- BTC was down by greater than 4.5% within the final 24 hours.

- Market indicators and metrics hinted at a continued value decline.

The wait is coming to an finish as Bitcoin [BTC] will endure its fourth halving in just some hours.

The significance of this course of has given rise to a number of speculations associated to how the king of crypto’s value would possibly react within the close to time period.

To grasp what to anticipate from BTC post-halving, AMBCrypto analyzed BTC’s on-chain knowledge.

Bitcoin halving is going on quickly

The halving is without doubt one of the most main occasions within the crypto house, because it impacts Bitcoin’s provide. After the method is accomplished, BTC miners’ rewards will probably be decreased by half.

As lovers waited eagerly, BTC bears continued to dominate the market.

In response to CoinMarketCap, BTC was down by greater than 13% final week. In reality, within the final 24 hours alone, the coin’s worth dropped by almost 4%.

At press time, it was buying and selling at $60,995 with a market capitalization of over $1.2 trillion.

The halving additionally may not have a direct constructive affect on the coin’s value.

Michael van de Poppe, a preferred crypto analyst, just lately posted a tweet highlighting that traders would possibly witness a number of calmer days earlier than one other impulse.

Bitcoin’s Concern and Greed Index’s worth was additionally dropping because it was getting nearer to the neural mark. This additionally steered a couple of slow-moving days. At press time, the indicator had a price of 57.

A value drop is probably going

AMBCrypto then checked different datasets to see whether or not bears would exert extra strain.

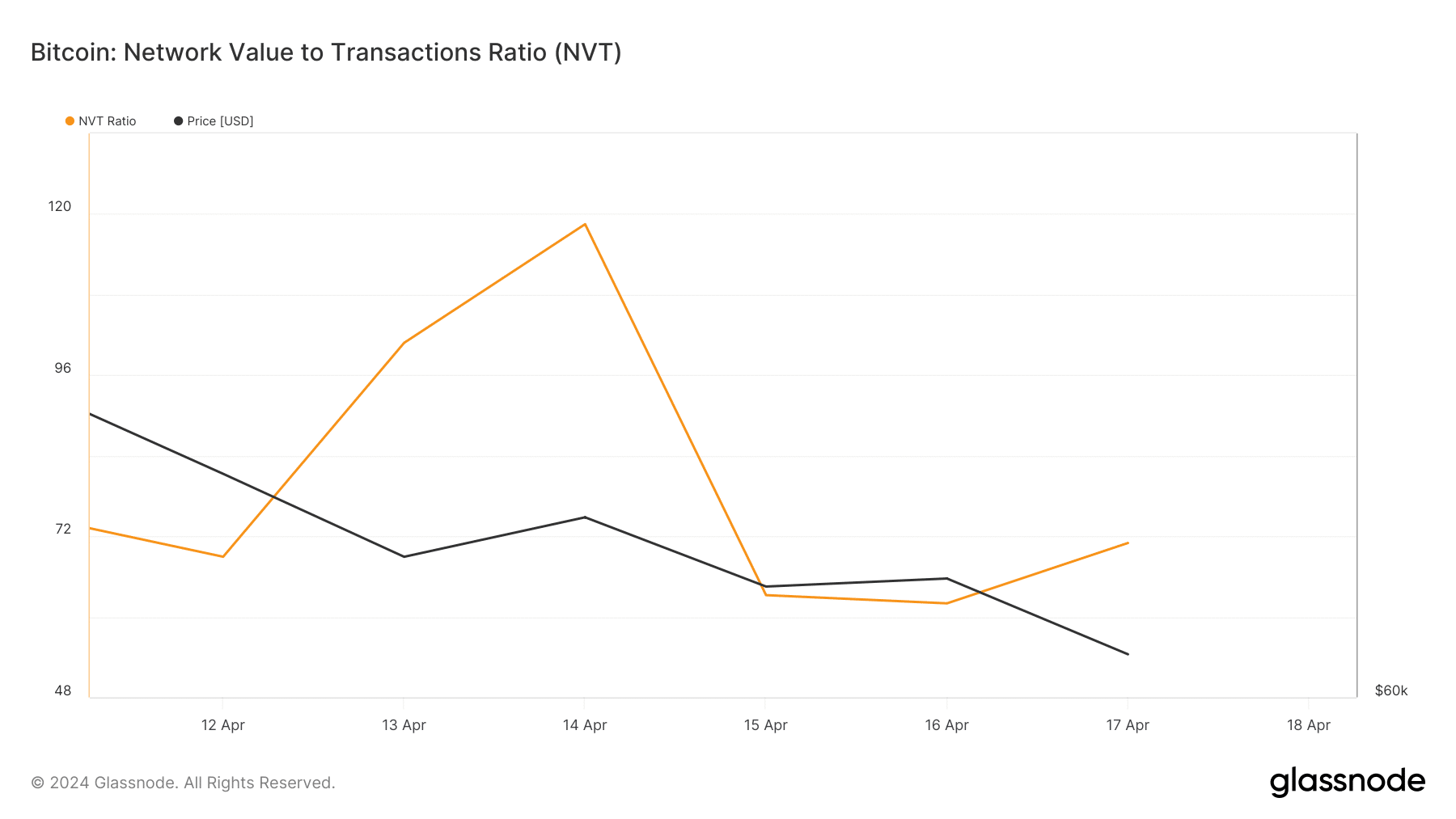

Our evaluation of Glassnode’s knowledge revealed that after a pointy decline on the fifteenth of April, BTC’s community to worth (NVT) ratio registered an uptick.

