.thumb.jpg.994f8ab59633ccf69676266a22946b18.jpg)

A protracted straddle choice technique is vega optimistic, gamma optimistic and theta damaging commerce. It really works based mostly on the premise that each name choices and put choices have limitless revenue potential however restricted loss. If nothing modifications and the inventory worth is steady, the straddle choice will lose cash every single day as a result of time decay, and the loss will speed up as we get nearer to expiration.

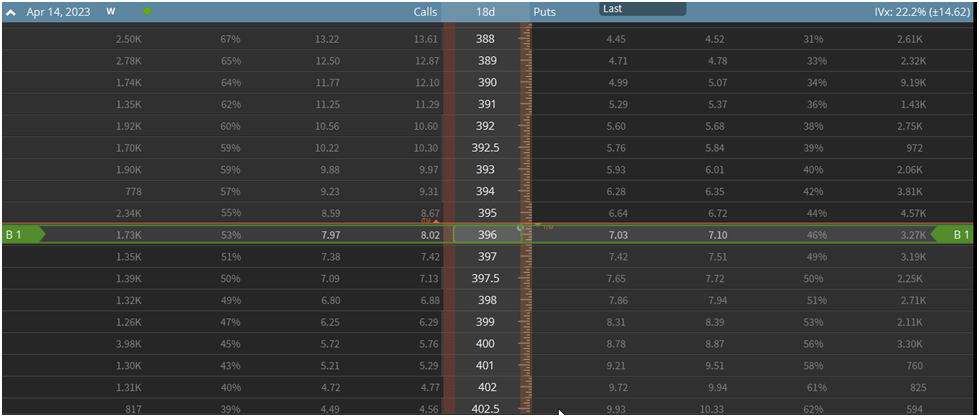

For instance, if the SPDR S&P 500 ETF (SPY) trades at $396 per share, we count on a big transfer within the S&P 500. Nonetheless, we’re not sure of the course of stated transfer. We would buy an at-the-money (ATM) straddle, which entails shopping for an ATM put and name choices.

On this case, we’d purchase the next choices:

-

BUY 1 396 Put @ $8.06

-

BUY 1 396 Name @ 9.31

- Whole commerce value: $17.37 (internet debit)

As you’ll be able to see, in shopping for each an at-the-money put and name choices, we revenue from important worth strikes in both course. Nonetheless, this comes at a excessive value, as you’ll be able to see by the appreciable premium outlay of $17.37, accounting for a bit greater than 4% of the full underlying inventory worth. For that reason, we would want a big transfer in SPY for our place to point out a revenue.

.thumb.jpg.994f8ab59633ccf69676266a22946b18.jpg)

Traits of a Lengthy Straddle Choice

The Lengthy Straddle is Market Impartial

A protracted straddle choice is a market-neutral choice unfold, which means it makes no try to predict the longer term worth of the underlying inventory worth. As a substitute, the thought is to revenue from a big worth transfer within the underlying inventory worth, no matter whether or not it strikes up or down.

For instance, let’s say we buy the lengthy straddle on SPY that we referenced within the introduction to this text.

If the worth of SPY soars over the month, our name choice will grow to be worthwhile, and we are able to promote it for a revenue. The reverse is true for our put choice. In both case, we’ll earn a living if the worth transfer is extra important than the worth of the choices we bought.

Whereas some merchants choose to forecast the worth of shares utilizing technical or basic evaluation, many seasoned choices merchants take solace in not having to foretell the place the worth will probably be subsequent month to earn a living within the markets.

A market-neutral technique just like the lengthy straddle as a substitute forecasts the longer term implied volatility of a inventory worth. Possibly that simply looks as if a unique sort of prediction. There’s good motive to imagine predicting future volatility is extra manageable than forecasting future worth course.

Whereas inventory costs can go seemingly wherever, volatility pricing is far more rhythmic. There’s appreciable educational proof that volatility clusters within the quick time period and mean-reverts over extra prolonged durations. In different phrases, there is a discernable sample to market volatility that shrewd merchants can revenue from.

The Lengthy Straddle Choice is Lengthy Volatility

Being “long-volatility” within the choices market is synonymous with being a internet purchaser of choices, or just, “long options.” The important side is that the lengthy straddle is a play on volatility relatively than worth, making the commerce vega optimistic.

