Assume Like a (Skilled) Gambler

A great, profitable poker participant is without doubt one of the finest fashions for a dealer to mimic.

Half of the battle for a poker participant begins earlier than the hand is even dealt. They keep away from damaging anticipated worth propositions by solely taking part in high-probability beginning fingers after they’re “in position,” or final to behave within the hand.

Poker gamers perceive that whereas they’ll meticulously calculate the possibilities of any given scenario and memorize all the important math of the sport, generally your opponents get fortunate.

Even one of the best gamers on the earth incessantly lose to far worse gamers as a result of in the end, they’ll’t management which fingers come out of the deck. They’re attempting to train a probabilistic edge over an enormous variety of fingers, not guaranteeing they win each time.

An effective way to intuitively grasp that is to watch the video the place YouTuber MrBeast, a leisure participant, gained $400,000 taking part in poker towards professionals.

Because of this randomness and variance they must cope with, professionals handle their bankroll conservatively. They’ve finished the calculations and know that even in case you do every little thing accurately, you’ll be able to nonetheless have a number of dropping classes in a row. So that they play in stakes the place they’ll handle that type of dropping streak with out going broke. Even when they’ve $1 million, they’re by no means shopping for right into a recreation with a $1 million buy-in, as there’s a robust likelihood they’ll lose all of it even when they play properly.

Skilled poker gamers perceive that each single choice they make inside a hand has some type of chance distribution hooked up to it. Their long-term winnings are merely a stack of those probability-weighted selections. If most of those selections have been optimistic anticipated worth, they make a revenue. So that they regularly examine and get higher on the recreation to enhance their choice making and therefore, revenue.

Don’t Simply Pay Lip Service to Managing Danger

Trading books for novices pay lip service to danger administration and randomness. However they’re too inflexible and persist with fundamental guidelines like “never risk more than 10% of your account on a trade.”

Nice begin, however going barely extra granular to get acquainted with ideas like danger of destroy and Kelly betting gives you a much better understanding of the distribution of seemingly outcomes on your buying and selling account.

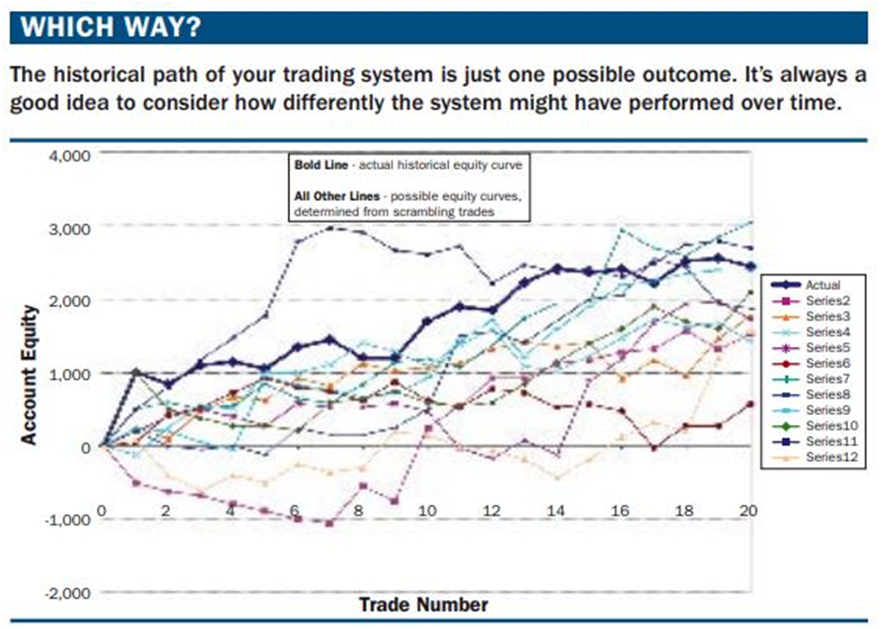

Think about the chart beneath, which exhibits the identical collection of 20 trades scrambled in numerous orders. Positive, it’s a small pattern dimension, however think about if the gods of chance gave you the fairness curve in crimson in direction of the underside of the chart, which options seven dropping trades in a row.

