- Analyst claims ETH will eclipse BTC in crypto summer time.

- The US liquidity injection may enhance the market within the second half 2024.

Ethereum [ETH] may outshine Bitcoin [BTC] as we inch nearer to crypto summer time. The daring projection was made by Raoul Pal, founding father of Actual Imaginative and prescient and key crypto market commentary determine.

In an X put up, Pal underscored that crypto summer time is an altcoin season that shifts consideration from Bitcoin to others. A part of his put up learn,

“Crypto Summer is usually the start of Alts season, which goes full “bubble-tastic” in Fall. That is when ETH bases and begins to outperform BTC. That is when SOL accelerates its outperformance of BTC & ETH.”

Including a timeline to his projection and the way “crazy” issues can get, Pal highlighted that,

“Once the markets are full refreshed, that is usually when The Banana Zone starts, picking up to full mania towards the latter part of the year…and well into 2025”

The US liquidity issue

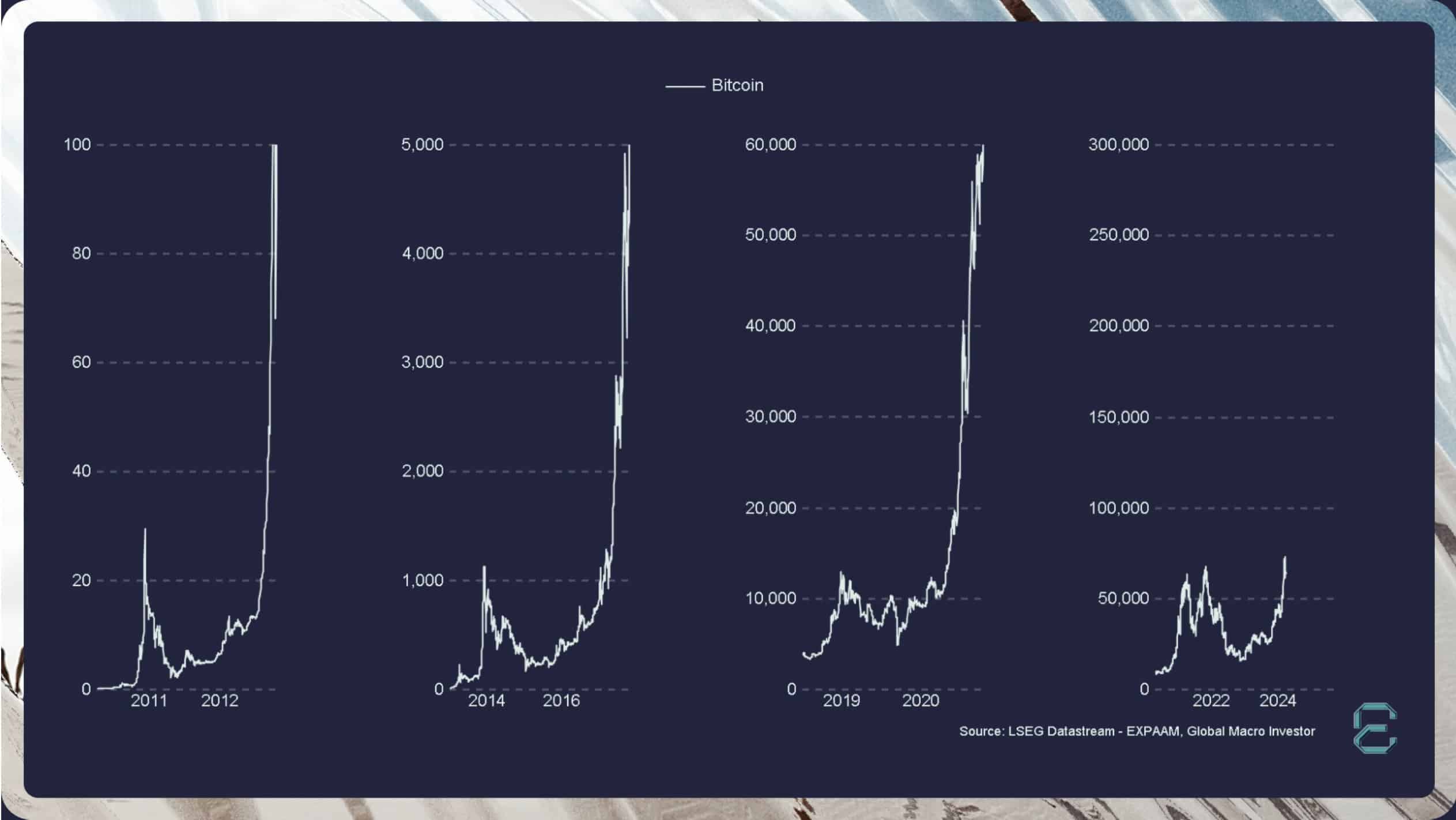

Pal’s projection is only primarily based on historic knowledge. Nonetheless, previous efficiency doesn’t essentially dictate future outcomes. So, what could possibly be the important thing catalyst for Pal’s wild projection?

An easing macro entrance is among the possible components. The Singapore-based crypto buying and selling agency, QCP, emphasised how US liquidity injection may drive markets.

In a weekend replace over Telegram, the agency acknowledged that US inflation was nonetheless scorching. Nonetheless, it reiterated that the US treasury may inject extra liquidity within the second half of the 12 months. A part of the assertion learn,

“However, at this point, monetary policy might matter much less than fiscal policy, which will be the main driver of liquidity and asset performance.”

The agency added that,

“The upcoming Quarterly Refunding Announcement (QRA) on 1st May could also see higher issuances in short-term US bills. This will drain the RRP, which currently has USD 400 billion, and also increase liquidity.”

Final week, BitMEX founder Arthur Hayes made a related projection. He highlighted that further liquidity shall be injected into the economic system in the course of the US elections.

Extra liquidity means an more money provide inside world or native markets, particularly when central banks minimize rates of interest. This can be a good situation for risk-on property to rally.

Whether or not Ethereum outperforms Bitcoin stays to be seen. Nonetheless, a lot of the hyped “crypto summer” could possibly be fueled primarily by macro components moderately than historic cycles.