Market Overview: EURUSD Foreign exchange

The market is forming a sideways EURUSD buying and selling vary on the month-to-month chart. The center of the buying and selling vary is an space of stability. Merchants will BLSH (Purchase Low, Promote Excessive) till there may be a breakout with sustained follow-through shopping for/promoting from both path. Poor follow-through and reversals are hallmarks of a buying and selling vary.

EURUSD Foreign exchange market

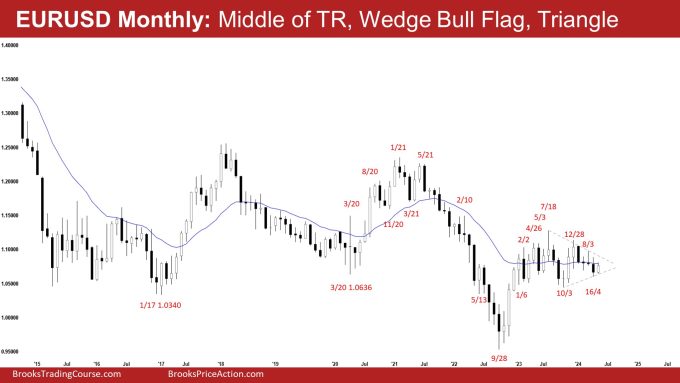

The Month-to-month EURUSD Foreign exchange chart

- The April month-to-month EURUSD candlestick was a bear bar closing beneath the 20-month EMA with tails above and beneath.

- Final month, we mentioned that after a weak transfer increased in March, we may see the market do the other by buying and selling decrease in April.

- The bulls need a reversal from a big wedge bull flag (Jan 6, Oct 3, and Apr 16) across the decrease third of the giant buying and selling vary.

- They hope to get one other leg as much as retest the December 28 excessive.

- They see the transfer down from December merely as a two-legged pullback.

- They need the market to reverse again above the 20-month EMA.

- The bears see the prior transfer up (Dec 28) as a retest of the July excessive and obtained a reversal from a decrease excessive main pattern reversal.

- They see the market as being in a 17-month buying and selling vary.

- They managed to get follow-through promoting beneath the 20-month EMA in April, however the outstanding tail beneath signifies that the bears are usually not but as robust as they hoped to be.

- They should create a follow-through bear bar in Might to extend the chances of a retest of the October low.

- Since April is a bear bar with a outstanding tail beneath, it’s a promote sign bar for Might albeit weaker.

- Might to date (as of Friday, 3 Might) has reversed increased to check the 20-month EMA, which is the center of the buying and selling vary. It’s an space of stability.

- For now, the chances for the bulls and bears stay fairly equal.

- Merchants will see if the bears can create one other bear bar in Might buying and selling beneath the 20-month EMA. In the event that they do, it’s going to improve the chances of a retest of the October low.

- Nevertheless, if the market continues to carry across the 20-month EMA for a few months, the chances of a retest of the December excessive will improve. This stays true.

- Merchants will BLSH (Purchase Low, Promote Excessive) till there may be a breakout with sustained follow-through shopping for/promoting from both path.

- Poor follow-through and reversals are hallmarks of a buying and selling vary.

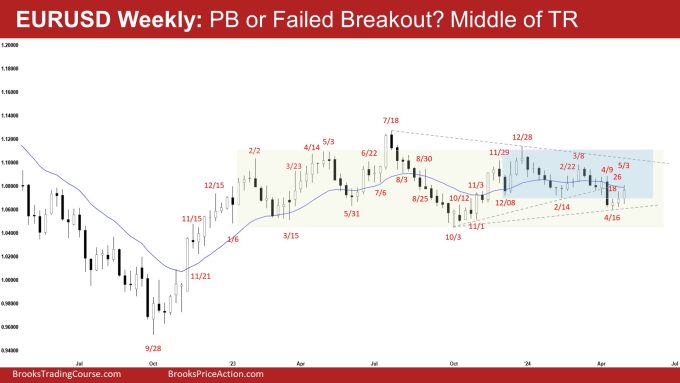

The Weekly EURUSD chart

- This week’s candlestick on the weekly EURUSD Foreign exchange chart was a bull bar with a outstanding tail above.

- Final week, we mentioned that the market should still be within the sideways to down bear leg. If the bulls get extra follow-through shopping for, it may swing the chances in favor of a failed breakout of the triangle sample and the smaller 22-week buying and selling vary.

- The market traded sideways to down earlier within the week however reversed increased from Wednesday onwards, testing the 20-week EMA.

- The bears obtained a breakout beneath the triangle sample and the smaller 22-week buying and selling vary however weren’t capable of get robust follow-through promoting.

- They hope that the final three weeks had been merely a pullback and a breakout take a look at.

- They wish to get at the least one other leg down from a micro wedge bear flag (Apr 18, Apr 26, and Might 3), finishing the wedge sample with the primary two legs being February 14 and April 16.

- On the very least, they need at the least a small retest of the April 16 low (even when it types a better low).

- If the EURUSD trades increased, the bears need the market to stall across the 20-week EMA.

- The bulls see the prior transfer down (to April 16) merely as a two-legged pullback (which began on Dec 28) and a bear leg inside a buying and selling vary.

- They need a reversal from across the decrease third of the giant buying and selling vary from a better low main pattern reversal, a bigger wedge bull flag (Mar 15, Oct 3, and Apr 16) and a wedge within the third leg down (Dec 8, Feb 14, and Apr 16).

- They should create consecutive bull bars closing close to their highs and buying and selling above the 20-week EMA to point they’re again in management.

- Since this week’s candlestick is a bull bar closing in its higher half, it’s a purchase sign bar for subsequent week albeit weaker.

- The market has reversed again to the center of the buying and selling vary. It’s an space of stability.

- Merchants will see if the bulls can get one other consecutive bull bar closing above the 20-week EMA.

- Whereas the final 3 consecutive bull bars are usually not very robust, the chances are slowly transferring in favor of a failed breakout of the triangle sample and the smaller 22-week buying and selling vary.

- The EURUSD is in a 76-week buying and selling vary. (Trading vary excessive: July 2023, Trading vary low: Oct 2023).

- The decrease third space of the giant buying and selling vary might be a purchase zone for buying and selling vary merchants. To this point, we’ve got seen merchants purchase round this space.

- Merchants will proceed to BLSH (Purchase Low, Promote Excessive) inside a buying and selling vary till there may be a breakout with follow-through promoting/shopping for.

- Poor follow-through and reversals are hallmarks of a buying and selling vary.

Market evaluation stories archive

You’ll be able to entry all weekend stories on the Market Evaluation web page.