CoinShares knowledgeable within the earlier week that digital asset funding merchandise noticed outflows for the third week in a row, amounting to an unlimited $435 million. It’s the most large outflow since March of this 12 months. The buying and selling volumes of Trade-Traded Merchandise had additionally decreased and totaled 11.8 billion, decrease than that of the earlier week’s 18 billion. On the similar time, the worth of Bitcoin fell by 6%.

Grayscale Sees Lowest Digital Asset Outflow in 9 Weeks

The foremost vacation spot of those outflows was the US which noticed round $388 million go away the area. An attention-grabbing truth, the year-to-date inflows within the U.S. reached a brand new all-time excessive of $13.6 billion. Grayscale, the biggest participant within the digital asset funding area, obtained probably the most of outflows at $440 million, which was the bottom outflow in 9 weeks.

Though Grayscale’s outflows are waning, there has additionally been a lower in influx from new issuers. The cryptocurrency created per week influx of $126 million, down from $254 million the earlier week. Different areas together with Germany and Canada had a destructive perspective, amassing $16 million and $32 million outflows. Conversely, Switzerland and Brazil recorded $5 million and $4 million inflows whereas different areas had destructive flows.

Altcoins Expertise Inflows Regardless of Bitcoin and Ethereum Outflows

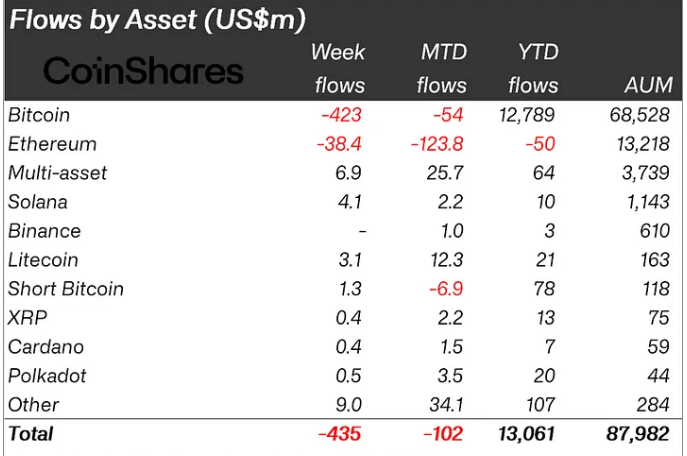

The outflows principally lined Bitcoin and Ethereum, which misplaced $423 million and $38 million from these belongings, showing in outflows. Such a case is uncommon as a result of nevertheless outflows, altcoins skilled inflows which means buyers’ need for diversification. Multi-coin funding merchandise witnessed inflows of $7 million. Alternatively, Solana, Litecoin, and Chainlink out influx of $4 million, $3 million, and $2.8 million, respectively.

Lastly, digital asset funding merchandise noticed important outflows for the third consecutive week. Though, it’s important to report that the primary outflows have been in Bitcoin and Ethereum; many inflows have been seen in some altcoins. This means that investor sentiment and their pursuits are altering. Nonetheless, though the outflows outweigh the inflows, the market stays on the transfer and always opens up new potentialities for funding and diversification. Because the cryptocurrency trade matures, such developments shall be extra widespread and mirror the continued growth and adaptation of the digital asset ecosystem.