- After the latest drop to $56.8k, Bitcoin appeared to have a short-term bearish bias.

- Indicators of accumulation and demand have been current, however the consolidation interval won’t finish quickly.

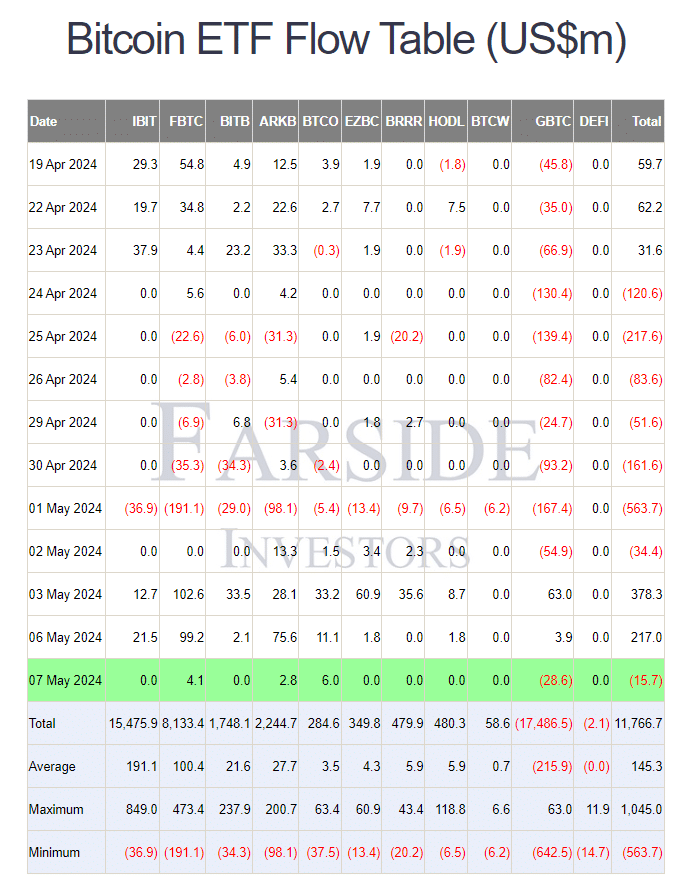

Bitcoin [BTC] was up 4.6% previously week. The Bitcoin ETF inflows chart additionally instructed that the bulls have been gaining power.

The Grayscale Bitcoin ETF GBTC, which was infamous for constant outflows, noticed a change earlier in Could.

Supply: Farside Buyers

This doesn’t imply that its short-term bias has shifted bullishly. The technical construction remained bearish. It’s price inspecting the on-chain metrics to know the place costs may very well be headed subsequent.

