- BTC was down by greater than 5% within the final seven days.

- BTC’s worth would possibly plummet to 61k earlier than turning bullish.

After a pointy decline, Bitcoin [BTC] dominance began to extend in the previous couple of days. The current rise in Bitcoin dominance was not a results of a BTC bull rally however slightly a consequence of altcoins turning bearish.

Due to this fact, AMBCrypto checked BTC’s state to see how the rising dominance may influence the coin’s worth.

Bitcoin’s rising dominance amidst a worth drop

CoinMarketCap’s knowledge revealed that BTC’s worth dropped by greater than 5% within the final seven days. This pushed the coin’s worth beneath $63k.

In actual fact, within the final 24 hours alone, BTC was down by 2%. At press time, it was buying and selling at $62,369.67, with a market capitalization of over $1.22 trillion.

The downturn was not solely restricted to BTC, as a number of altcoins, together with Ethereum [ETH], additionally witnessed worth corrections.

The general decline within the altcoin market cap allowed BTC’s dominance to rise once more after a steep decline on the twenty eighth of April. At press time, Bitcoin dominance was 50.9%.

Will rising dominance assist BTC flip bullish?

Since BTC dominance was rising, AMBCrypto deliberate to verify its metrics to learn how this affected investor sentiment. We discovered that promoting stress on BTC dropped in the previous couple of hours as its change reserve declined.

Moreover, its web deposit on exchanges was additionally low in comparison with the final seven-day common. A have a look at CryptoQuant’s knowledge revealed that miners have been additionally promoting at a slower tempo, indicating their will to carry BTC.

The rise in shopping for stress and buyers’ willingness to carry BTC would possibly set off a pattern reversal, permitting BTC to color its charts inexperienced. To higher perceive whether or not that’s doable, we then analyzed BTC’s day by day chart.

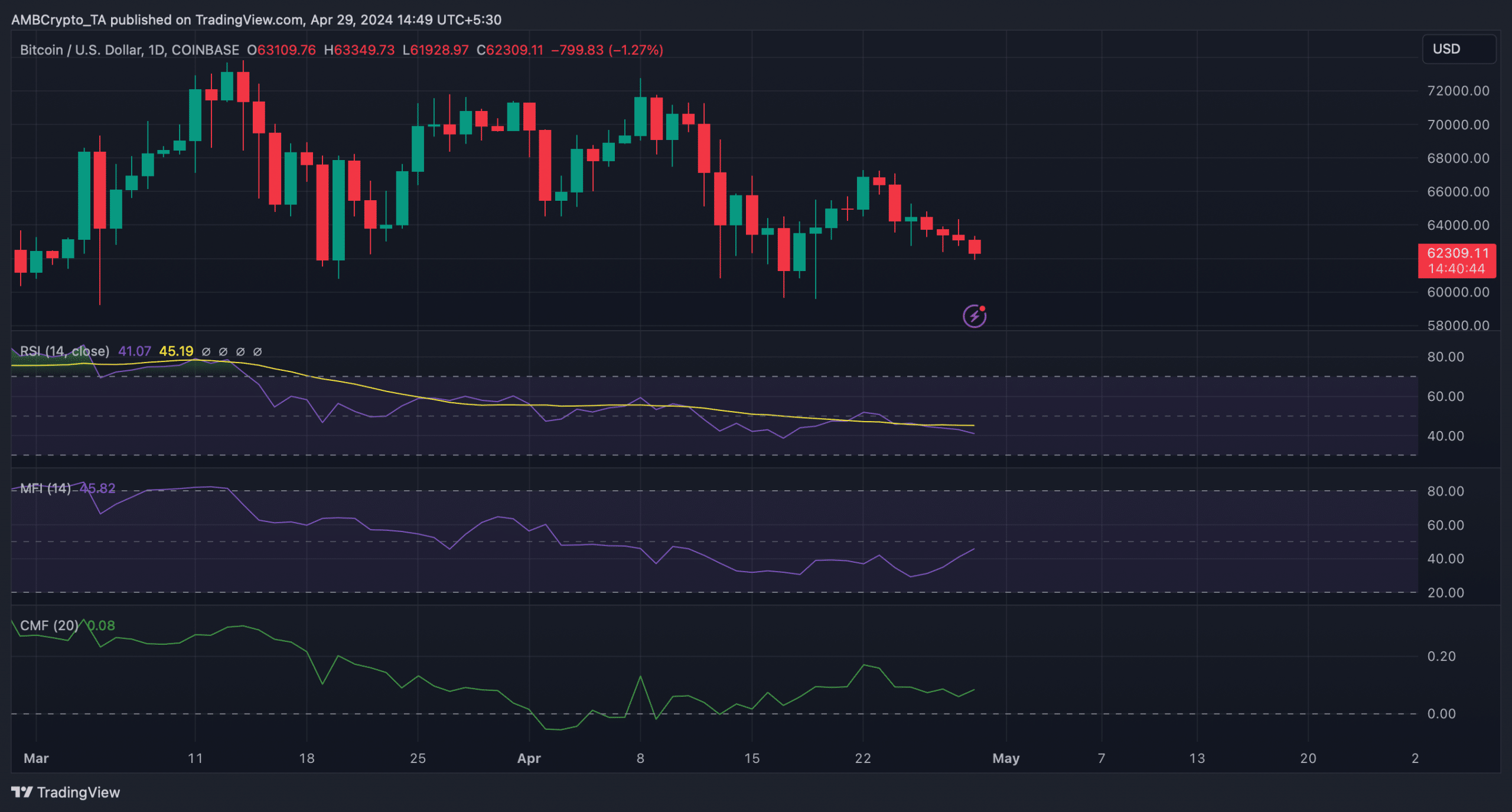

As per our evaluation, BTC’s Chaikin Cash Movement (CMF) registered an uptick and at press time had a worth of 0.08.