Within the choices market, an at-the-money (ATM) straddle finest represents the choices market’s estimation of future volatility, often known as implied volatility. A straightforward approach to escape all of the jargon and technical minutia of the choices world is to consider the ATM straddle because the over/beneath on volatility for that inventory worth.

Permit me to clarify. Let’s return to our instance within the S&P 500 ETF (SPY). To remind you, right here is the ATM straddle pricing for choices expiring in 25 days:

SPY Lengthy Straddle:

-

BUY 1 396 Put @ $8.06

-

BUY 1 396 Name @ 9.31

- Whole commerce value: $17.37 (internet debit)

With our commerce value at $17.37, SPY has to maneuver a minimum of $17.37 in both course inside 25 days for us to revenue from this commerce. Is that lots or slightly? That is the place your buying and selling expertise are available.

Choices merchants use quite a lot of elements to find out if a straddle is appropriately priced, together with the place implied volatility is at the moment in comparison with its historic vary, their technical evaluation view, how they assume the market will react to imminent occasions like Federal Reserve conferences, and so forth.

Lengthy Straddles Have Outlined Threat

As a result of the lengthy straddle entails shopping for a put and name choice, the utmost threat is outlined. It is merely the mixed value of the 2 choices. This offers a big benefit, as you might be completely certain of your worst-case state of affairs in a protracted straddle.

Not like quick choices methods, just like the quick straddle, which have limitless and undefined most threat ranges.

For that reason, lengthy straddles are sometimes among the first choices spreads that novice choices merchants start to experiment with past merely shopping for single put or name choices. It’s similar to what they’re used to doing, besides it removes the directional ingredient.

Returning to our SPY instance from earlier than, the max we are able to lose on this state of affairs is $17.37.

The Lengthy Straddle Has Limitless Revenue Potential

The lengthy straddle has theoretically limitless upside revenue potential. Which means that if the underlying inventory makes an enormous transfer in both course, nothing stops your earnings from happening without end, besides the inventory worth goes to zero on the draw back.

