- Bitcoin is anticipated to commerce inside the established vary within the weeks after the halving.

- Within the close to time period, the $66.8k stage was essential resistance, and one other assist stage was price watching.

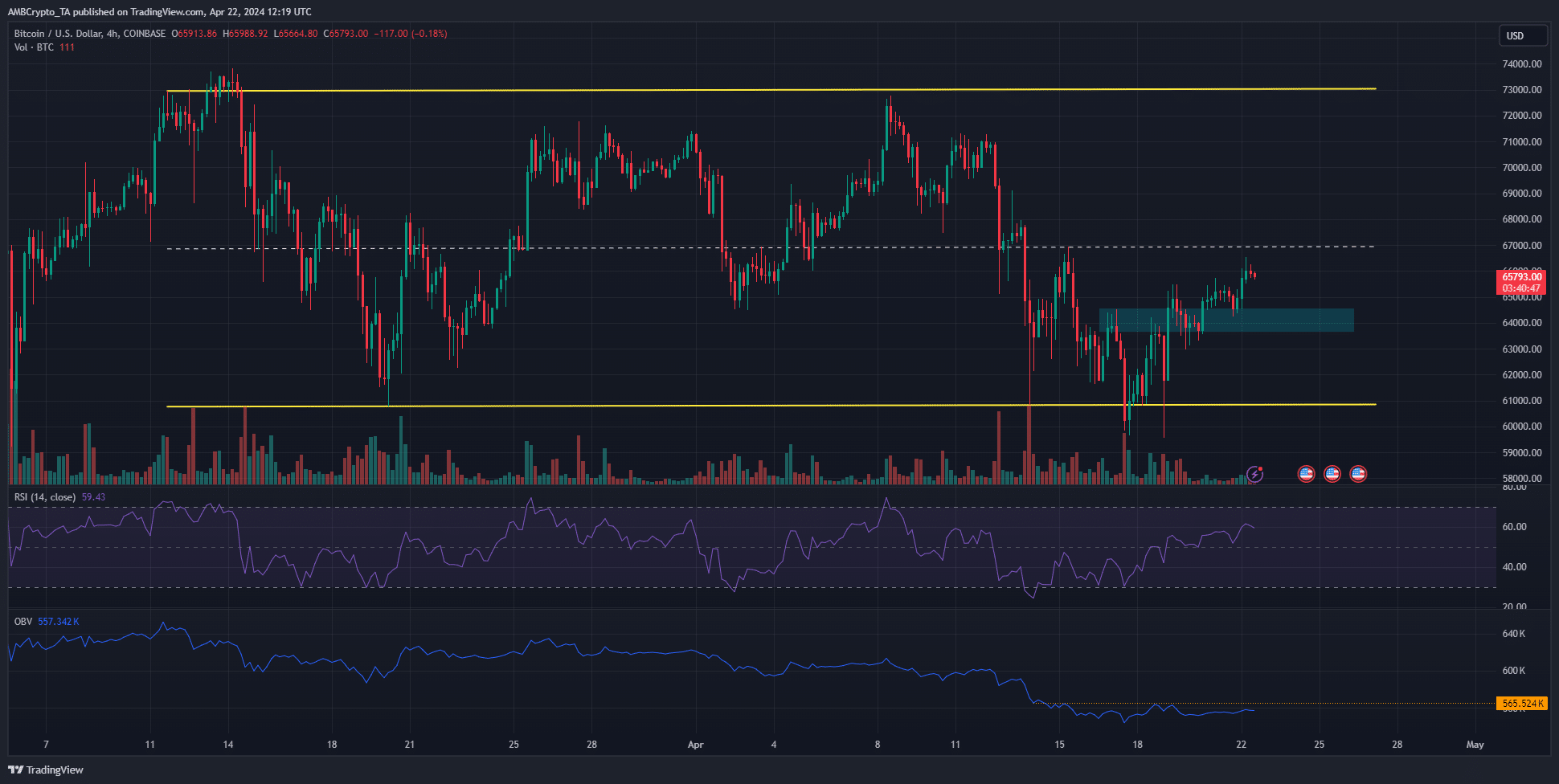

Bitcoin [BTC] shaped a variety between $73k and $60.7k. The mid-point of this vary sat at $66.9k.

Bitcoin noticed a wholesome uptrend at press time, however the New York Open on Monday the twenty second of April had not but occurred.

On Sunday, crypto analyst CrypNuevo posted on X (previously Twitter) that he anticipated a transfer to $66k to start.

This has come to go, and AMBCrypto determined to analyze the place BTC costs would go subsequent inside the vary.

