Merchants,

As at all times, I’m wanting ahead to sharing my high swing concepts with you for the upcoming week, together with my actual entry and exit targets for setups which may have important follow-through.

Final week, my concepts have been remoted to particular person names and outlier situations, not correlated to the general market. That’s as a result of the general market lacks a pattern. I’ve mentioned this in much more element in my weekly assembly within the SMB Inside Entry.

Sticking with that theme and doubling down on persistence, permitting the market to point out its hand higher earlier than I get extra aggressive with swing concepts, listed here are my high concepts for the upcoming week.

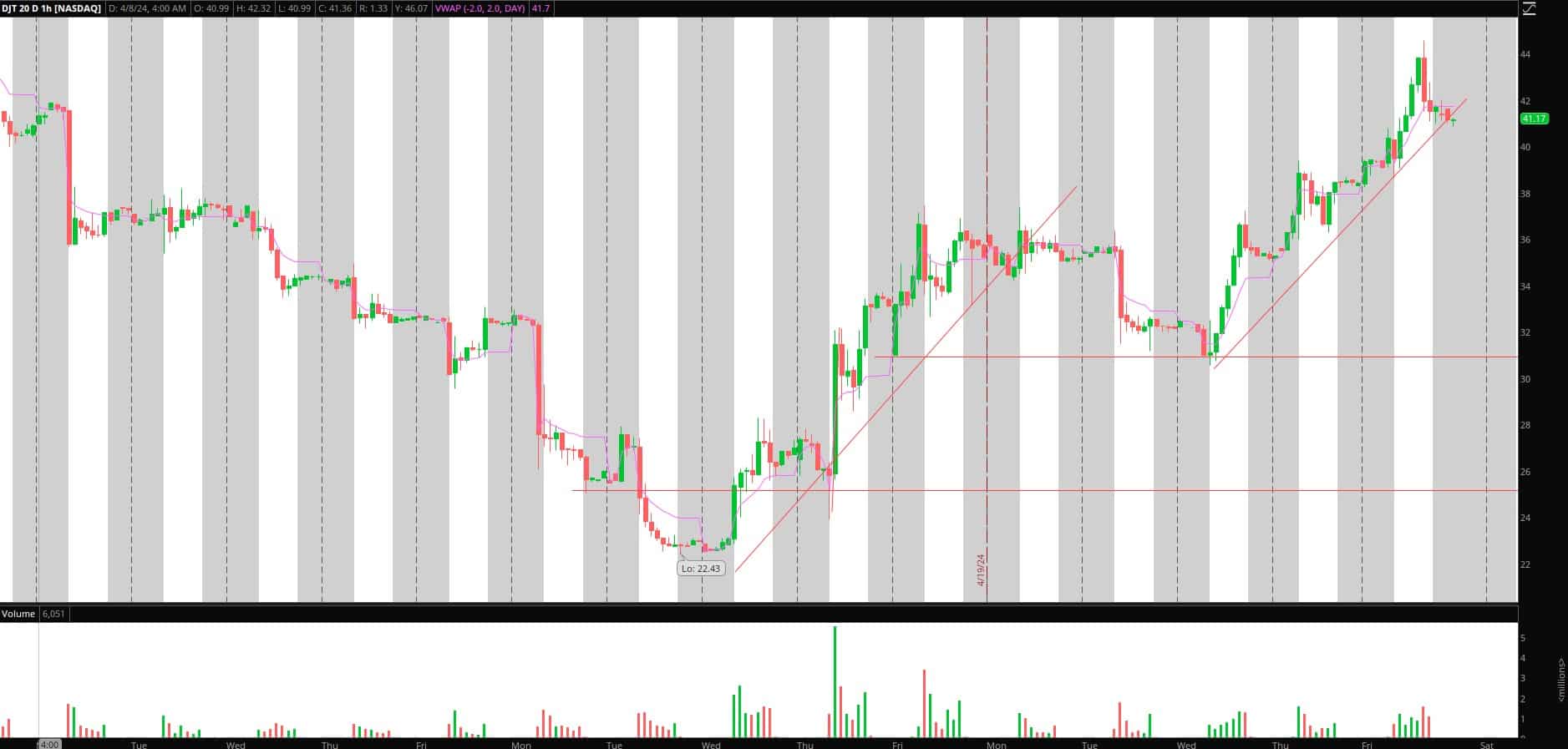

Brief Swing in DJT

The one thought from final week that by no means materialized and triggered an entry was DJT. Nonetheless, it continues to type a greater setup because the bounce stretches. Due to this fact, as I discussed final week, the upper this goes, the higher, making for a juicier commerce as soon as confirmed.

Right here’s my plan, just like final week:

*Please word that the costs and different statistics on this web page are hypothetical, and don’t mirror the impression, if any, of sure market components similar to liquidity, slippage and commissions.

Good grind and squeeze larger final week, adopted by a fast selloff into the shut on Friday. Going ahead, I’m monitoring the worth motion if it pushes again into ~ $43 for a possible decrease excessive brief entry. If it holds up, I’ll proceed stalking for a failure larger—no should be early as there may be loads of meat on the bone. If a decrease excessive is confirmed, I’ll search for a 3 – 5 day brief place, trailing the cease in opposition to the prior day’s excessive, concentrating on a transfer towards the mid-to-low $30s, and scaling out alongside the best way.

Pullback in SOXL

The swing-long bounce in SOXL performed out fantastically final week after the upper low was confirmed on Monday. It was an excellent setup to return and playbook and research. Nonetheless, after closing the week up virtually 30%, I’m now concentrating on a pullback alternative over 1 – 2 days.