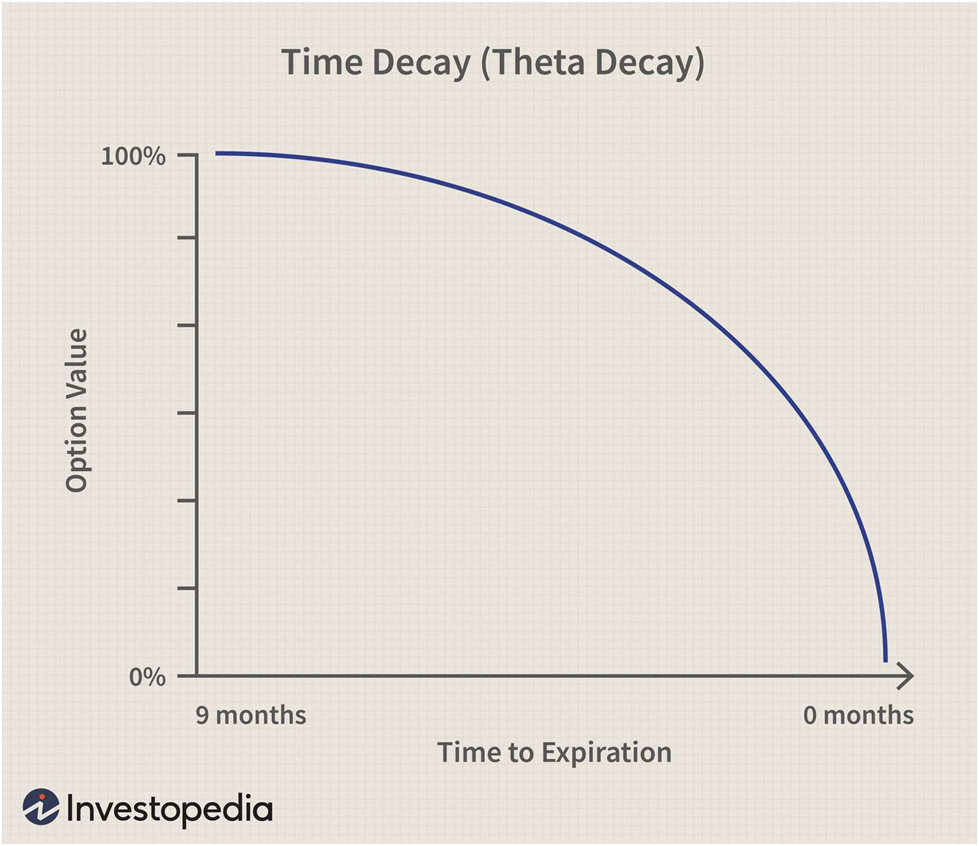

The Lengthy Straddle Suffers from Time Decay (Brief Theta)

Once you purchase choices, you’re betting in opposition to the clock. The underlying inventory worth should make your required transfer earlier than the expiration date, or else the choice will expire nugatory. This idea is named “time decay” or the extra technical time period, “theta decay.”

Theta is the Choices Greek which measures an choice place’s publicity to the passage of time. The beauty of the choices Greeks is you’ll be able to mathematically derive them. So you already know precisely how a lot an choice place will lose per day from the passage of time if all issues stay equal.

If we return to our SPY lengthy straddle instance, the place has a theta of -0.34, which means the place will lose about $0.34 in worth per day till the expiration date. Remember that theta modifications over the lifetime of an choice. Because the expiration date nears, the worth of theta declines, as there may be much less time worth within the choice.

So the each day decay will probably be decrease in absolute phrases. Nonetheless, it may usually be increased by way of the share of the place’s worth if the underlying inventory worth hasn’t moved in your favor. The next chart from Investopedia ought to put issues into perspective:

Supply: Investopedia

Find out how to Create a Lengthy Straddle place

The lengthy straddle is without doubt one of the easiest choices spreads on the market. It simply consists of a protracted put and name choices. Right here’s what a protracted straddle would possibly seem like on an choices chain:

As you’ll be able to see, we’re shopping for a put and name choice on the similar strike worth on the similar expiration date. The above instance exhibits an at-the-money (ATM) straddle. Nonetheless, you’ll be able to construction a straddle to raised suit your market view.

For example, if we transfer the strike worth of our straddle increased, it will grow to be extra worthwhile on the draw back faster and take a extra important worth transfer for it to grow to be worthwhile on the upside. The other of that is additionally true.

Lengthy Straddle Payoff and Max Revenue/Loss

Lengthy Straddle Breakeven Costs

The lengthy straddle could be very simple to calculate breakeven, max revenue, and max loss ranges for. That is one more reason it is a superb unfold for novices to start to dip their toes in choices unfold buying and selling.

For instance, we’ll use our SPY lengthy straddle once more and calculate the varied ranges for it:

SPY Lengthy Straddle:

-

BUY 1 396 Put @ $8.06

-

BUY 1 396 Name @ 9.31

-

Theta: -0.34

- Whole commerce value: $17.37 (internet debit)