The same growing pattern was additionally famous on Bitcoin’s Cash Movement Index (MFI) chart. Each of those technical indicators hinted at a worth improve within the coming days.

Nevertheless, the Relative Energy Index (RSI) remained bearish because it registered a downtick.

Learn Bitcoin’s [BTC] Worth Prediction 2024-2025

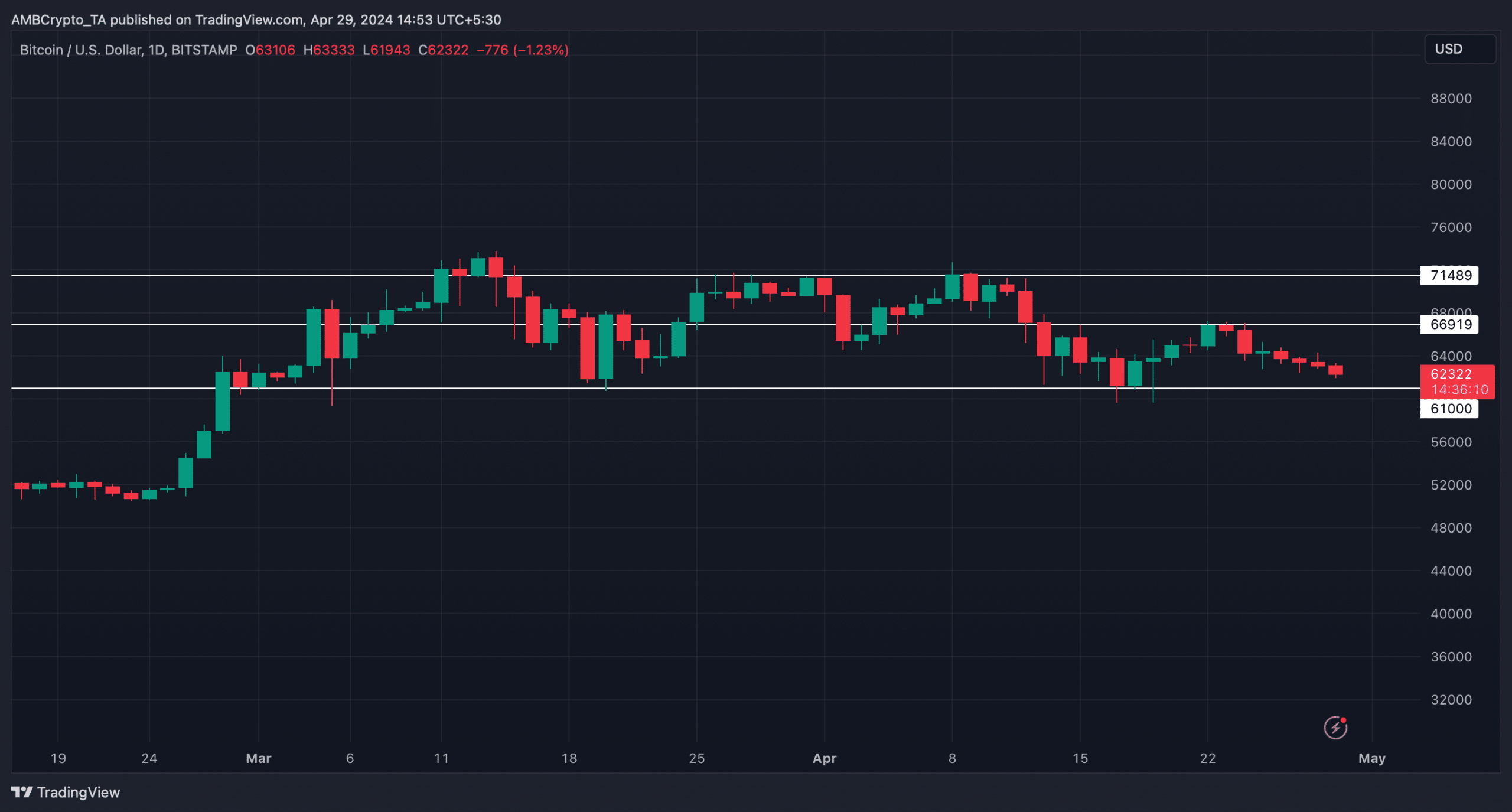

Going ahead, we analyzed BTC’s chart to foretell the subsequent doable targets BTC would possibly hit if a bull rally occurs. BTC’s worth within the close to time period would possibly first plummet to $61k help.

A profitable take a look at of that help may provoke a bull rally, permitting it to first reclaim $66k. An extra worth improve may lead to BTC touching $71k earlier than it reaches a brand new all-time excessive within the months to comply with.