Insider Shopping for and Promoting

In doing so we’re competing with quant-based evaluation that’s poring a whole bunch of tens of millions of {dollars} into comparable issues and barely does the retail investor get a peek in with any edge. Courtesy of regulation, nevertheless, there are a variety of issues that we – the retail investor – can see as nicely (or as poorly) as anybody else and a type of issues is insider shopping for. Resulting from gray zones in reporting and execution of trades, the precise timing isn’t what issues essentially the most, it’s merely a head’s up that insiders are shopping for.

Why is that this significant, nicely to cite one of many old-time funding greats:

“Insiders might sell their shares for any number of reasons, but they buy them for only one: they think the price will rise.” —Peter Lynch

Insider shopping for is way more vital than promoting as a result of so many causes may cause an individual to require cash that don’t have anything to do with the corporate in query, essentially the most clearly ubiquitous one being DIVORCE! Shopping for is extraordinary as a result of these doing it are literally rising their publicity to the inventory in query when normally they’re already employed by the corporate and on high of that have a tendency to profit from share choices or firm plans. Often a CEO/CFO has to make a public present of confidence in his personal firm by shopping for (keep away from these conditions) however by and enormous the run of the mill insider purchaser actually has no motive to purchase besides they assume issues are wanting good for the inventory. In betting phrases, insiders shopping for is them doubling down on an already very massive publicity to the success of the corporate in query.

Peter Lynch was very a lot an individual who believed it’s best to put money into shares you perceive. The instance he gave of ‘unexpected’ insider shopping for (i.e. an unregulated one) was the Nineteen Fifties fireman assuring hearth security rounds in an industrial space round Palmer Massachusetts who needed to hold widening the stroll of his spherical as a result of a specific firm (Tambrands) increasing on a regular basis. With out actually understanding what they made, he purchased shares within the firm in query and retired a millionaire by 1970. In the identical logic I invested (for my mom’s portfolio) in NVDIA again in April 2016 – why? My firm pitched for his or her enterprise (we didn’t get it) and their public RFP was the primary doc I ever learn that made any sense to me as regards a technique for AI (self-driving vehicles the truth is). These two examples do have a warning inherent in them and Peter Lynch’s quote above is continuously cited however his second advice is extra hardly ever reported:

“Finding the promising company is only the first step. The next step is doing the research.” —Peter Lynch

NVDA case

The NVDIA state of affairs was a living proof, the funding made for my mom was based mostly on her having a diversified portfolio and an understanding of semi-conductor shares. A pleasant RFP itself wasn’t the one motive to decide on to make the leap, it was mixed with different issues and that is how it’s best to method all insider shopping for. There was a really fascinating Reddit publish about this which we will shamelessly steal from use as analysis on this article. You see, not all insider shopping for at all times results in success.

