Market Overview: DAX 40 Futures

DAX futures went decrease final month with a bear outdoors bar closing on its midpoint. It’s sideways after a robust bull spike and presumably two legs up. It may very well be time for a correction, however with no first rate promote sign, it would transition right into a broader channel as a substitute.

DAX 40 Futures

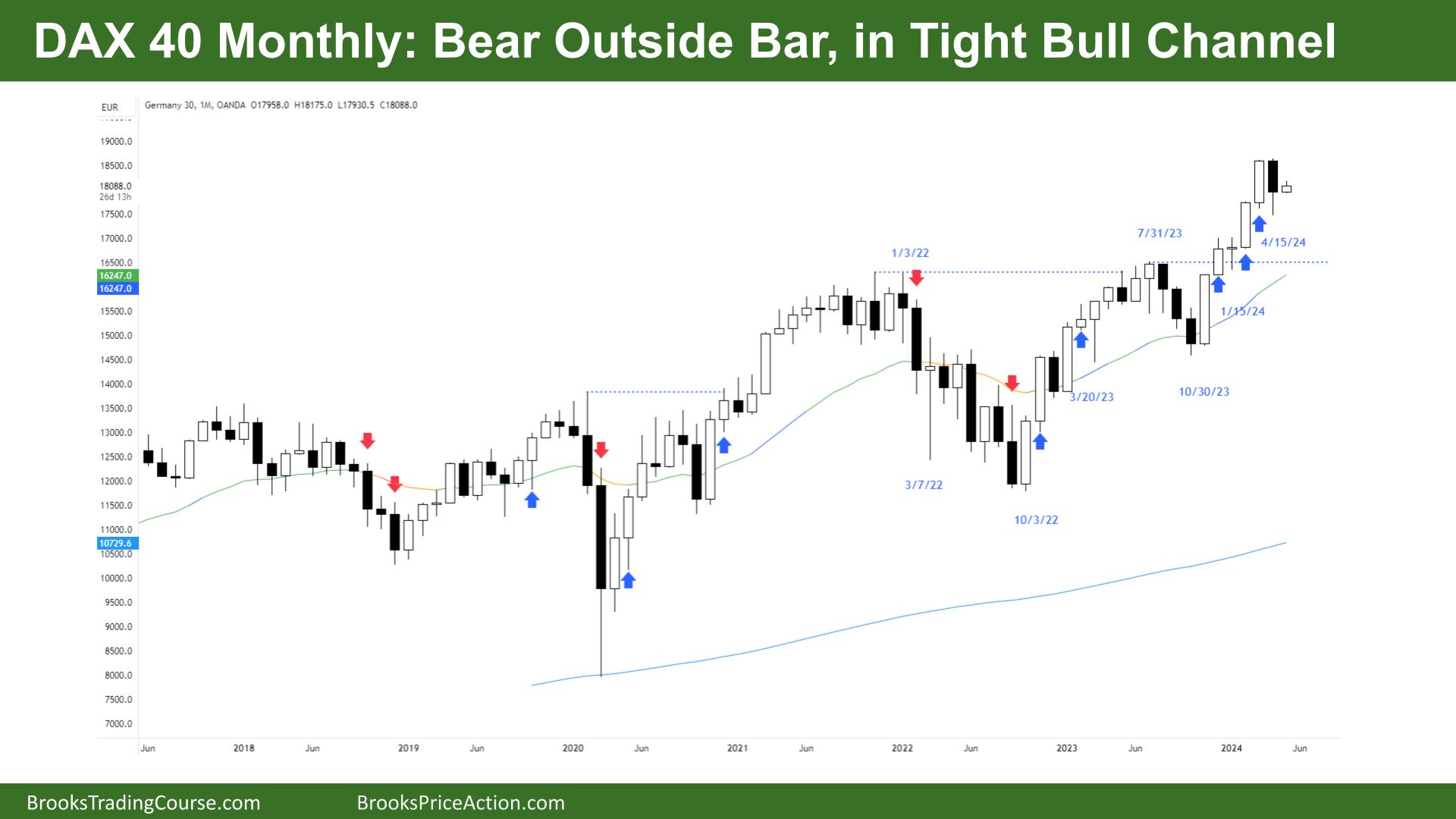

The Month-to-month DAX chart

- The DAX 40 futures was a bear outdoors bar, closing on its midpoint final month.

- It was a bull microchannel, the place each low was above the prior low. So, the primary time we go under the low of a previous bar is a purchase sign. Bulls purchased.

- However it’s probably for a scalp again to the month-to-month shut space.

- Is it sufficiently big of a shock for always-in bulls to exit? I feel most bulls had targets that had been hit round right here.

- However on this chart, that bear bar is weak. We nonetheless triggered the purchase above. Sometimes after we set off the cease entry purchase, these bulls will have the ability to exit with no loss.

- The bears want a double prime or one thing stronger to persuade the bulls to not scale in decrease.

- The bulls see a breakout above the longer-term bull channel. Additionally they see a buying and selling vary with closed gaps and a break above it.

- The transfer up was so robust it may very well be the primary leg of one thing bigger. However the cease is way away on this chart, and we hit a number of measured transfer targets. It may be time for sideways to down.

- The bears acquired a bear bar however a weak promote sign in a good bull channel, so there’s a low chance of promoting under that bar. There may be extra bears promoting above it.

- Most merchants must be lengthy or flat as a result of we’re all the time in lengthy.

- The bulls need to take a look at the assist again on the breakout level or hold a spot open.

- There was loads of buying and selling vary value motion up so far so it would probably proceed.

- Two legs up, so this may be the 2 legs sideways earlier than the ultimate leg of the bull transfer earlier than a bigger correction.

