- Bitcoin short-term whales are underwater, which doubtless offered a really perfect shopping for alternative

- Metrics resembled how they have been earlier than the earlier main bull run

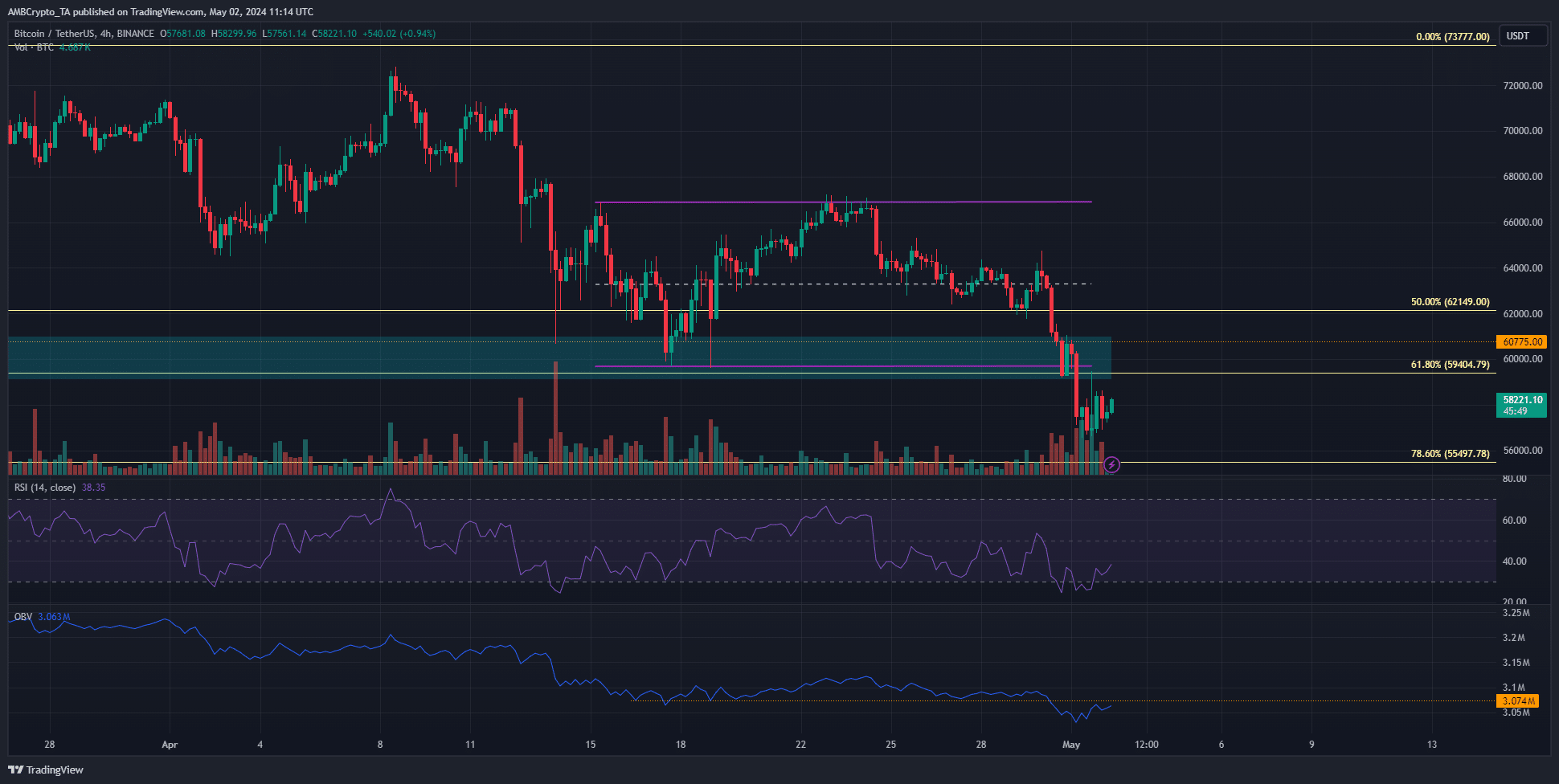

Bitcoin [BTC] sank under the important thing demand zone at $60k.

This area had held the sellers at bay however finally gave means. Crypto technical analyst CrypNuevo highlighted that we’d get a post-FOMC bounce to $61k in a publish on X (previously Twitter).

Ought to merchants count on to see the $60k former assist reclaimed? Alternatively, ought to they appear to go quick upon a retest? Right here’s what market individuals might be careful for earlier than making their subsequent transfer.