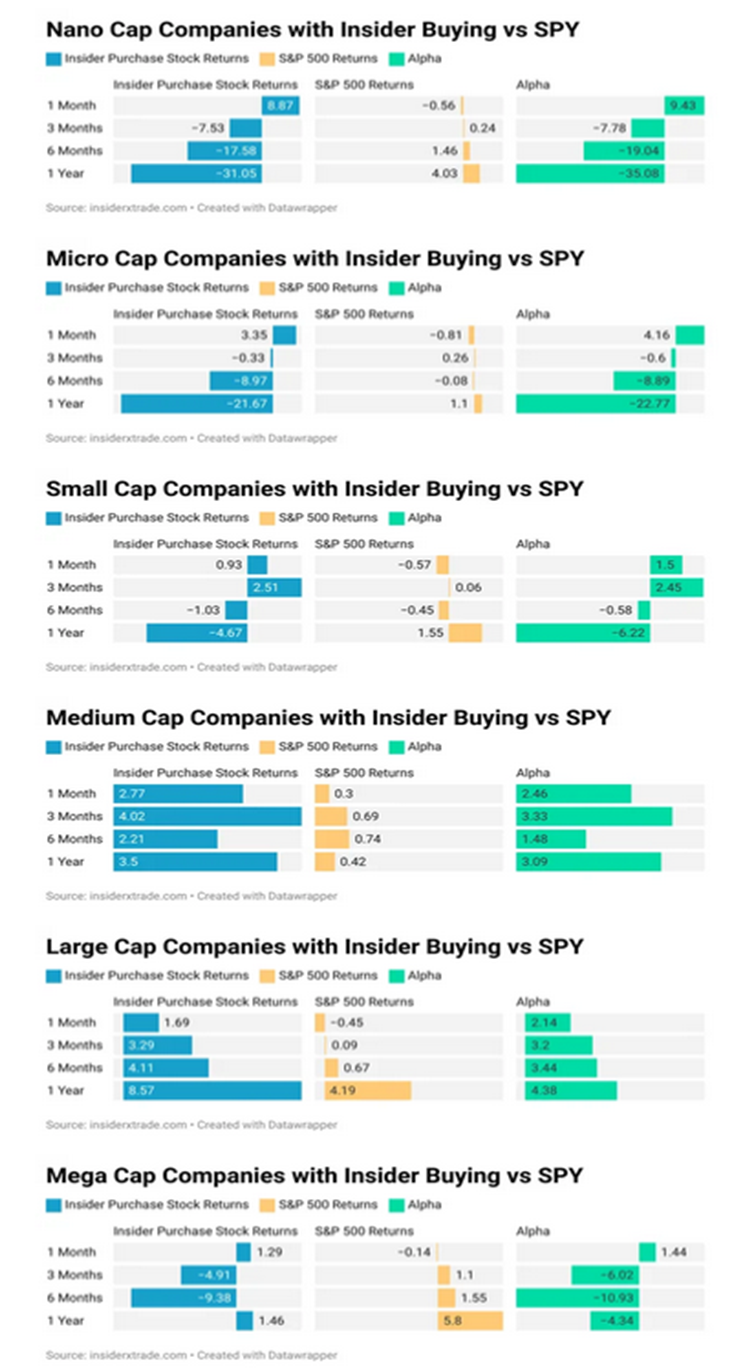

Determine 1 Supply r/choices on Reddit 02/25/2024

The above analysis by the redditor lined a 3-year interval and supplies sobering studying for anybody believing it’s merely a query of blindly following insiders. While the publish was most likely meant to get you to subscribe to insiderxtrade.com, it was fairly enlightening. The interval covers 3 years previous to Q2 2023 which was a very difficult inventory market atmosphere. One may conclude that the smallest cap shares are solely fascinating within the shorter time frames and presumably that mid and bigger cap shares insider consumers are extra on level about what they do. This evaluation adopted an older evaluation that was much less granular however likewise concluded that merely buying and selling the S&P yielded extra optimistic returns BUT insofar because the returns of the insider purchaser have been winners, they have been bigger winners than the S&P by some margin. So clearly no matter we do it can’t merely be to purchase when insiders are shopping for.

Whom must you comply with?

This brings us again to the identical query: we must always solely comply with the appropriate insiders however the query is which of them?

