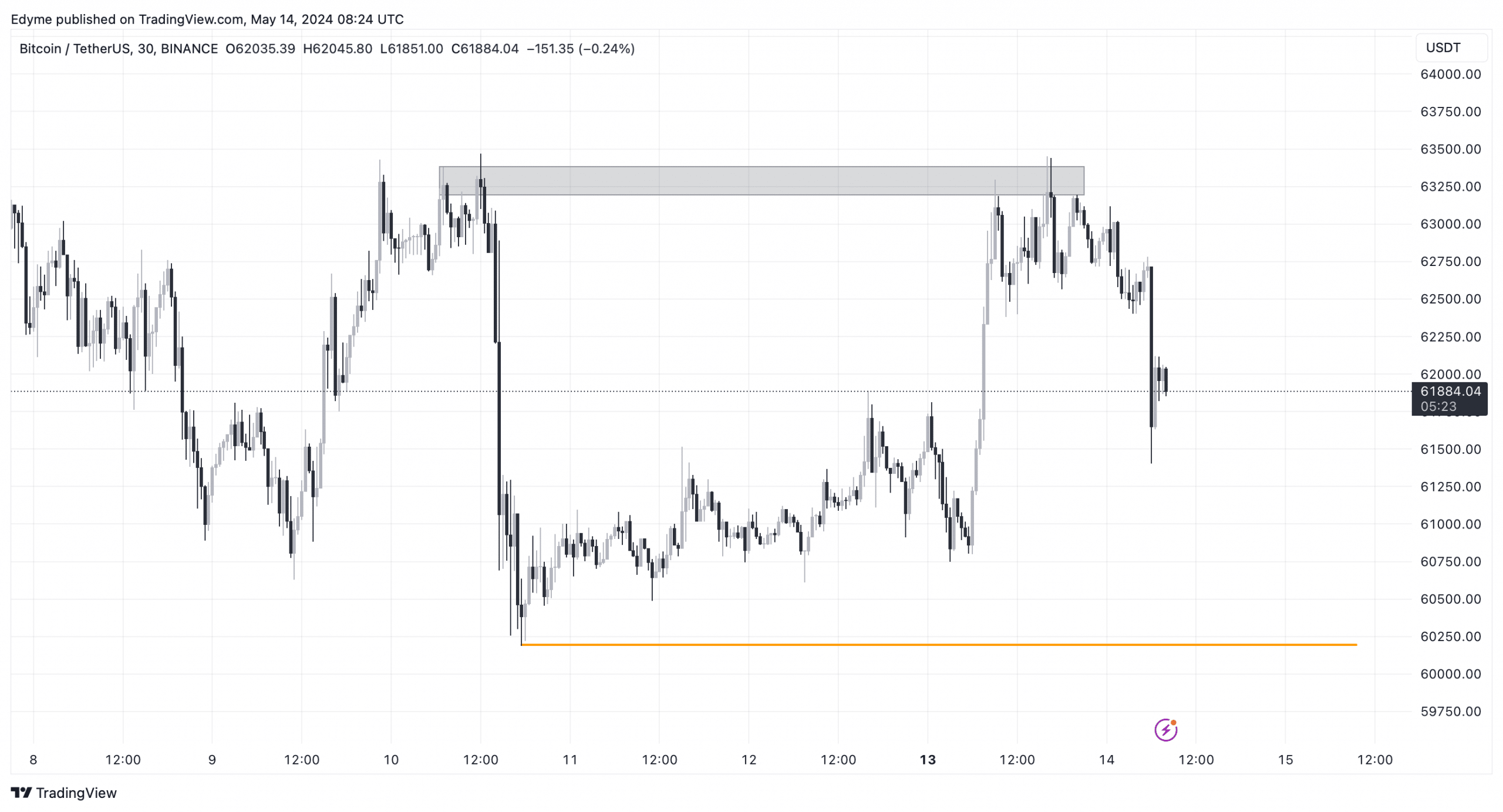

Brief-term technical evaluation steered that Bitcoin took out liquidity on the 30-minute chart on the 14th of Might.

This steered that the asset may proceed to retract in direction of the $60,000 vary—a swing low—earlier than any vital upward motion happens.

Is your portfolio inexperienced? Examine the Bitcoin Revenue Calculator

The potential decline, coupled with pressures on miners, may set the stage for a unstable interval within the Bitcoin market.

In the meantime, AMBCrytpo has just lately reported that crypto analyst Ali Martinez has projected that if Bitcoin can reclaim $64,290 as a assist degree, there may very well be a pathway to a bullish rise towards $76,610.