The present breakdown has been on a excessive buying and selling quantity

The important thing ranges are $59.4k and $60.7k within the quick time period. A cluster of liquidity is probably going current close to these ranges, marking them as vital areas the place a bearish continuation might happen.

Such a continuation is predicted as a result of the OBV has fallen under two-week assist, highlighting promoting strain dominance.

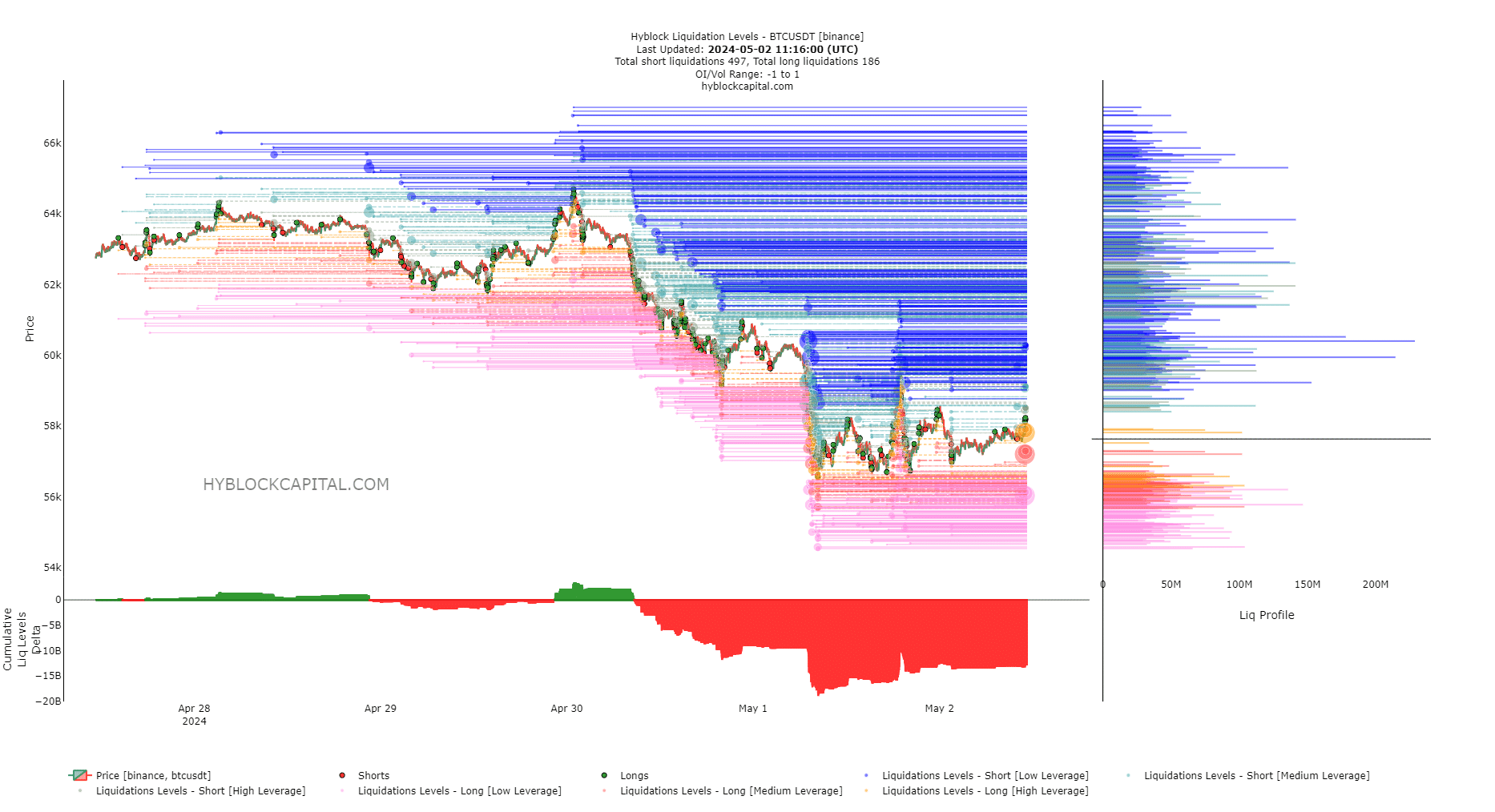

Supply: Hyblock

The liquidation ranges confirmed that the cumulative liq ranges delta was vastly detrimental. Due to this fact, we will count on a transfer upward within the short-term to gather liquidity and wipe out the imbalance.

The $60.5k and the $63.8k ranges had the very best cluster of liquidation ranges. Therefore, a transfer to those ranges earlier than a reversal southward is anticipated.