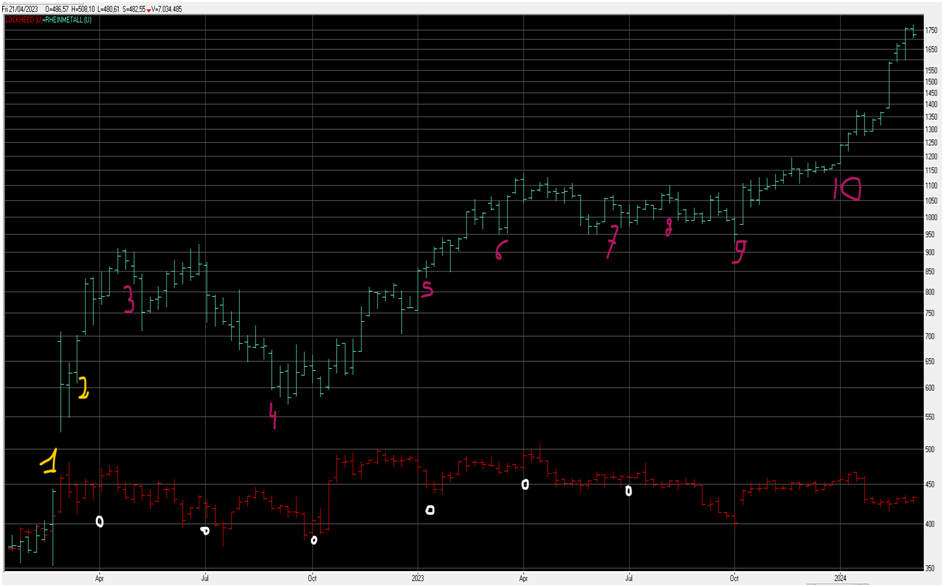

The reply is that we must always comply with these the place different issues inform us that the inventory in query may very well be of curiosity however that we’re not sure concerning the normal timing of coming into an uptrend. Warren Buffet’s concept that what went up final 12 months will go up subsequent 12 months is a truism that’s onerous to comply with in apply after we inevitably choose the one inventory that nosedives regardless of a stellar prior 12 months. An instance of a reasoned method utilizing insider shopping for is given beneath for 2 firms within the protection sector. In RED is Lockheed Martin (LMT) and in BLUE is German inventory market quoted protection agency Rheinmetall (RHM.DE).

To grasp the chart beneath, be aware that for each firms – as is common for any quoted firms – they’re topic to sure quarterly home windows of shopping for and promoting that are simply identifiable wanting on the timing of purchases by insider.

-

Factors 1 & 2 in yellow are public occasions related to the 2 shares in query – specifically Russia’s invasion of Ukraine and the announcement by the German Chancellor of a “Zeitenwende” a flowery German time period that Bob Dylan said extra merely as: “The times they are a changing”. This coincided with a €100 billion protection spending bundle to improve the German armed forces. No prizes for guessing that each gadgets are related for a protection inventory however the place the primary occasion drove each of them; the second solely drove up the German agency. While US firms in protection make more cash – the few remaining in Europe stand to develop quicker as they begin from a a lot decrease base. This made them fascinating to put money into.

-

The little white dots is the insider shopping for in LMT – the truth is it’s one man: John Donovan who hasn’t had the perfect of luck in his selections to get in. This from amongst the 115,000 staff of LMT and a really massive corps of folks that should report insider trades. LMT reviews about 30 insider trades a 12 months – primarily executions and gross sales. John is the lone bull and combines his LMT director place with a director place at PANW;

- The reddish pink numbers are buys by Rheinmetall insiders – the truth is in that complete interval there are solely two gross sales and they’re from a single one who additionally acquired many shares. Each quantity there represents between ~3 to six insiders shopping for inventory. When you think about Rheinmetall solely has 33,000 staff and the very fact they report about 10 transactions per 12 months, the distinction between LMT and them is much more outstanding.

The distinction in efficiency is super with Rheinmetall simply outpacing LMT however as one can see from (3) not all of the purchases have been essentially completely timed. The meteoric rise of the inventory in early 2022 led to a normal pause during which not the corporate efficiency however the normal market drove the inventory, . Insiders stored shopping for on a regular basis and that is the place the mix of an organization that’s in a superb place mixed with sustained insider shopping for and hardly any promoting makes the case compelling. Lonely John Donovan isn’t out of pocket however definitely the tightknit group of consumers in Rheinmetall have had the higher of it. The differential is that within the Germans case there was a lot greater than only a regional battle to drive the inventory worth that it was price paying consideration at what insiders have been doing. Principally they verify that the uptrend ought to final if you find yourself an insiders and the tip of a superb factor is in sight you promote and positively don’t purchase.