Whereas buying and selling literature pays lip service to the concept that you’ll go on profitable and dropping streaks that can in the end common out to your long-term anticipated worth, there’s a distinction between doing the work your self and seeing it in simulations, and studying it in a ebook or article.

A lot of this work simply serves to eliminate the notion that markets in any respect function deterministically, and as an alternative provide you with an intuitive grasp for a way random they are often.

Perceive The Fundamental, Nicely-Recognized Edges

The overwhelming majority of buying and selling methods intention to use one among forces current in markets, these are:

-

Momentum: the tendency for large value strikes to proceed in the identical route

- Imply reversion: the tendency for large value strikes to reverse in the other way

The favored buying and selling and investing methods they write books about virtually all fall into one among these two classes. Worth investing–buying low-cost crushed down firms is imply reversion. Investing in disruptive development shares is momentum. Passively investing in index funds is momentum. Utilizing shifting common crossovers is momentum. Utilizing RSI to establish oversold ranges is imply reversion. We are able to go on and on, however it’s best to get the purpose.

Inside these two kinds of buying and selling, there are a number of buying and selling methods with well-accepted optimistic return profiles detailed in educational literature. Chances are high, the technique you suppose is new and distinctive is already on the market and revealed about.

In case your particular sauce is particular guidelines for buying and selling or investing, there’s nothing proprietary to what you do. The sting in being a discretionary dealer is utilizing the well-established sources of returns and figuring out underappreciated strategies of making use of them, executing properly, and maybe having some good instinct and tape studying skills.

Going deeply into every of those sources of returns is past the scope of this text, however we’ll present a brief record so that you can proceed your personal analysis in case you’re .

Imply reversion:

-

Pairs buying and selling: buying and selling the divergences between two intently associated securities (Coke and Pepsi is the basic instance)

-

Relative worth: much like pairs buying and selling, the place you discover two comparable securities and purchase the undervalued one and quick the overvalued one. Many hedge funds do that within the credit score house, the place two bonds are mainly the identical danger however have totally different rates of interest.

-

Share class arbitrage: some shares problem a number of lessons of inventory which all commerce on exchanges. Typically, the pricing of those get out of whack and it presents a chance to promote the costly class and purchase the cheaper class.

-

Volatility arbitrage: like relative worth, however for choices. Two comparable choices that ought to be pierced close to identically, however have a substantial divergence in pricing.

- Shorting pump and dumps and parabolic micro-cap shares: virtually on a regular basis there are small shares that day merchants pump up 50%+ for little cause. This gives a chance to quick them for an enormous, albeit extremely dangerous return.

Momentum:

-

Basic futures pattern following: lots of the well-known merchants within the Market Wizards books bought wealthy shopping for the futures contracts going up probably the most and holding them till they broke beneath some type of trendline or shifting common. The Eighties have been the heyday for buying and selling however there’s loads of hedge funds and CTAs nonetheless making use of mainly the identical technique.

-

Publish-earnings announcement drift: lecturers found out that buyers systematically underreact to optimistic earnings surprises which creates intermediate-term developments in earnings winners.

- Cross-sectional momentum: this includes rating shares based mostly on their momentum (usually some mixture of returns and slope of ascent) and shopping for the top-ranked shares and shorting the worst-ranked shares. It’s form of like relative worth however for momentum merchants

No one is recommending you go and commerce these methods “out of the box,” however understanding what drives their return profiles dramatically improves your understanding of how markets work, and what sort of buying and selling the market rewards.

Many merchants have their very own hybrid type the place they stack a number of of those edges mixed with their very own tape studying skills.

Perceive Fundamental Correlations

In at present’s extremely passive market surroundings, understanding how the motion of shares is interrelated is extra vital than ever.

When the S&P 500 goes up, nearly all of shares go up and vice versa. The correlation will get stronger as you get down into sector, {industry}, and sub-industry pairs. Visa and MasterCard, or Coke and Pepsi are extremely correlated and prone to transfer collectively.

It may get far deeper too. Some shares are extremely delicate to the motion of the US greenback, others to the worth of oil or rates of interest. Some obsessive quants try and quantify each issue affecting the worth of a inventory and make it an engineering drawback.

