A part of approaching markets probabilistically is guaranteeing that your trades, on common, generate profits. Merchants use a number of metrics like threat/reward ratio, Sharpe ratio, revenue issue, and win charge to estimate what they need to anticipate from their common commerce.

Nevertheless, your threat/reward ratio and win charge are the fundamental constructing blocks you’d use to grasp how your common commerce performs.

Out of your threat/reward ratio and win ratio, we are able to make a tough calculation of your anticipated worth or how a lot you’ll be able to anticipate to earn out of your common commerce over a big pattern dimension. Understanding your anticipated worth permits you to undertaking how your portfolio will carry out over time.

Earlier than that, let’s choose what your win charge and threat/reward ratio imply in buying and selling.

What’s a Win Price in Trading?

Put merely, your win charge is the proportion of your trades that present a revenue. A 60% win charge dealer makes cash on 60% of his trades.

Too many novices are taken by the attract of a excessive win charge. In any case, what number of ads for Foreign currency trading programs promote a excessive (80%+) win charge? However we should do not forget that a win charge solely takes into consideration the proportion of trades you win, not how a lot you win or lose on every commerce.

You may rapidly devise a really excessive win-rate buying and selling “system” with little work. Merely purchase an possibility or inventory and instantly submit a restrict order to promote it one tick larger than your buy value. Haven’t any cease loss.

More often than not, the safety will commerce above your buy value, and you may win nearly your whole trades. Nevertheless, as a result of you haven’t any cease loss, typically you will lose most or your whole capital employed.

You most likely don’t want telling that it is a very poor and unprofitable buying and selling technique regardless of its excessive win charge.

Conversely, a low win charge is undoubtedly not a disqualifying issue for the standard of a buying and selling system. Futures pattern followers just like the Turtle merchants of the late Nineteen Eighties are a well-known instance of merchants who win round 30% of their trades but are worthwhile as a result of their profitable trades are method greater than their dropping trades.

What’s a Threat/Reward Ratio in Trading?

Only a technicality right here to keep away from confusion. Whereas the nomenclature in buying and selling tradition is to confer with this metric as a threat/reward ratio, what merchants are usually referring to is the reward/threat ratio, which locations ‘reward’ because the numerator. From right here on out, we’ll confer with the reward/threat ratio. Simply remember the fact that when most merchants say “risk/reward,” they’re actually speaking about reward/threat.

As choices merchants, we’ve got the reward of with the ability to form our reward/threat ratio in practically any method we would like. In contrast to delta one markets like equities and futures, it is a lot simpler to repair our threat and reward ranges utilizing choices spreads surgically.

If you need a 2.0 reward/threat ratio, you’ll be able to probably assemble that utilizing a vertical unfold. When you’re searching for substantial dwelling runs, you’ll be able to probably discover a worthwhile approach to get lengthy out-of-the-money choices whereas remaining smart.

The first factor to bear in mind is that you just subsidize your threat/reward ratio along with your win charge. In different phrases, you’ll be able to’t have a excessive win charge and a excessive threat/reward ratio or vice versa. We’ll get into the specifics as to why quickly.

You may calculate your reward/threat ratio you want two items of data:

-

How a lot you propose to threat on a given commerce

- How a lot you estimate to win ought to the commerce work out in your favor.

Maybe we intend to threat $100 per commerce after we lose and acquire $150 after we win. The calculator is so simple as $150/$100 = 1.5. 1.5 is our reward/threat ratio, that means we are able to anticipate to earn 1.5x extra on our profitable trades than on our dropping trades.

Whereas a optimistic reward/threat ratio is usually bought as a holy grail, the choices market shouldn’t be that straightforward, and you can’t method choices buying and selling the best way a delta one fairness dealer does. In any case, shopping for out-of-the-money calls yields a really excessive reward/threat ratio, typically larger than 10. However your chance of truly profitable these trades could be very low. After accounting for the low win charge, it is continuously an unprofitable technique.

Alternatively, methods like promoting volatility can have low reward/threat ratios of 0.2 and nonetheless be worthwhile. Positive, your dropping trades shall be enormous, however you will win most of your trades. Some short-volatility merchants can get so in tune with the present market cycle that they will go 20-30 trades earlier than they’ve one which blows up of their face.

So we can’t view our reward/threat ratio in a vacuum. We’ll reveal this extra after we discuss anticipated worth, which mixes reward/threat and win charge.

The purpose right here is that reward/threat, and win charge is linked. You may’t actually manipulate one with out affecting the opposite. If you need a excessive win charge, you have to settle for an unfavorable reward/threat ratio and vice versa.

There is no free lunch in markets the place you’ll be able to obtain a 3:1 reward/threat ratio with a 70% win charge, save for uncommon illiquid, and unscalable conditions. This must be self-evident, too. If a dealer can constantly make trades in liquid markets with an anticipated worth like this, he’d personal the complete capitalization of the inventory market very quickly.

