Merchants,

I’m excited to share my high swing buying and selling concepts for the week forward. This week’s concepts will as soon as once more differ from final week’s because the market takes a breather amid the selloff in semi-stocks.

Whereas there are undoubtedly high swing alternatives on the market, it’s not as easy because it has been for the previous a number of months, with a number of tech shares breaking out of consolidations every week. Now, issues are taking a reset, and it’s important to regulate to it. Identical to I did final week with the short-swing concept within the semis.

However, there’s a catalyst with the potential to shake issues up this week and trigger vital directional strikes.

So, let’s get straight into it as I share my actionable concepts, plans, and commerce administration for my high swing buying and selling concepts for the week forward.

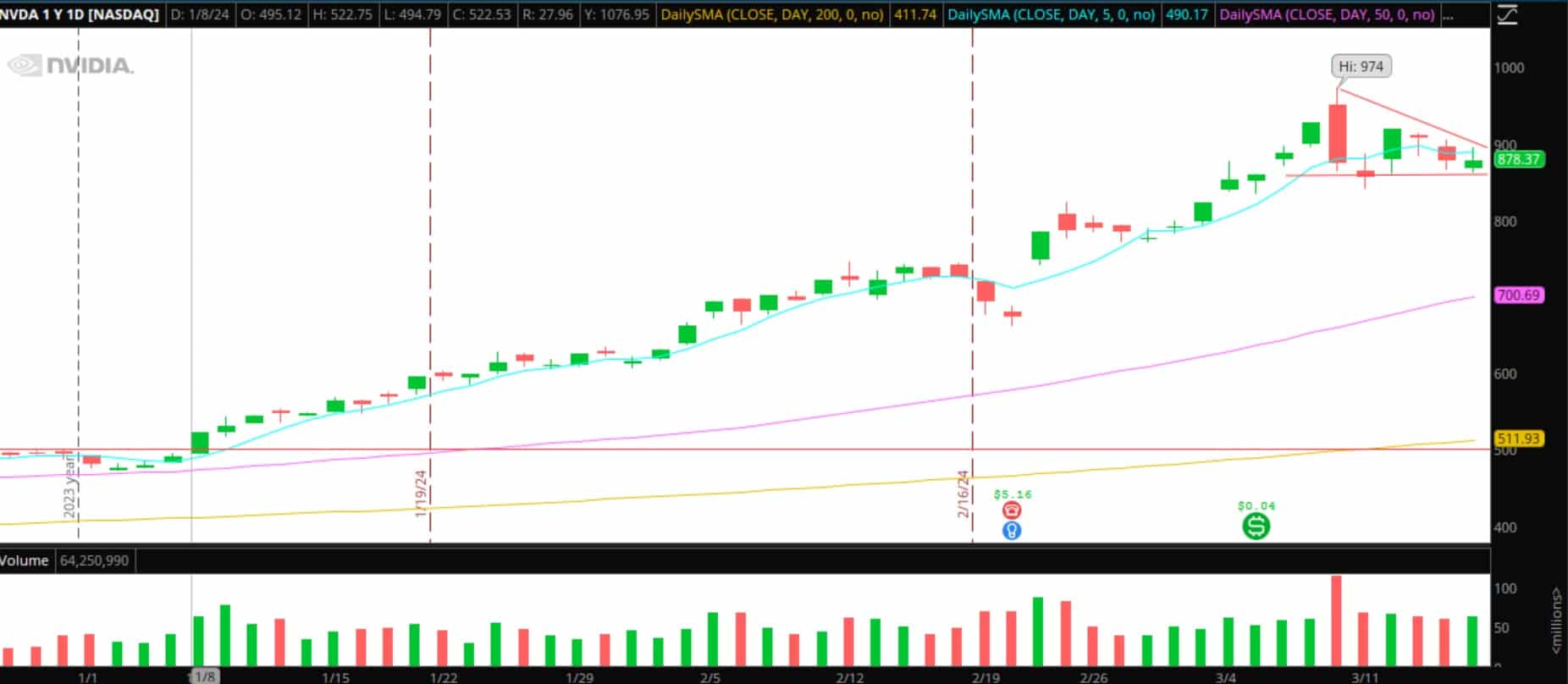

Nvidia’s Annual GTC Convention

After going considerably parabolic, the semis / AI sector has taken a breather over the previous week and pulled again. This comes simply earlier than a serious AI convention—Nvidia’s annual GTC convention—takes off Monday. With over 300 exhibitors, together with Meta and OpenAI, collaborating within the four-day convention, it’s not only a catalyst for Nvidia however for your complete sector and market.

So, staying within the loop with the newest developments and headlines might be crucial.

Concerning Nvidia, I’m not in search of a multi-day swing. Nevertheless, the chart has coiled properly over the previous week, presenting a stable, directional, reactive alternative for me.

*Please be aware that the costs and different statistics on this web page are hypothetical, and don’t mirror the influence, if any, of sure market elements equivalent to liquidity, slippage and commissions.

Right here’s the plan:

With coiled motion, I’m in search of both an extended or a brief, relying in the marketplace’s response to Monday’s keynote deal with. It’s not a multi-day place however a probably one-day pattern play after the inventory picks a route.

For the lengthy: A number of time frames aligned, with $900 because the breakout stage for the upside. Ought to the inventory break by means of this stage with quantity, I might be lengthy with a cease both on the day’s low or under the 5-minute low (I might be buying and selling this on the 5-minute TF).

I’ll scale out of the place because the inventory makes new intraday highs on the 5-min TF. My lofty objective is $950, and I’ll path the cease utilizing larger lows.