The purpose isn’t that you have to perceive the worldwide economic system on such a micro stage that you just turn out to be this man:

https://www.youtube.com/watch?v=kxh2X6NjuhY

Nonetheless, it is to grasp that shares usually comply with the motion of the broad market and their sector. For a inventory to interrupt that correlation within the short-term, it wants a big catalyst.

So usually whenever you’re buying and selling a setup in a inventory, you’re merely buying and selling a better or decrease model of the inventory market or the inventory’s broad sector. Otherwise you’ll see a setup in say, Capital One (COF), however the underlying transfer was pushed by a terrific earnings report in Uncover (DFS).

With this fundamental understanding, it lets you construction your trades higher.

Shopping for Outright Choices Is Usually a Dangerous Commerce (For Newcomers)

Newcomers sometimes get into buying and selling to make thematic trades. Hashish is turning into much more socially accepted within the US and appears to be on the cusp for federal legalization within the subsequent decade. So novices suppose they’ll’t lose shopping for hashish shares. It’s after a loss in trades like these that they be taught concerning the market’s discounting mechanism and the way the inventory value isn’t vital, however the valuation.

However the identical is true for the choices market. Novices get drawn in by the recent media frenzy of the day like GameStop or AMC and purchase calls. They’re usually proper on the route and befuddled after they really lose cash on the commerce. It’s right here the place many give up, calling the market a rip-off, however those who stick round be taught concerning the fundamentals of choice pricing, and that it’s not simply the strike value that’s vital, however the implied volatility they’re paying for when shopping for choices.

Sadly, most get drawn in at exactly the improper time, when the frenzy is at a fever pitch, implied volatility is sky excessive from retail name shopping for, and there are few left shopping for to assist present costs.

Perceive How Scalability Pertains to Returns

Normally, the extra scalable a buying and selling technique is, the smaller its potential returns. There are actually methods on the market which you can also make 100%+ a yr in case you’re actually expert, however not with any scalability.

To grasp why, think about the man buying and selling the above technique went to Jeff Bezos and informed him “we can probably double your money each. I want 20% of the upside.” If we compounded Bezos’ $139B web value simply 5 years ahead, his web value would exceed the GDP of the US by yr 5.

The reverse can be true. Sometimes, the much less scalable a technique, the upper its potential returns. When you discover an arbitrage that solely works in shares that commerce lower than $100K in quantity per day, you’ll be too huge for that market fairly quickly and now you’ll be able to’t do your commerce. Plus, your buying and selling has an impact available on the market and also you’d seemingly find yourself closing the arbitrage with your personal buying and selling exercise.

As a brand new dealer, this is a bonus. Whereas the most important and most liquid markets just like the S&P 500 have low transaction prices and commerce cleanly, it by no means hurts to discover areas the place solely folks along with your account dimension can afford to discover.

This is without doubt one of the most underrated benefits that undercapitalized merchants have. Warren Buffett is legendary for saying that if he restarted with a small quantity of capital, he’s assured he might ship 50%+ returns by investing in smaller alternatives.

Promoting Choices Is Not All the time “Being the House”

Promoters love promoting the concept that promoting choices is much like being the home at a on line casino. As a result of most choices expire nugatory, so the pondering goes, an choice vendor ought to win most of their trades.

However this angle reeks of truthiness. In actuality, in line with the CBOE, solely 30-35% of choices expire nugatory.

Certainly, there’s an edge to promoting premium if utilized accurately. Benefiting from time decay and the truth that choices volatility is incessantly overpriced is nice, nevertheless it does not imply that blindly promoting choices is prone to convey you riches. Removed from it.

A premium vendor, on the core, is a imply reversion dealer. They’re figuring out that volatility has gotten too excessive in a sure choice collection and fading it, hoping to commerce it again to honest worth. The true edge is in figuring out these dislocations, the place somebody was compelled to pay an excessive amount of for defense, or when the market is overestimating the affect of an upcoming catalyst.

And these aren’t trivial issues to resolve. The explanation promoting choices generally is a nice technique is that the market can usually overvalue insurance coverage. A lot of the institutional demand has traditionally been lengthy choices however promoting places grew to become a crowded commerce amongst hedge funds in recent times, making this “volatility is overstated” phenomenon much less systemic. As all the time, selecting your spots is paramount.