- Bitcoin’s Open Curiosity grew materially as value of BTC declined.

- Long run holders start promoting their holdings, curiosity in ETFs remained excessive.

Bitcoin [BTC] witnessed a large surge in open curiosity over the previous couple of days, regardless of its value hovering across the $63,000 vary.

Open Curiosity on the rise

Extra Open Curiosity usually signifies extra merchants are getting into the market utilizing futures contracts. This could result in increased volatility as these merchants place bets on the longer term value of Bitcoin.

With more cash on the road, value swings can turn out to be extra pronounced as bulls and bears battle it out. This volatility can create alternatives for revenue but additionally carries better threat.

A rise in Open Curiosity may enhance liquidity within the Bitcoin market. With extra Futures contracts excellent, there’s a bigger pool of consumers and sellers, making it simpler to enter and exit positions.

This may be useful for the general market well being for BTC.

ETF saga

In line with Coinglass’ knowledge, the variety of brief positions taken towards BTC had outnumbered the lengthy positions. It stays to be seen whether or not the bears transform proper about their calls.

One other issue that would impression BTC could be the state of Bitcoin ETFs. In line with SoSoValue’s report, Bitcoin spot ETFs skilled a complete web outflow of $84.6581 million on the tenth of Might.

Grayscale’s GBTC ETF noticed a each day web outflow of $103 million, whereas BlackRock’s IBIT ETF had an influx of $12.4363 million, and Constancy’s FBTC ETF had an influx of $5.3039 million.

The excessive quantity of inflows might impression the value of BTC positively in the long term.

Lengthy-term holders take a hike

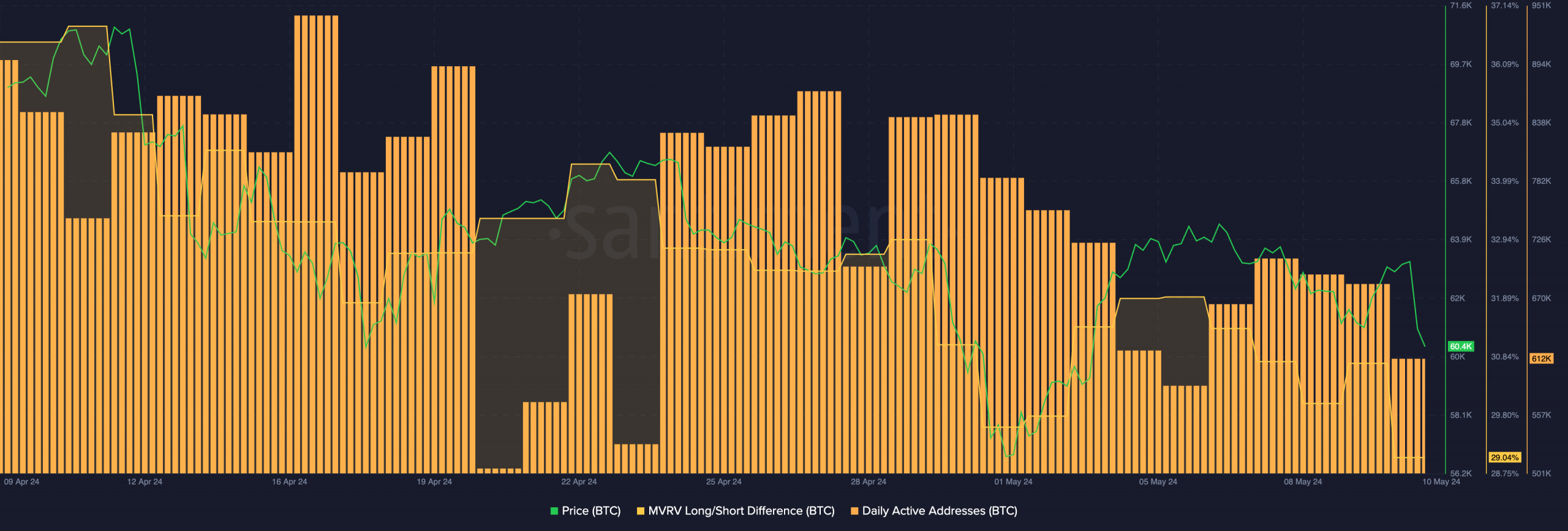

Nonetheless, at press time, issues have been wanting dire for BTC. The value of BTC had fallen to $60,833.76 as a result of a decline of three.4% within the final 24 hours. The quantity at which BTC was buying and selling at had additionally declined by 1.8%.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

Surprisingly, the Lengthy/Quick distinction of BTC fell together with the value. This means that the variety of long-term addresses holding BTC had fallen.

Every day lively addresses on the community additionally fell materially over the previous couple of days, which meant that the general curiosity within the Bitcoin ecosystem was additionally waning, which might additional impression BTC’s value negatively.