Development Break Affirmation

This brings us to a 3rd means to have a look at insider shopping for in a distinct mild – as a affirmation of a pattern break to the optimistic. Up to now now we have examined insider shopping for as one thing inventory based mostly, secretly hoping that some magnificent epiphany is driving the insiders and that we will revenue by affiliation. Evidently, buying and selling on insider information isn’t permitted and due to this fact it is smart to have a look at insider shopping for at a extra metalevel.

You probably have been investing for a whilst you have been by way of a market downturn – my first publicity was the 1987 crash however a lot of you’ll recall the market collapse following COVID, dot.com, subprime or the federal government debt disaster and so forth. Warren Buffet at all times regales (and comforts us) together with his quote that the flag goes out when the market goes down as a result of within the Home of Buffet it’s a superb factor when ‘hamburgers’ get cheaper. The purpose is that we by no means appear to have the ability to make certain that the market is not going to go down additional. Expertise tells us that for those who purchase wherever close to the nadir of the market – the truth is inside fairly a large margin of the nadir – the restoration is extraordinarily highly effective. It’s a sort of ‘buy and hold’ on steroids however our worry tends to drive us away from investing on the proper second after which wanting again we bemoan that: ‘it was obvious this pandemic thing was going to go away one day.’ Or no matter equal new increase has adopted the bust that made us skittish.

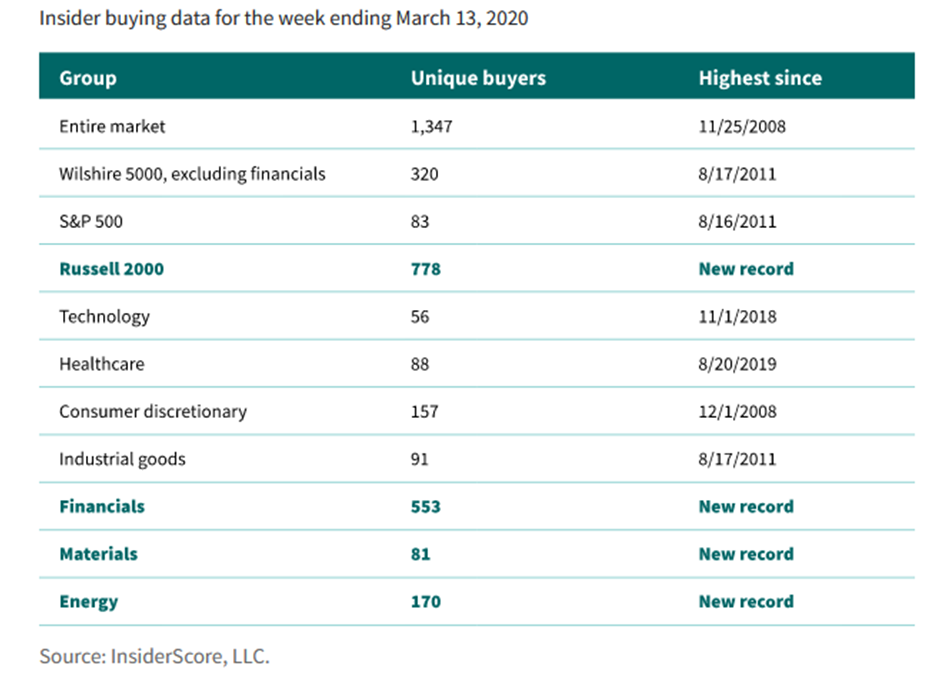

The evaluation beneath is once more ‘researched’ by Putnam however fairly a superb information for a distinct means of taking a look at insider shopping for. They observed the next in 2020 after the COVID Armageddon:

These have been ranges unseen in line with them however what makes their evaluation fascinating is that on that foundation they then made a selection about WHERE they might make investments. They selected the heavy cyclical aspect of the market because the one which had been hammered essentially the most and that tends to recovers quickest when a restoration units in after the ‘doom and gloom’ is dispelled.

