- XRP has massively underperformed BTC for some time.

- XRP hit a key demand zone, however an analyst downplayed a robust bullish reversal for the altcoin.

Ripple [XRP] market contributors have been upbeat after revelations that the SEC lawsuit may quickly finish. The general market sentiment round XRP was optimistic, too, within the final week.

Some XRP bulls even set conservative targets at $3 on the finish of this cycle.

Nevertheless, Peter Brandt, a classical worth chart analyst, downplayed bulls’ optimism, particularly when weighing XRP’s efficiency in opposition to Bitcoin [BTC].

Primarily based on the XRP/BTC chart, Brandt famous,

“My comparison is to BTC, not USD, so here is what I don’t understand. How can XRP bulls be so insistent in that XRP is near ATLs vs BTC, and, in fact, has only closed higher than present levels in 6 of the last 126 months?”

Is XRP headed to ‘zero’?

The above XRP/BTC chart tracks XRP efficiency in opposition to BTC. If the worth is destructive or declining, it means XRP is underperforming BTC.

Then again, a optimistic worth, or rising XRP/BTC, interprets to XRP outperforming BTC.

Primarily based on the chart, Brandt claimed that XRP is “headed to zero,” that means XRP was massively underperforming BTC, and XRP holders would slightly ditch their holdings and exchange them with BTC.

When requested whether or not the ‘low’ XRP meant that the altcoin had extra upside potential than BTC in the remainder of the cycle, Brandt quipped,

“Very possible. But the burden of proof is on XRP, not BTC. And, if the play now is with Alts, why not something other than XRP?”

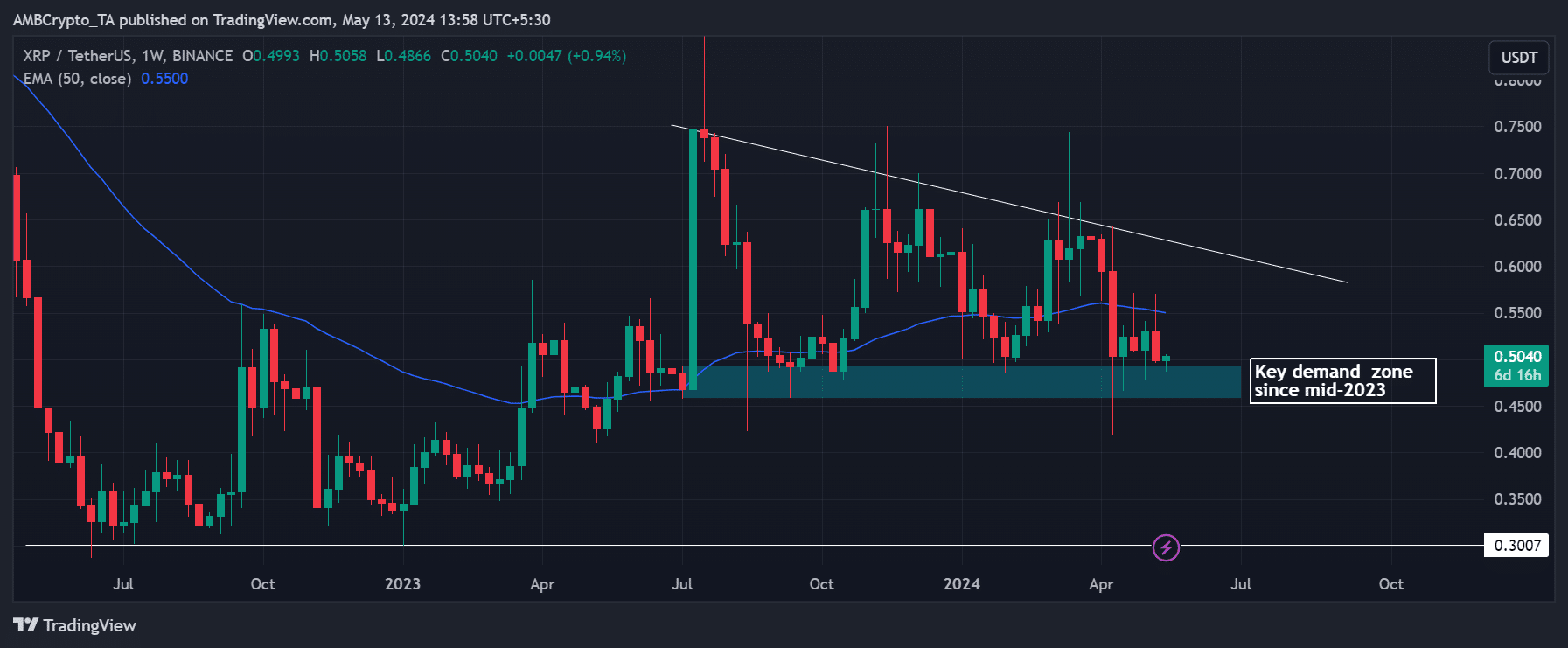

A have a look at XRP’s weekly charts (XRP/USDT) confirmed that the altcoin has eased right into a key demand zone that has confirmed regular since mid-2023.

So, a transfer above the blue 50-EMA (Exponential Shifting Common) may embolden bulls to purpose on the trendline resistance (white).

Moreover, one specific on-chain metric confirmed that bulls may prevail. In response to Santiment information, the altcoin recorded a destructive Alternate Move Stability (-6.66 million XRP) on the time of writing.

That meant 6.66 million XRP was withdrawn from exchanges—an accumulation pattern.

The Alternate Move Stability is the distinction between XRP transferring to or out of trade wallets. A optimistic worth means extra XRP moved into an trade than out (indicators promoting stress).

The alternative is true, a destructive worth means extra XRP withdrawn from exchanges, an accumulation sign.

Regardless of the sturdy accumulation on the key demand zone close to $0.05, market sentiment was nonetheless barely destructive, as proven by the bearish studying on the Weighted Sentiment metric.

Ergo, one can argue that XRP has underperformed BTC however has dropped to a key demand stage. This makes it ripe for a bullish reversal if the SEC lawsuit and long-term market situations grow to be favorable.

![Ripple [XRP]](https://ambcrypto.com/wp-content/uploads/2024/05/XRP-Ledger-XRP-10.44.25-13-May-2024.png)