- Over the previous 48 hours, Bitcoin’s liquidation has been beneath $50 million.

- BTC has held the $60,000 worth vary.

The previous week witnessed a major decline in Bitcoin’s [BTC] worth because it slipped beneath the $60,000 threshold.

This downturn resulted in a surge of each quick and lengthy liquidations, inflicting some positions to be worn out.

Nevertheless, there seems to be a current equilibrium between worth motion and liquidations, suggesting a stabilization available in the market.

Bitcoin liquidation declines

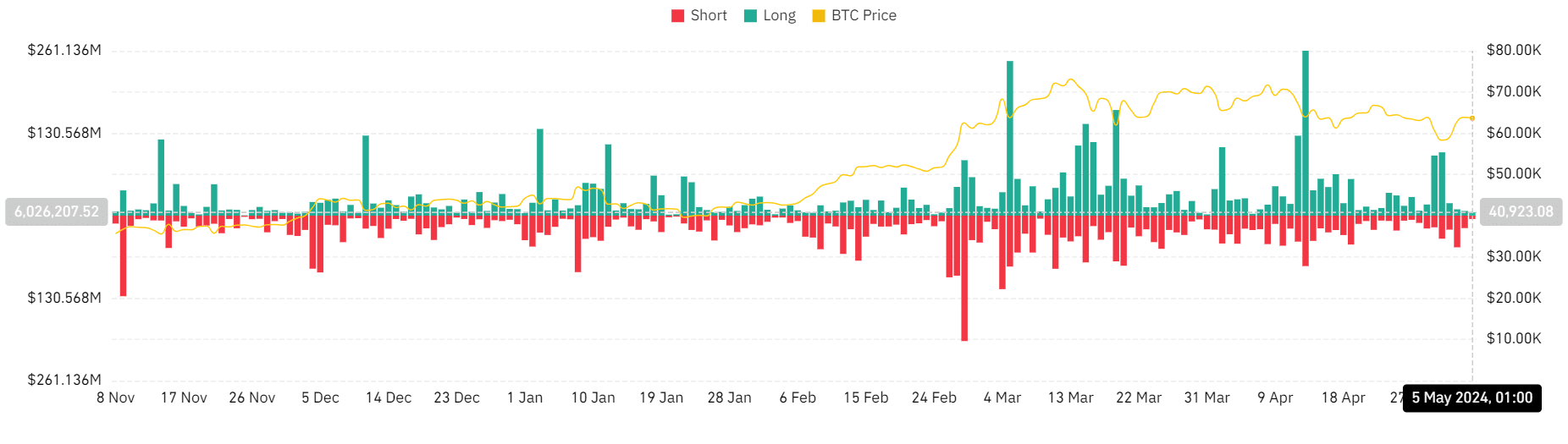

AMBCrypto’s evaluation of the Bitcoin liquidation chart on Coinglass revealed a surge in liquidation on the thirtieth of April and the first of Might.

On the thirtieth of April, the liquidation quantity was over $113 million, with lengthy positions accounting for over $95 million.

This pattern continued into the first of Might, with the liquidation quantity surpassing $136 million and lengthy positions representing over $100 million.

Nevertheless, as the worth of BTC rebounded and reclaimed the $60,000 worth vary, the liquidation quantity started to say no.

Subsequently, because the 2nd of Might, the liquidation quantity has solely exceeded $50 million as soon as. The most recent knowledge exhibits that the liquidation quantity was round $10 million at press time.

