- Bitcoin’s bullish worth trajectory ensures profitability amid challenges

- Halving may trigger provide shock, driving volatility and worth rise

The yr 2024 has confirmed to be an distinctive one for Bitcoin [BTC], boosted by ETFs and capped off by its 4th halving. Nonetheless, that’s not all as apparently, there has additionally been a big change in miner conduct.

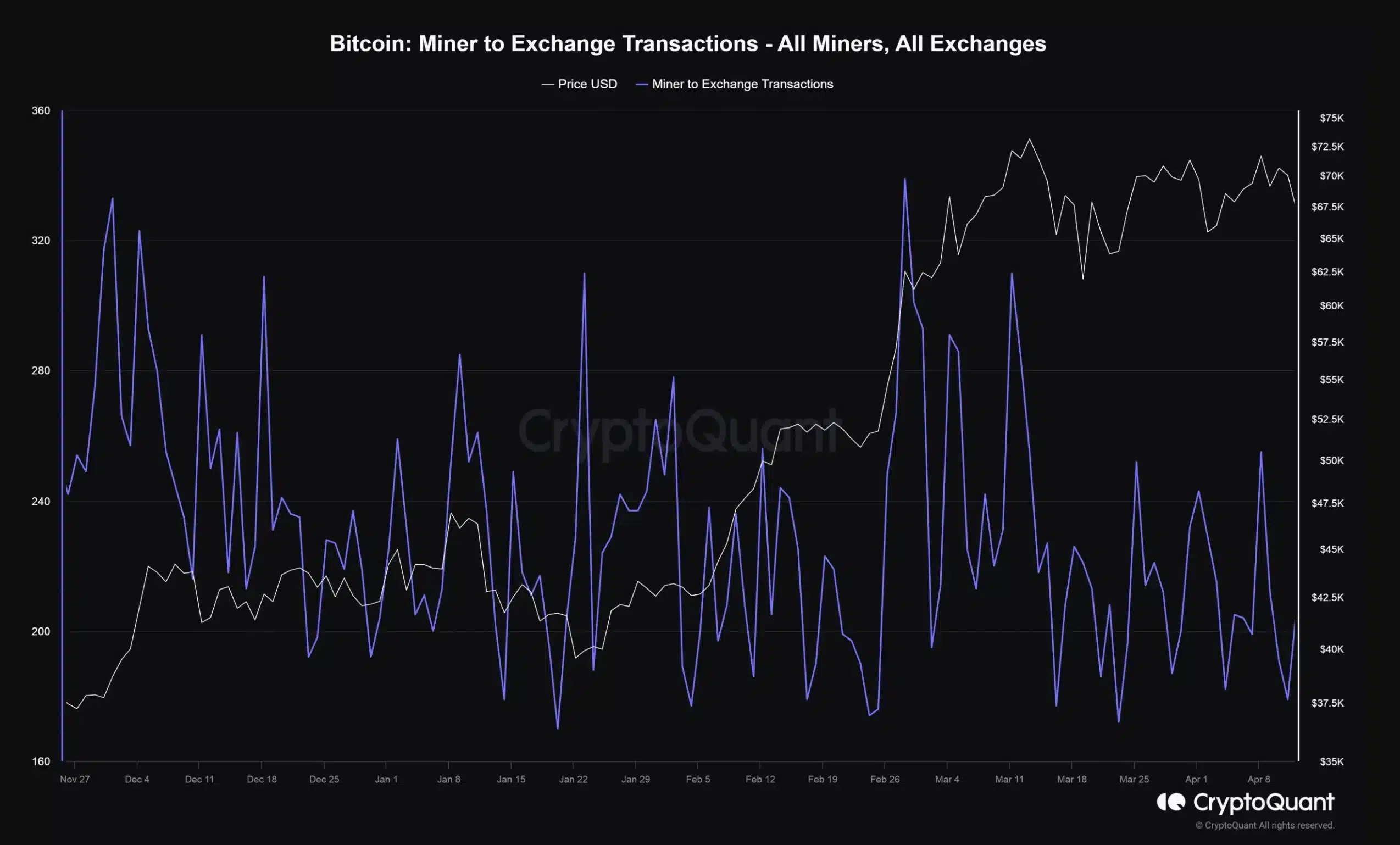

In reality, current knowledge from CryptoQuant’s researcher revealed that miners have been sending roughly 374 BTC to identify exchanges each day over the previous month. This quantity was lower than one-third of the each day common noticed again in February.

How will Bitcoin’s halving have an effect on miners?

Opposite to what some would say, the Bitcoin halving occasion isn’t essentially a doomsday situation for miners. This, based on Adam Sullivan, CEO of Core Scientific. In a current interview, he mentioned,

“Bitcoin halving is not the Armageddon moment for us.”

He added,

“Well today, with Bitcoin above $60,000, profitability means almost no machines are actually going to turn off. During the halving, many of them are going to maintain profitability.”

What this implies is that quite a few mining corporations are financially sturdy and able to endure short-term profitability challenges. Possibly, smaller, much less environment friendly miners might face difficulties post-halving. This, nevertheless, would seemingly lead to business consolidation.

Is there potential for a provide shock?

Mark Yusko, Founding father of Morgan Creek Capital Administration, believes in any other case although. He believes that Bitcoin’s halving occasion could also be underestimated, with the potential for a big provide shock. Shedding gentle on the identical he mentioned,

“I actually think the halving is going to have a bigger impact and I don’t think it’s priced in. I think people are distracted by the demand shift that happened that caused this ATH.”

He added,

“So they’re forgetting that when the having occurs there will still be miners who are in trouble because their costs are fixed and the number of rewards goes down and so there’ll be a a supply shock event.”

Moreover, in a separate interview, Dan Dolev, Managing Director at Mizuho Securities, expressed the view that the halving occasion would immediate a “sell-the-news” response.

@BobLoukas was fast to refute this although, stating,

“‘The halving is not priced in.Totally False.”

Bitcoin’s future outlook

Regardless of prevailing skepticism earlier than its halving, Bitcoin projected robust shopping for strain put up the occasion, as is evidenced by its worth appreciation of three.26%. In accordance with David Alderman, a Digital Asset Analysis Analyst at Franklin Templeton,

“As the price goes up, I think the noise is going up a lot more.”

Therefore, it’s intriguing to look at that regardless of ongoing geopolitical tensions, Bitcoin has adhered to its historic patterns and surged following the halving occasion.