- All the time in, bulls will get out under the low of a superb bear bar, closing under its midpoint. Have they got to get out under that outdoors bar? Some gained’t due to the tail under.

- The bulls even have open micro gaps—gaps between the primary and third bars in a set. These gaps grow to be assist areas in robust tendencies.

- Count on sideways to up subsequent month.

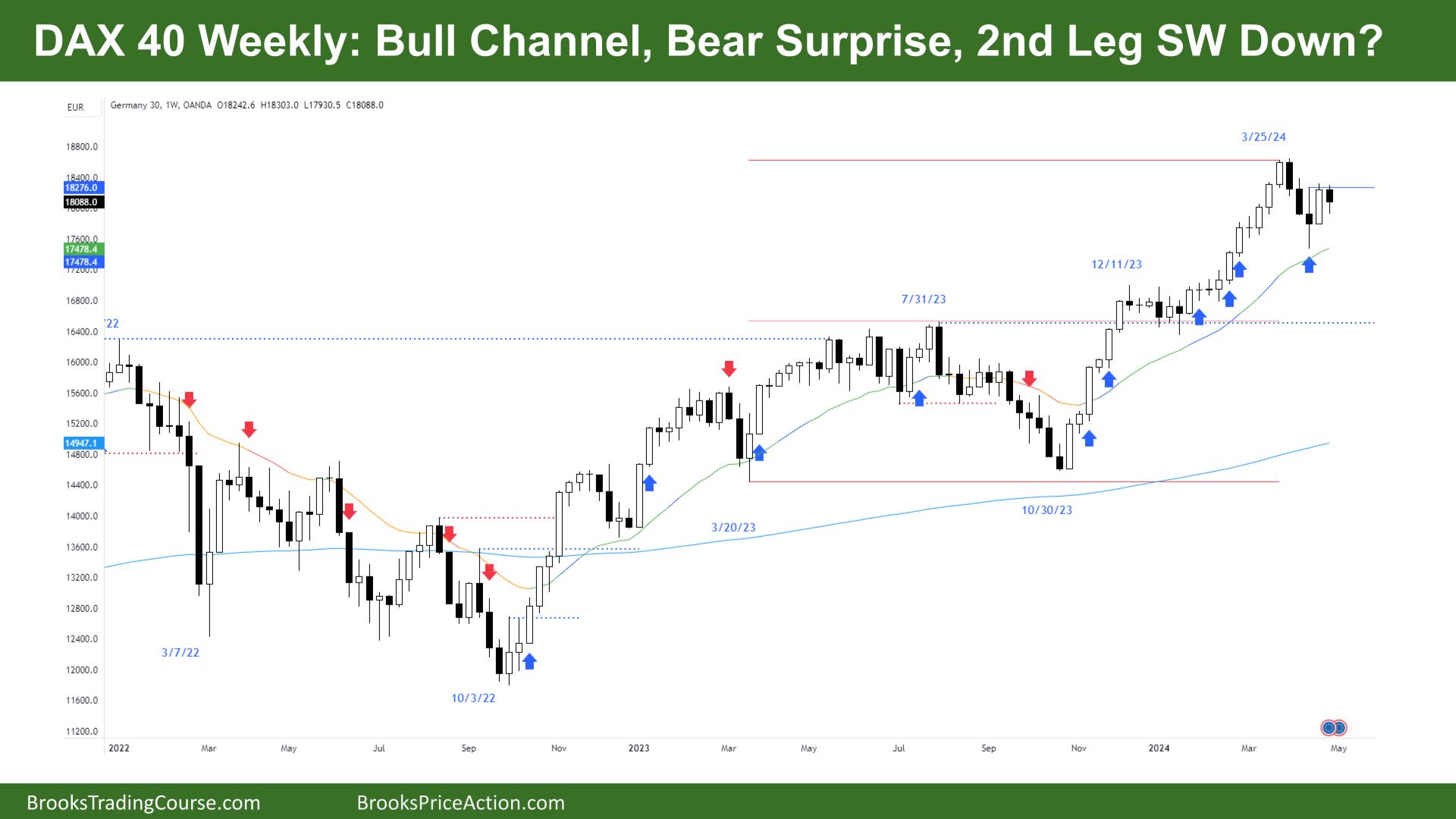

The Weekly DAX chart

- The DAX 40 futures was small bear inside bar final week closing on its midpoint.

- It was an indecision bar which was probably.

- There was an affordable promote above the excessive of that bear doji that labored – we known as it final week and hope merchants took it!

- Bulls see a Excessive 1, however after 3 bear bars not nice. Bears had a promote scalp however would favor to promote larger.

- It’s complicated as a result of bull tendencies don’t have loads of 3 consecutive bear bar pullbacks.

- It’s a Low 2 promote under that bear bar, however I’m not going to take it. The bull bar final week was robust and has no decrease tail.

- Which implies there have been too many patrons on the open of it.

- I think they’ll nonetheless be round trying to scale in for the following a part of the transfer.

- Bears need a large bar subsequent week to lure all these bulls into a nasty lengthy. However once more, they’re prone to exit on the transferring common.

- All the time in lengthy nonetheless, although you’ll be able to argue buying and selling vary with a bear shock.

- All the time in bulls are out and searching for a superb bull bar to purchase above. They could have orders above the excessive of final week.

- The Excessive 1 didn’t set off, so a Excessive 2 will likely be extra prone to succeed, however the location is necessary. The bulls need it low sufficient to get the revenue again to the best shut.

- Count on sideways to up subsequent week.

Market evaluation reviews archive

You’ll be able to entry all weekend reviews on the Market Evaluation web page.