Of golden and dying crosses

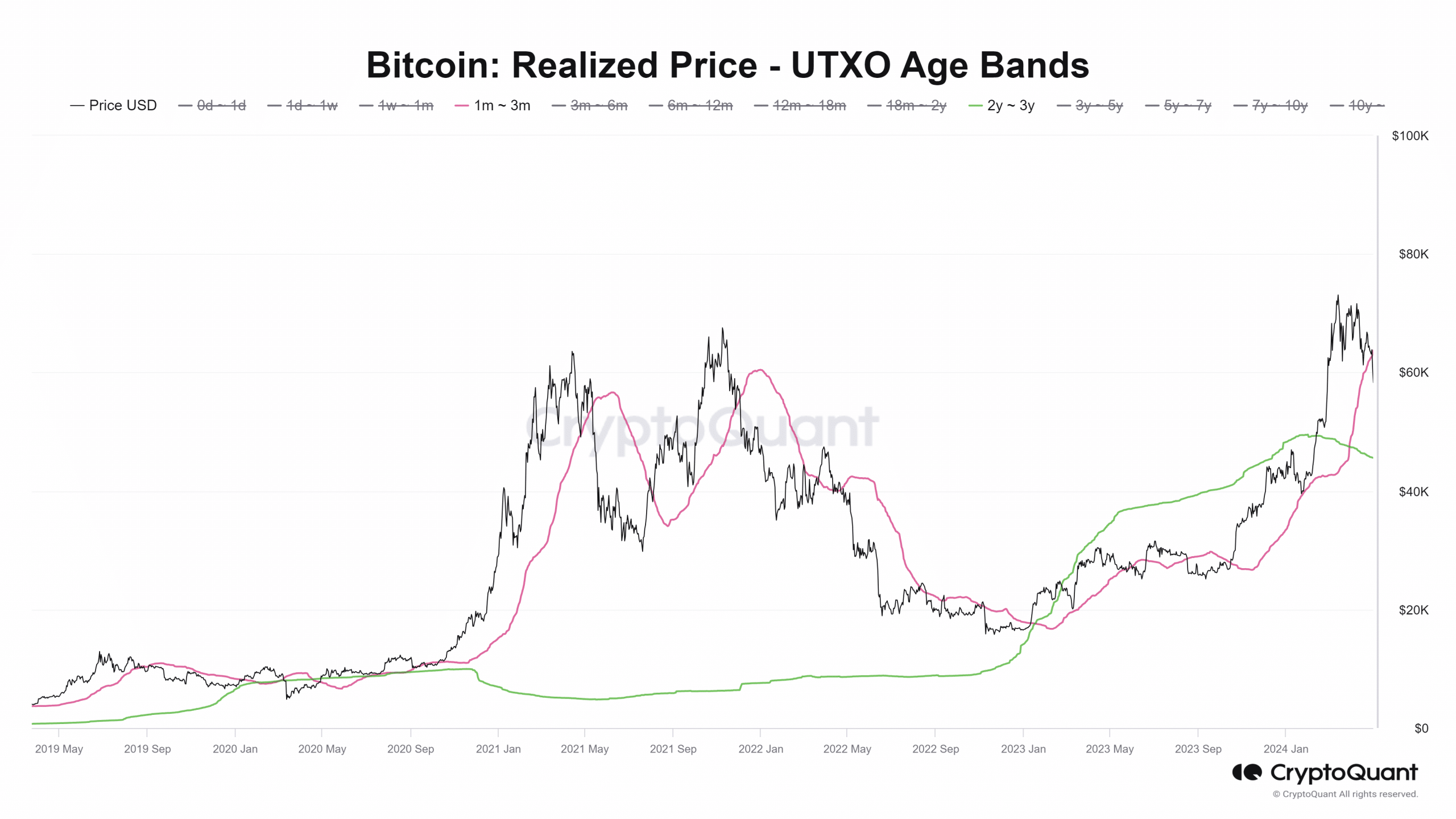

Supply: CryptoQuant

In a CryptoQuant Insights publish, person CoinLupin identified an fascinating improvement.

Wanting on the realized UTXO age bands, the onset of main bull runs got here when the realized worth of 1-3 month and 2-3 yr bands noticed a smoothing course of.

This occurred in 2020 from January to September, and costs are likely to consolidate close to the realized costs of those age bands.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

Within the present cycle, there weren’t as many golden and dying crosses between these two age bands.

Nevertheless, the latest pullback could possibly be adopted by deeper losses as savvy market individuals purchase from impatient BTC sellers. This could possibly be adopted by the true bull run, the analyst identified.