The situations for a transfer previous $66k

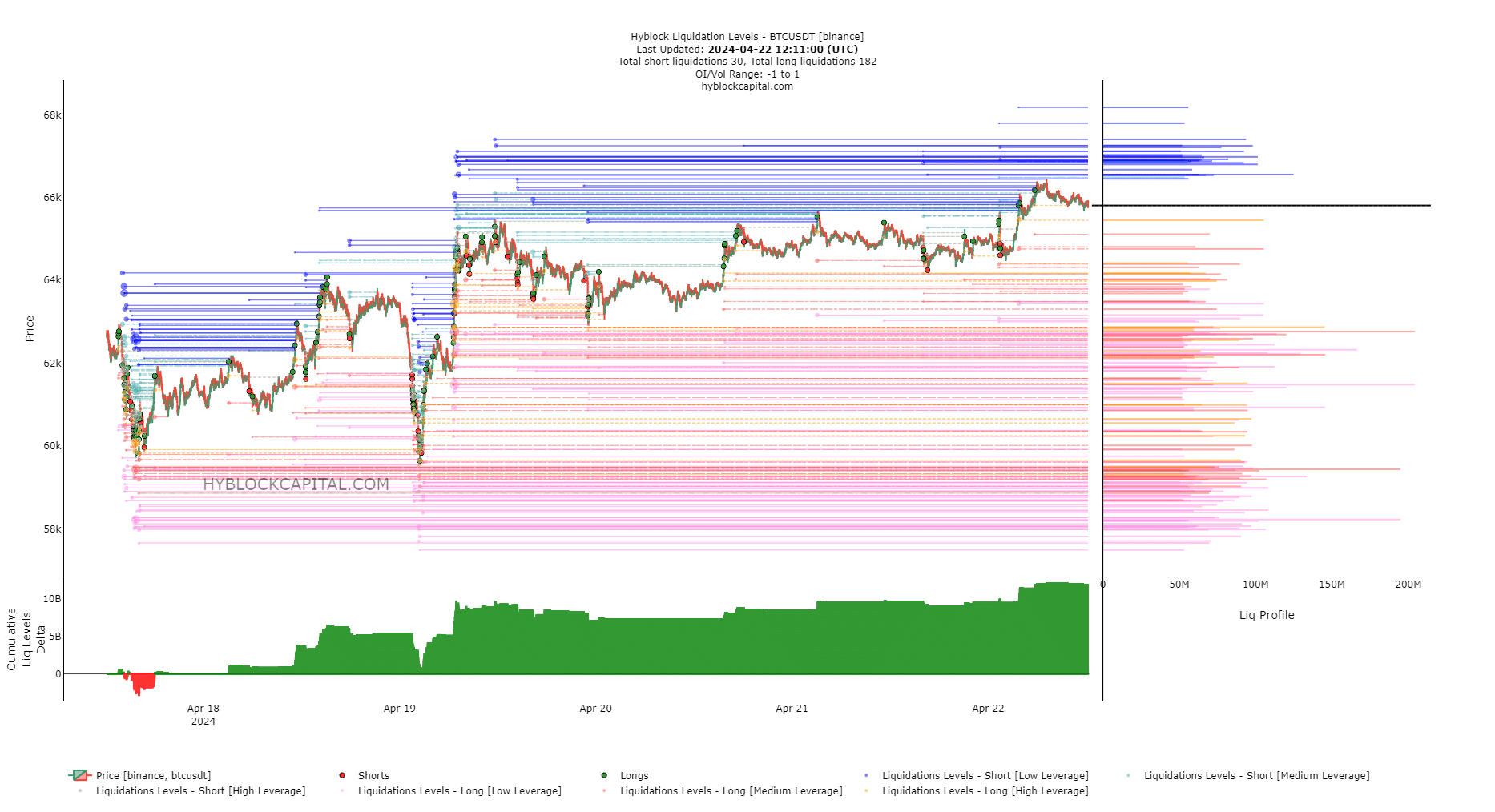

CrypNuevo identified that the 7-day look-back interval liquidation heatmap confirmed a cluster of liquidation ranges on the $66k stage.

This stage can be lower than 1% beneath the mid-range stage of the vary formation talked about earlier.

This was a very good place for costs to reverse bearishly. The New York session open may see costs leap previous $66k, and gather the liquidity there.

It could doubtless comply with up by plunging decrease to take out the keen bulls ready for a transfer previous the $65k-$66k short-term resistance zone.

The invalidation of such a bearish reversal could be a continued transfer previous $66k. A transfer beneath $64.5k would point out that $63k was the following goal.

Supply: Hyblock

The liquidation ranges confirmed the lengthy positions far outweighed the quick positions. This indicated {that a} downward transfer was favorable. The $66.8k area had a excessive focus of huge quick liquidations.

In the meantime, the $62.8k space had a cluster of lengthy liquidation ranges as properly. Due to this fact, a drop beneath $64.5k would doubtless see a dip to $62.8k.

Combining technical indicators with the vary formation

CrypNuevo highlighted {that a} deviation beneath the vary lows often sees costs go to the other excessive of the vary.

We noticed such a deviation on the seventeenth of April, when costs fell to $59.8k. Since then, the route has reversed.

The RSI on the 4-hour chart additionally highlighted bullish momentum. But, the OBV was unable to scale the native resistance stage. This indicated an absence of shopping for quantity previously week.

Is your portfolio inexperienced? Try the BTC Revenue Calculator

The vary highs and vary lows have confluence with the liquidity pockets at $73.2k and $56k. Due to this fact, these are the upper timeframe ranges of curiosity.

It’s anticipated that Bitcoin would consolidate inside these ranges for just a few weeks and collect energy for its breakout after the promoting strain that got here with the halving.