A rise within the metric means that an asset is overvalued, hinting at a value correction.

CryptoQuant’s knowledge revealed that BTC’s Internet Unrealized Revenue and Loss (NUPL) was rising. This meant that traders have been in a “belief” section the place they have been at the moment in a state of excessive, unrealized income.

Nonetheless, the aSORP seemed optimistic because it indicated that extra traders have been promoting at a loss. In the midst of a bear market, it could point out a market backside.

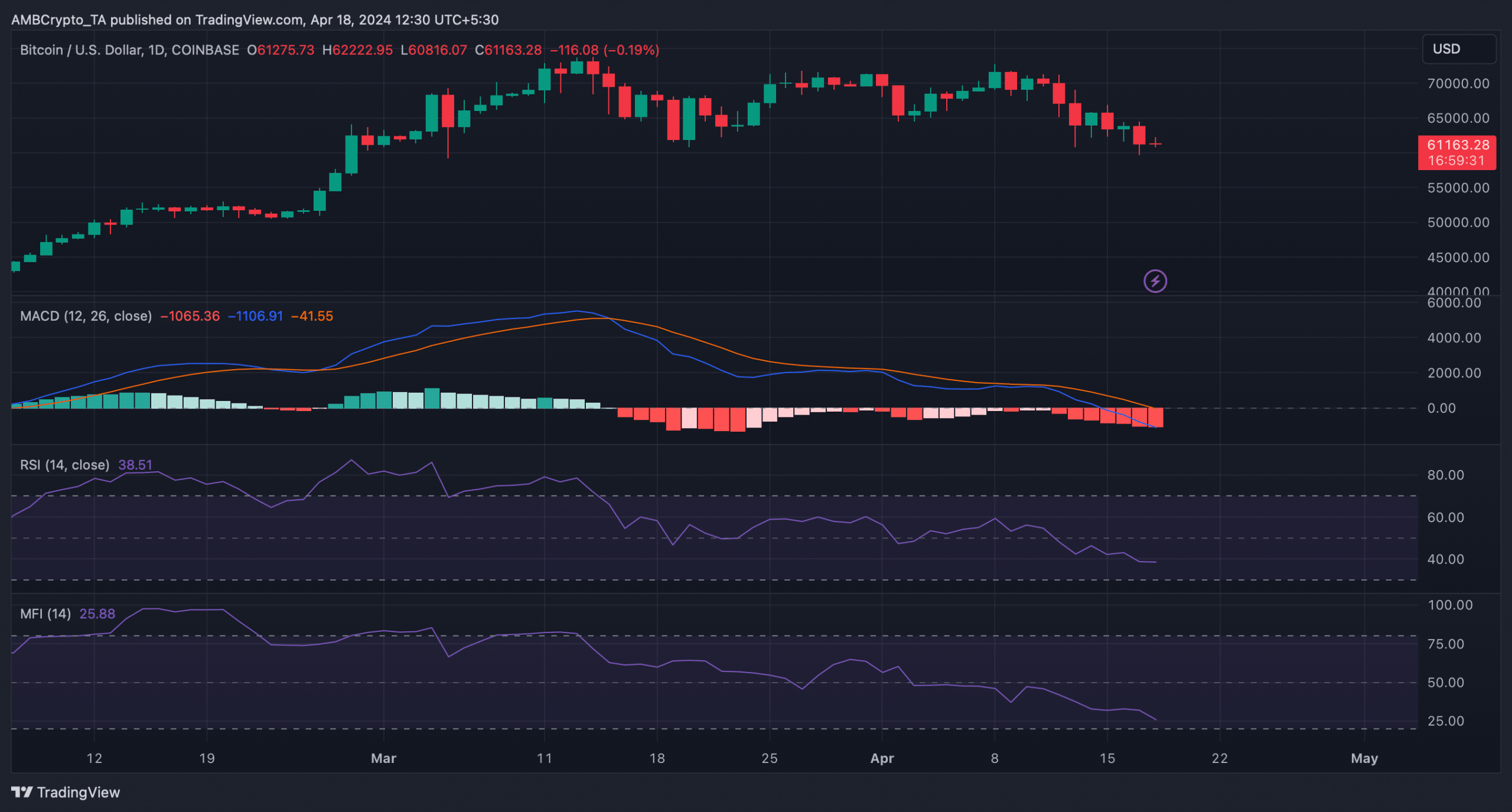

Nevertheless, technical indicators remained bearish. As an example, each BTC’s Relative Energy Index (RSI) and Cash Movement Index (MFI) registered downticks.

The MACD displayed a transparent bearish upperhand available in the market, hinting at an additional value decline.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

AMBCrypto then checked Hyblock Capital’s knowledge to search out the help ranges at which BTC would possibly plummet to post-halving if the downtrend continues. As per our evaluation, BTC has a help degree close to $59,950.

A plummet beneath that degree could possibly be harmful, as it’d push BTC’s value down close to $58k, the place a considerable quantity of BTC will get liquidated.