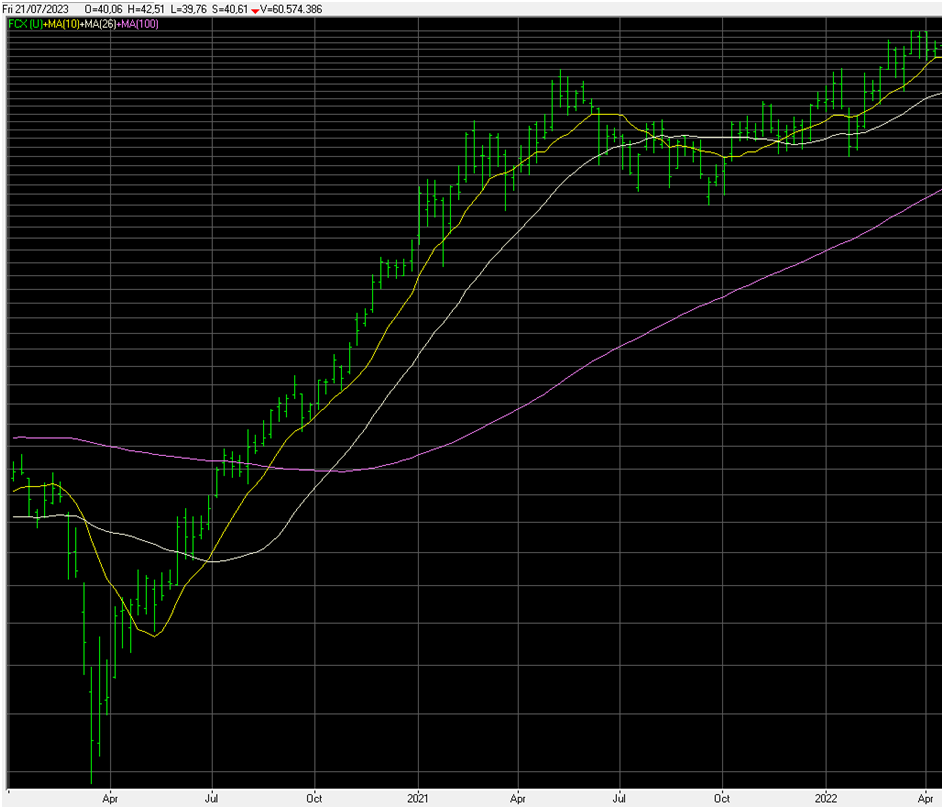

It’s too late now to have a look at the insider shopping for within the interval – at the least on the NASDAQ web site – however one should presume that their selection inventory FCX had its share of insider shopping for. It’s also very delicate to the copper worth which itself is immediately associated to financial exercise: there isn’t any financial progress with out copper and its worth has been a bell climate for the entire financial system since electronics began dominating our lives.

Determine 2 FCX chart from 01/01/2020 to 04/2022

As you may see from the chart above, Putnam will need to have carried out nicely however frankly it didn’t take a genius to determine this out nor quantum entry to information and even costly instruments. Actually, you couldn’t presumably time the dip, however you may be roughly proper: even a month or 3 would have been superb. What was secret is the mix of insider shopping for and the perception into different drivers of a inventory (on this case the belief the market was bottoming due to broad insider shopping for and the copper worth bottoming out).

The underside line

The conclusion of this publish is that insider shopping for isn’t a direct set off for funding however merely a helpful contributing sign in sure circumstances. Choices are perfect for making use of those indicators as a result of they will help play the market extra subtly than outright share buys can. The method to a duly researched insider shopping for situation may very well be to purchase a LEAP and promote some quick choices towards all or a part of the funding. This may give a little bit safety if the market goes down or sideways while making it doable to maneuver the bought name up steadily if the inventory picks up steam. The poor man’s lined name, as it’s typically referred to as, is the choice dealer’s good friend for insider shopping for methods.