Resolving the lengthy and short-term outlook

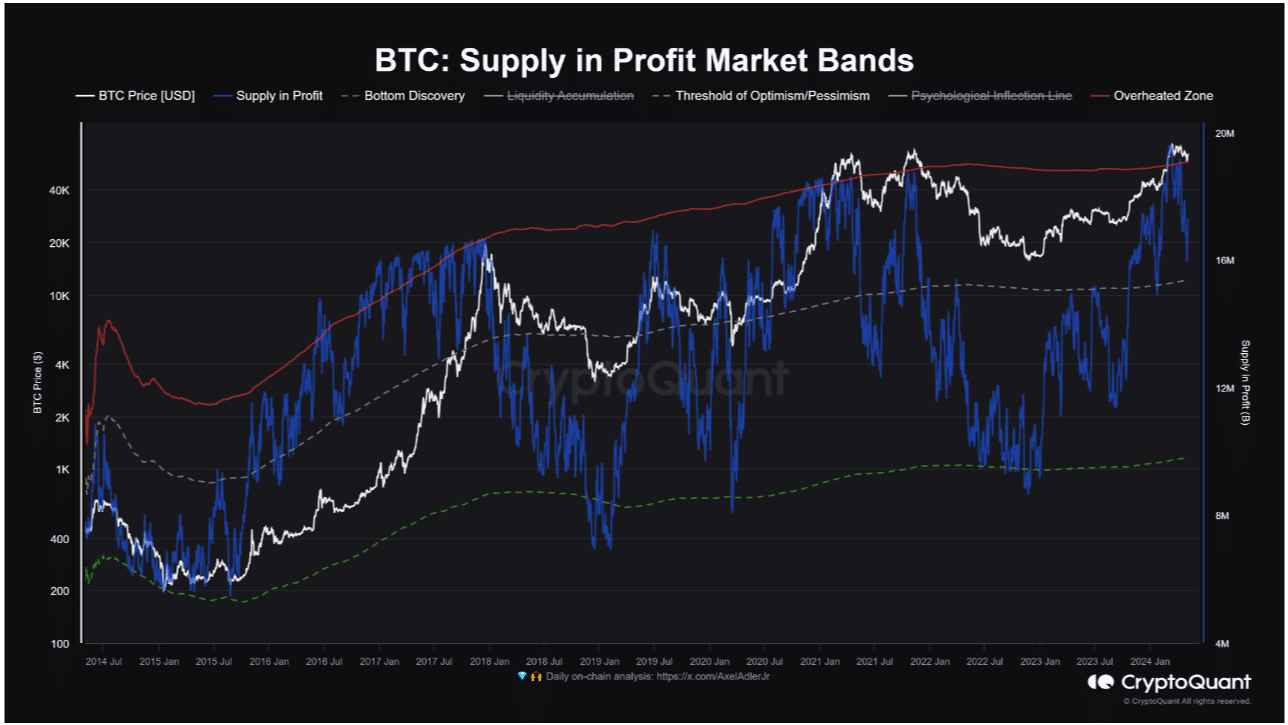

Supply: CryptoQuant

In a put up on CryptoQuant Insights, analyst Kripto Mevsimi identified that the latest correction noticed the Bitcoin provide in revenue decline.

A set of bands was used to focus on the place the overheated zone, the underside discovery, and the brink for optimism and pessimism have been.

At press time, the metric was headed towards this threshold. If it falls beneath it, we may witness a deeper correction as BTC falls towards backside discovery.

As long as the metric stays above this line, market sentiment would possible be constructive total, and bulls may hope for a restoration.

Within the 2016 cycle, the availability in revenue metric was repeatedly within the overheated zone for months with no main correction.

The 2020 July-2021 January run additionally noticed the overheated zone visited regularly. We’re not but in that a part of the cycle.

Ideally, BTC bulls wish to see the grey line defended and costs get well and push increased and rally within the coming months to resemble the earlier cycle bull runs.

Is it time to purchase Bitcoin, or do you have to wait?

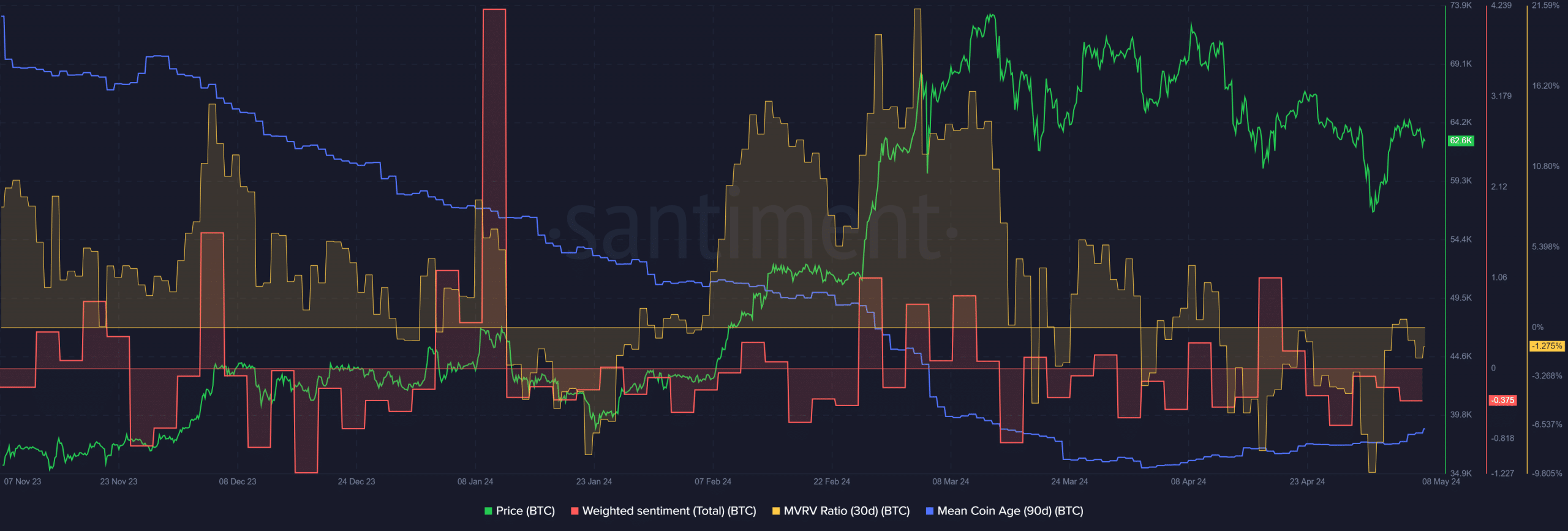

Supply: Santiment

The long-term bias of Bitcoin was bullish, the short-term was bearish. The opportunity of a deeper correction is current.

AMBCrypto investigated some metrics from Santiment to know if a shopping for alternative is current.

The 30-day MVRV has been damaging for a big a part of the previous month. This confirmed that the asset was undervalued. Nonetheless, the 3-day weighted sentiment remained damaging previously two weeks.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

The imply coin age metric seemed to have halted its earlier downtrend over the previous month. It has inched its method increased over the previous month. Mixed with the MVRV, this was a sign to purchase Bitcoin.

Nonetheless, the value motion instructed that the bears at the moment have the higher hand, and $55k may very well be visited this summer season.