Market Overview: Nifty 50 Futures

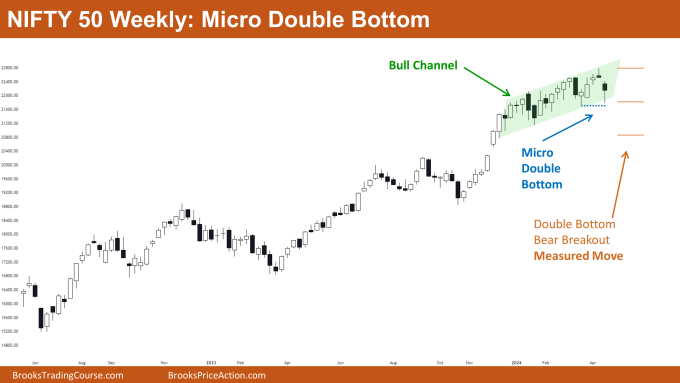

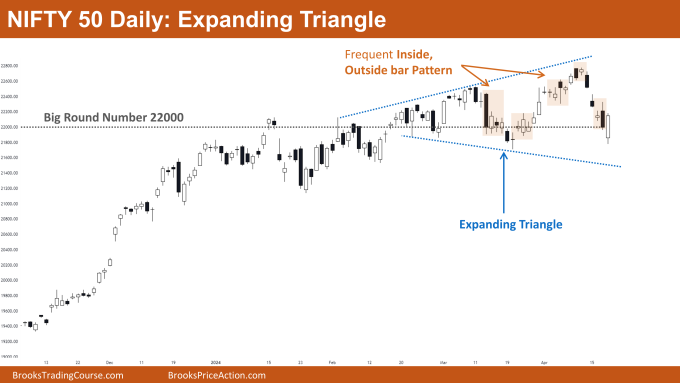

Nifty 50 Micro Double Backside on the weekly chart. This week, the market closed with a weak bearish tone. The candle exhibits a small bearish physique with a protracted tail on the backside. This weak shut reduces the probability of a major pattern reversal. As a substitute, the bears may see a buying and selling vary somewhat than a full reversal. The market has additionally shaped a micro double backside, and if there’s a bearish breakout from this sample, it might push the market in direction of a worth round 21,000, which might function robust assist. On the day by day chart, Nifty 50 is buying and selling inside a big increasing triangle sample. At present, it’s in a bearish leg approaching the underside of this increasing triangle. With the market buying and selling close to the numerous spherical variety of 22,000, merchants ought to anticipate buying and selling vary worth motion within the upcoming buying and selling week.

Nifty 50 futures

The Weekly Nifty 50 chart

- Common Dialogue

- Bulls who’re presently holding lengthy positions ought to proceed holding them because the market hasn’t proven robust indicators of a serious pattern reversal.

- The market is buying and selling close to the underside of the bull channel and is forming a micro double backside. Thus, bears ought to chorus from promoting close to these ranges.

- Merchants who haven’t but entered this robust bull pattern can contemplate getting into when the market achieves a powerful bull shut above the excessive of this week’s bar or above the all-time excessive.

- Deeper into Value Motion

- Over the previous a number of weeks, the market has shaped extra bull bars than bear bars. Nonetheless, it’s value noting that these bull bars have small our bodies and tails.

- This might point out an upcoming buying and selling vary. If the bears handle a bear breakout of the micro double backside, the probability of a buying and selling vary would enhance.

- The anticipated buying and selling vary peak in that state of affairs can be equal to the peak of the bull channel the market is presently buying and selling inside.

- Patterns

- The market is buying and selling inside a decent bull channel, making it difficult for bears to revenue. In such a bull channel, bears ought to all the time watch for a bear breakout.

- The market has shaped a micro double backside close to the underside trendline of the bull channel. If bulls obtain a bull breakout above the neckline, the market might expertise a measured transfer upward.

The Day by day Nifty 50 chart

- Common Dialogue

- Because the market is presently buying and selling close to the underside of the increasing triangle, bulls can begin taking lengthy positions. Bears, then again, shouldn’t be shorting the market.

- Bears who already shorted on the prime of the increasing triangle and are nonetheless holding a brief place can begin to exit their place.

- For the reason that earlier bear leg was robust, the probabilities of a 2nd leg down are excessive. Due to this fact, each the bulls and bears can have a chance to purchase and promote, respectively, at a greater worth.

- Deeper into Value Motion

- Nifty 50 is presently buying and selling close to the numerous stage of 22000. Merchants ought to deal with the market like a buying and selling vary, which means they need to purchase low, promote excessive, and take fast exits.

- Each time the market makes a powerful transfer in a single route, the probabilities of a 2nd leg are excessive. As an example, if the market kinds a powerful bull leg in a bull pattern, the probabilities of a 2nd leg up earlier than a reversal are very excessive.

- It’s important to notice that the above sample shouldn’t be legitimate when the market is buying and selling in a buying and selling vary. The likelihood that the market would type a 2nd leg is increased in trending phases and reduces if the market is in a buying and selling vary part.

- Patterns

- The market has been forming quite a lot of inside bars and outdoors bars on the day by day chart. Each time inside/outdoors bars happen too incessantly, this can be a signal of a buying and selling vary part.

Market evaluation studies archive

You’ll be able to entry all weekend studies on the Market Evaluation web page.