*Please word that the costs and different statistics on this web page are hypothetical, and don’t mirror the impression, if any, of sure market components similar to liquidity, slippage and commissions.

I’d prefer to see a niche up / push towards its flattening 50-day and rejection close to $42 or a big decrease excessive and fail to carry above the uptrend’s help close to $39 for a brief entry. After that, I might aggressively path the cease utilizing decrease highs on the 5-minute timeframe and scale out of the place on important decrease lows and extensions from the VWAP, concentrating on a transfer towards $35 / the 5-day SMA.

Further Concepts:

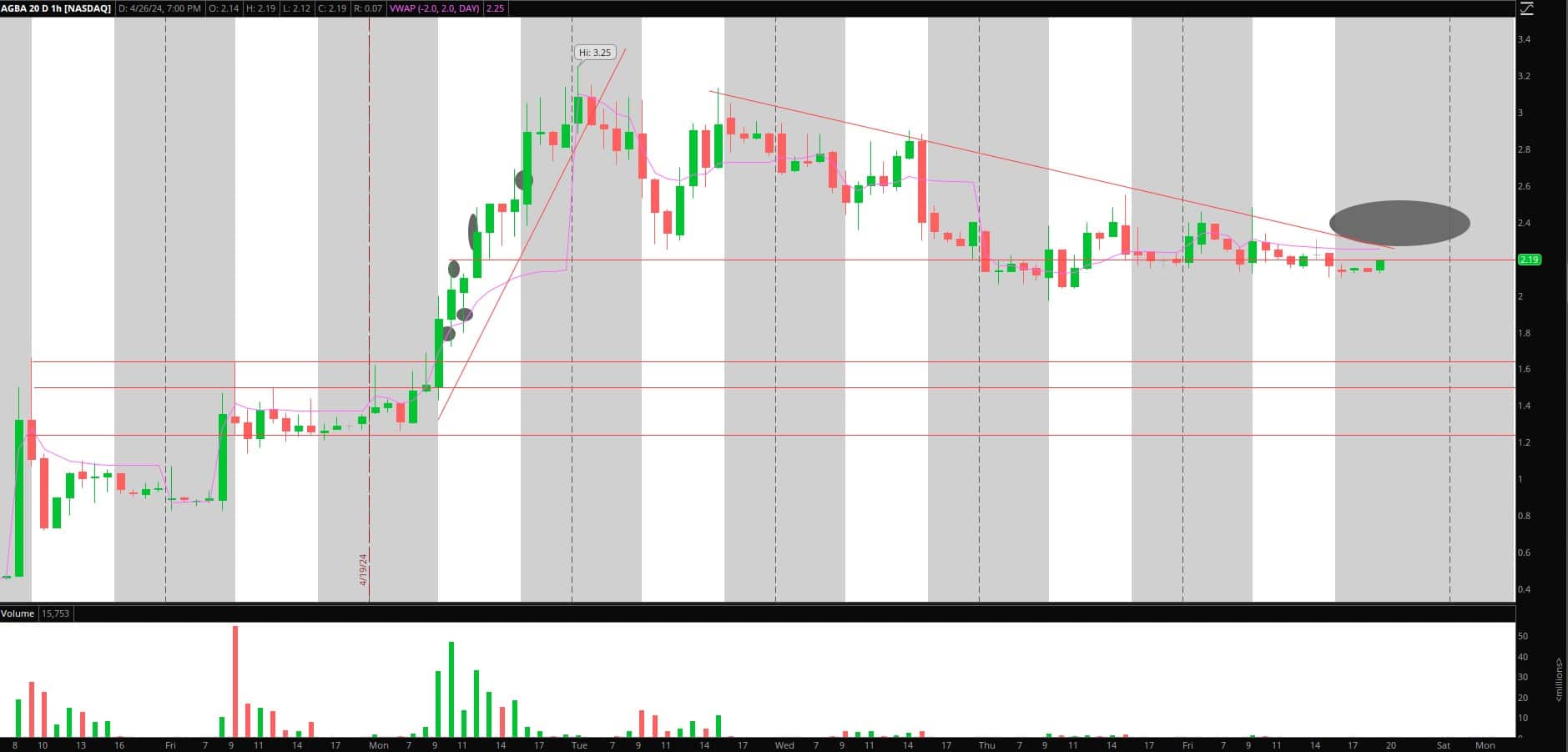

Secondary Liquidity Entice in AGBA: Stable thought from final week. Has since pulled in, and quantity has died. If this reclaims $2.30s and churns larger, shorts is perhaps trapped for a retest of $3+. On look ahead to the $2.30 reclaim and uptrend intraday to type for a 2-day lengthy concentrating on $3+.

*Please word that the costs and different statistics on this web page are hypothetical, and don’t mirror the impression, if any, of sure market components similar to liquidity, slippage and commissions.

Penny Inventory Breakout in JAGX: I just like the setup from a technical perspective, but it surely’s additionally necessary to acknowledge that it is a serial diluter, and the corporate wants money—know what you personal. 600 million shares traded 9 days in the past. Since then, the amount has died down, with $0.20 performing as important resistance. I’m searching for a breakout in worth and quantity over $0.20 for a one—to two-day transfer towards $0.40.

*Please word that the costs and different statistics on this web page are hypothetical, and don’t mirror the impression, if any, of sure market components similar to liquidity, slippage and commissions.