For the brief: It’s the identical because the lengthy concept, simply flipped round. If the inventory breaks Friday’s low with authority, maybe on an underwhelming announcement, I might be brief versus the earlier decrease excessive or breakdown stage if a severe second happens. As it really works, I’ll scale out on intraday lows, trailing the cease on decrease highs.

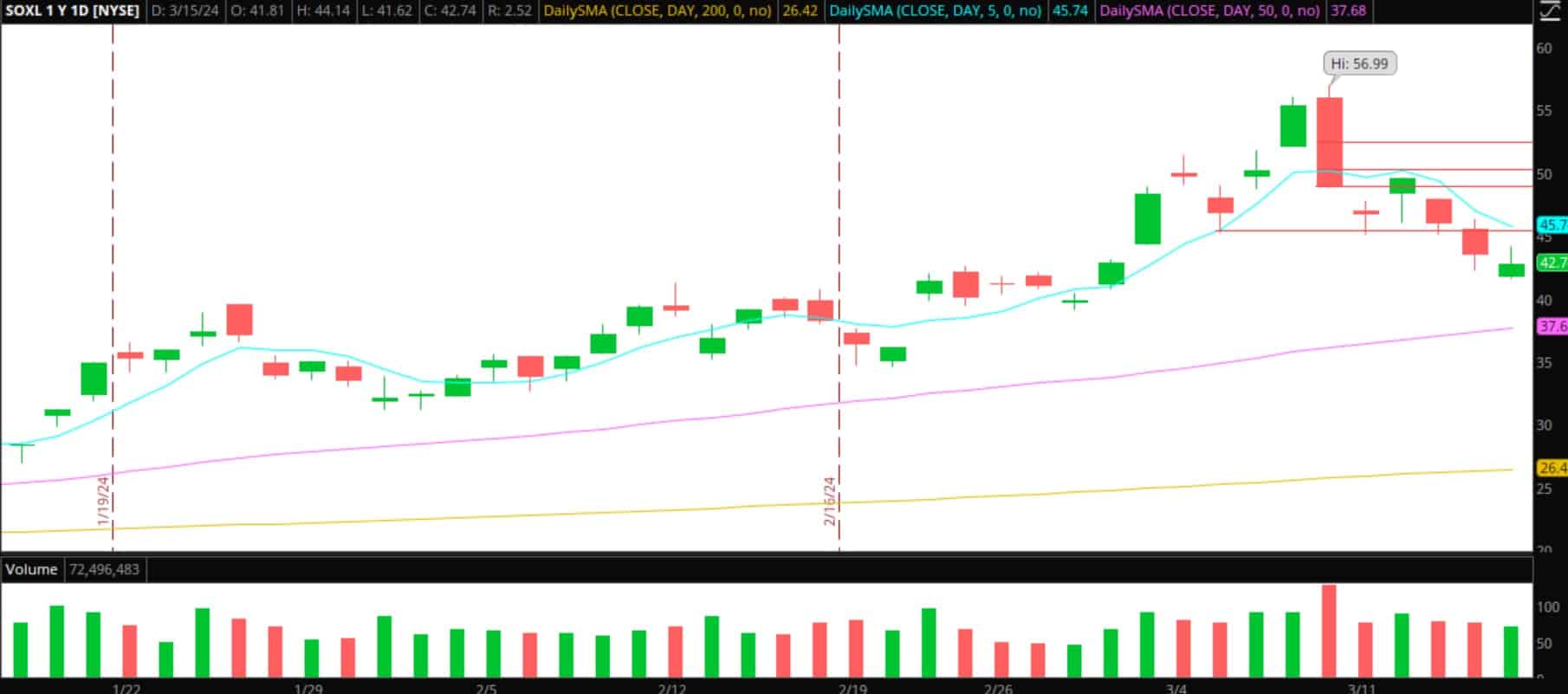

Bounce in SOXL

SOXL labored superbly final week. It was undoubtedly the highest concept on final week’s watchlist. Nevertheless, after a straight week of promoting and being considerably off the highs, I’ll now eye it for a bounce. It will likely be reactive to the motion I see in NVDA and another high holdings and heavyweights of the sector.

*Please be aware that the costs and different statistics on this web page are hypothetical, and don’t mirror the influence, if any, of sure market elements equivalent to liquidity, slippage and commissions.

Right here’s my plan:

With the catalyst this week, this may also be a reactive commerce. However with lots of its high holdings, like AMD and AVGO, approaching key SMAs and considerably off their highs, ought to particular person shares inside the sector discover their footing and catch a bid, together with momentum in NVDA, I’ll get lengthy for a multi-day bounce.

So, ought to relative power and constructive flows be current within the sector, I’ll get lengthy SOXL with a cease on the day’s low. My first goal for a bounce can be both an ATR up transfer or $45.50 – $46, a momentum breakdown stage from final week. After that, I’ll scale out of the remainder of the place on the 5-minute timeframe because the inventory makes new larger highs. My cease might be trailed on the 5-minute timeframe, conservatively, as I think aggressive momentum and a transparent pattern. So, I might be out if it makes a transparent pivot lower-low on the 5-minute timeframe and key holdings start to show weak point.

Two Further Backburner Concepts:

SOUN: Unimaginable endurance and brief squeeze. They are going to be presenting on the convention this week. I received’t be in search of an extended, contemplating how a lot the inventory has already surged. Reasonably, I’m eyeing pops to $9 – $10 for failure and potential sell-the-news setup.

VERB: Small-cap inventory with an unbelievable quantity surge on Friday. After the weak shut on Friday, a ton of longs at the moment are trapped and underwater. I’ll have alerts set for pops again into potential main provide zones, like $0.65 – $0.80. Ought to the inventory push again into this space and fail intraday, I’ll search for the brief versus the excessive of the day.