Whereas most merchants direct the sturdy type of the environment friendly markets speculation, few would deny that markets are environment friendly sufficient to disclaim you alternatives to print cash with little threat by permitting you to systematically and scalably commerce with a excessive threat/reward ratio and a excessive win charge.

Let’s reveal this, too, so you’ll be able to viscerally perceive how one can’t have the perfect of each worlds relating to reward/threat and win charge.

What’s Anticipated Worth in Trading?

Think about I supplied you even cash to wager on a good coin flip. The anticipated worth of this recreation is zero.

As an example you decide tails. Every time the flip comes up tails, you win a greenback, every time it comes up heads, you lose a greenback. As a result of the percentages of tails and heads hitting are even at 50%, you’ll be able to anticipate to make $0 per flip over a big pattern dimension of coin flips.

Nevertheless, if I altered the percentages so that you just win $2 for tails and lose $1 for heads, this recreation’s anticipated worth is now $0.50 per flip.

We will calculate this with a simple components:

(Quantity received per commerce * likelihood of profitable the commerce) – (Quantity misplaced per commerce * likelihood of dropping the commerce)

It’d appear to be this for our up to date coin flip recreation:

($2 * 0.50) – ($1 * 0.50) = $0.50

Hopefully, it goes with out saying that if somebody ever gives you odds like these, take all of them day.

That is anticipated worth in a nutshell. Wikipedia places it like this in order for you a extra technical definition:

The anticipated worth is the arithmetic imply of a lot of independently chosen outcomes of a random variable.

Demonstrating Anticipated Worth in Trading

The mixture of reward/threat ratio and win charge is your anticipated worth. It is a components that solutions the query, “given my probability of winning a trade, how much can I expect to win per trade, over a large number of trades, given my reward/risk ratio?”

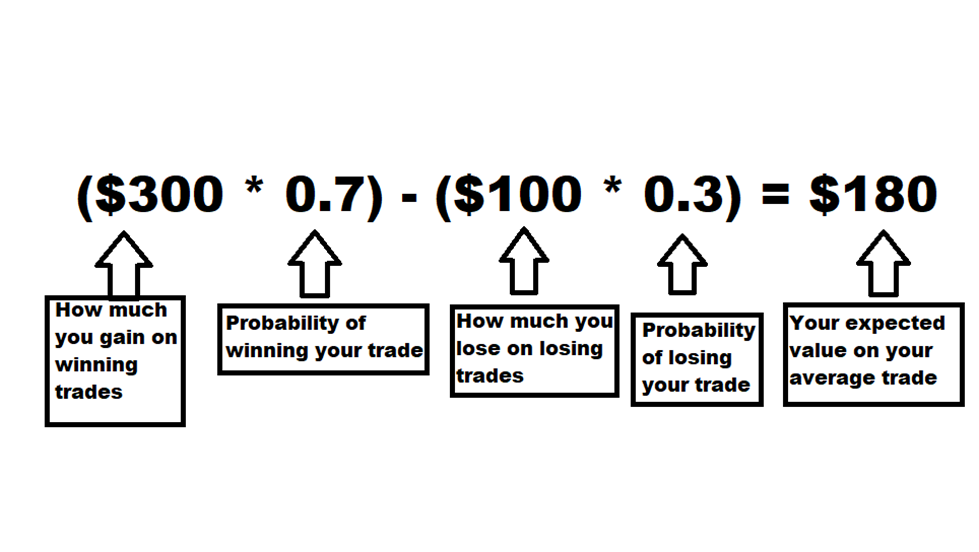

We’ll use the instance of a 3:1 reward/threat ratio and a 70% win charge, risking $100 per commerce. First, we calculate the anticipated worth of the common commerce utilizing the identical easy components we used for our coin instance:

(Quantity received per commerce * likelihood of profitable the commerce) – (Quantity misplaced per commerce * likelihood of dropping the commerce)

Our components would appear to be this:

Keep in mind that that is a wholly unreasonable mixture of win charge and reward/threat and is supposed to reveal the folly of looking for the golden system that provides you each.

Doing an elementary compounding calculation in Excel additionally reveals you this. If we begin with a bankroll of $10,000 and threat 1% (or $100 as within the instance above) and make 4 trades every week, on the finish of the yr, our bankroll can be 360K, representing a 3,775% annual return.

In fact, that is primarily based on an anticipated worth of $180 per commerce with none variance calculations, however it reveals how the market works. You may have a excessive reward/threat or excessive win charge. Decide one.

Backside Line

To summarize:

-

Win charge refers to how typically you win your trades. Excessive win charges usually imply unfavorable reward/threat ratios and vice versa.

-

The market permits you to select in order for you a excessive win charge or a excessive reward/threat ratio, however not each, besides within the rarest of instances.

-

Understanding and understanding each your win charge and your reward/threat ratio is crucial, and you may’t solely depend on one metric.

- Anticipated worth represents the mixture of win charge and reward/threat and tells you what you’ll be able to anticipate to earn in your common commerce.