Bitcoin maintains pattern above $60,000

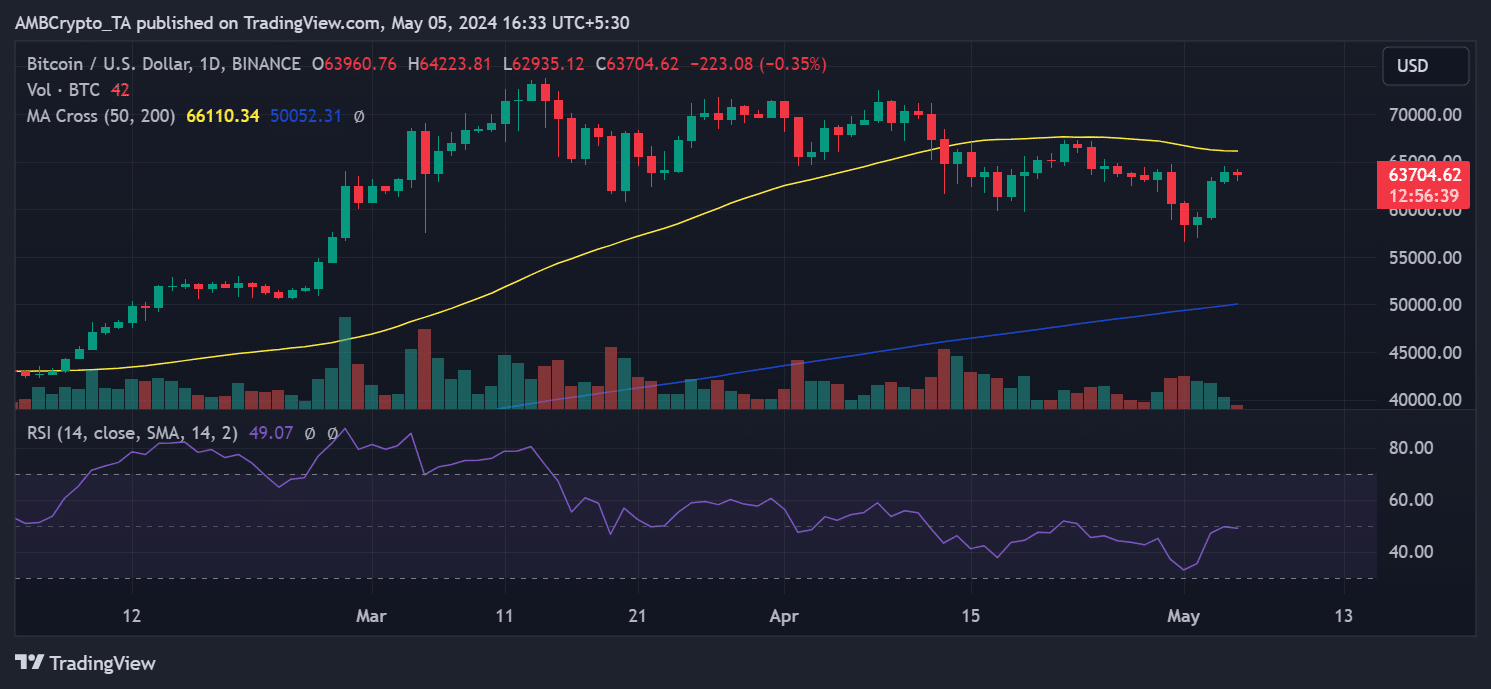

AMBCrypto’s have a look at Bitcoin’s worth pattern on the day by day timeframe chart indicated a notable rebound following its declines on the thirtieth of April and the first of Might, throughout which it skilled an 8% loss over 48 hours.

AMBCrypto’s chart evaluation revealed consecutive uptrends starting on the 2nd of Might, with a notable enhance of over 6% noticed on the third of Might.

By the tip of buying and selling on the 4th of Might, Bitcoin had elevated by over 1%, reaching roughly $63,900.

As of this writing, it was buying and selling with a lower of lower than 1%, however it nonetheless maintained the $63,000 worth vary.

Regardless of this rebound, its quick shifting common (yellow line) continued to function resistance at round $66,000.

Strained revenue for 30-days holders

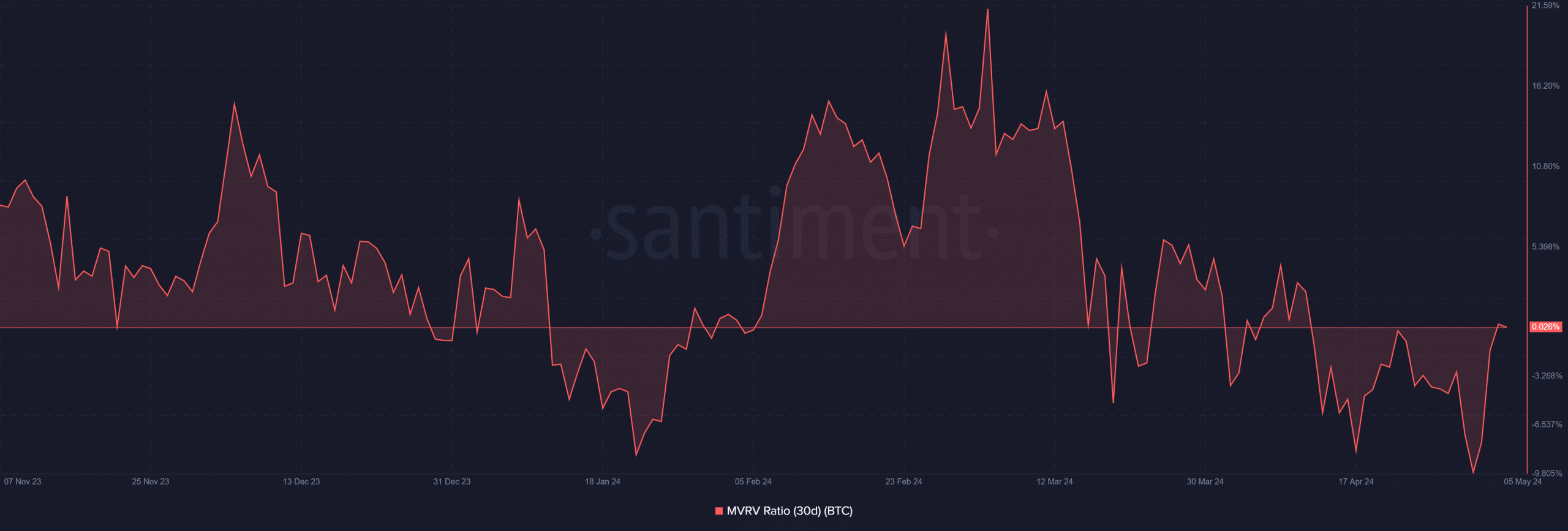

Bitcoin’s 30-day Market Worth Realized Worth ratio (MVRV) indicated that holders skilled a interval of being underwater for a lot of April.

The chart revealed that BTC remained beneath zero and reached its lowest level in months, dropping to -9.71%.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

Nevertheless, on the time of this evaluation, the MVRV has barely risen above zero, hovering round 0.026%.

This means that holders inside this timeframe are profiting, seemingly because of the current slight enhance in BTC’s worth.