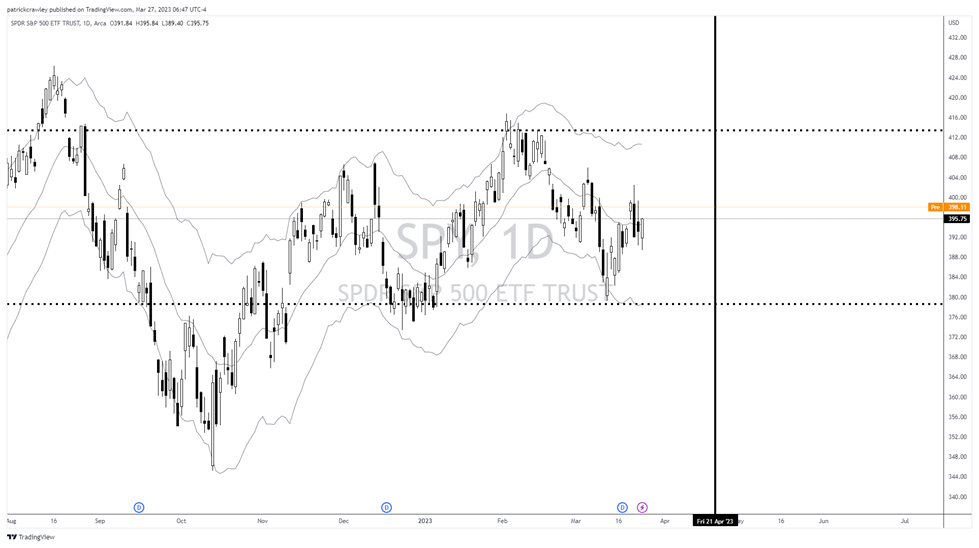

To calculate the higher breakeven worth for a protracted straddle, merely add the full premium paid to the strike worth. On this case, you merely add $396 + $17.37 = $413.37. Our higher breakeven worth is $413.37.

The decrease breakeven worth for a protracted straddle is equally simple to calculate. You merely subtract the full premium paid from the strike worth. On this case, that’s $396 – $17.37 = $378.63.

To contextualize these costs, I’ll plot them on a chart of SPY:

The thick dotted traces characterize the higher and decrease breakeven costs, whereas the vertical black hyperlink represents the expiration date. The value of SPY must exceed both of those ranges for our hypothetical lengthy straddle place to point out a revenue earlier than the expiration date.

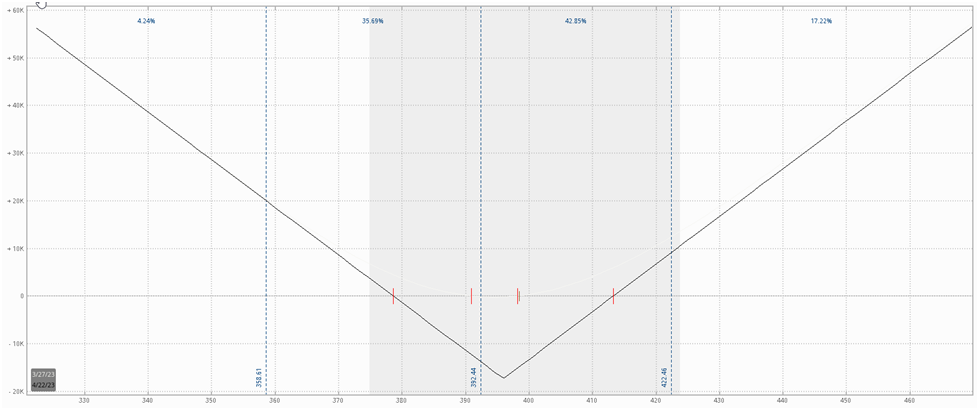

This one is simple. The utmost upside revenue for a protracted straddle place is theoretically limitless. There’s no restrict to how excessive a inventory worth can go.

Nonetheless, on the draw back, your max revenue is simply restricted by the inventory worth. As a result of a inventory worth can solely go to zero, you’ll be able to calculate the max revenue by subtracting the full premium paid from the strike worth. On this case, the strike worth is $369, and the full premium paid for our SPY lengthy straddle is $17.37, so the max revenue from the inventory declining is $378.63, which is identical as our decrease breakeven worth.

Lengthy Straddle Most Loss/Threat

As a result of a protracted straddle entails shopping for two choices, no formulation are required to calculate your most threat. The utmost threat for this place is the full premium paid. In our SPY straddle instance, that’s $17.37.

Nonetheless, absolutely the most loss in a straddle is fairly uncommon, as you’ll see after we present you the payoff diagram of the lengthy straddle.

Lengthy Straddle Payoff Diagram

The lengthy straddle payoff diagram is characterised by a V-shape. That is not like the straddle’s sister unfold, the Lengthy Strangle, which is marked by a flattened U-shape.

Right here is the straddle payoff diagram:

:max_bytes(150000):strip_icc()/understandingstraddles22-19b55dd41aee458287dda61e4929428a.png)

Let’s have a look at a real-life instance of a protracted straddle payoff diagram, utilizing our SPY straddle for example.

As a reminder, right here is our SPY lengthy straddle place:

SPY Lengthy Straddle:

-

BUY 1 396 Put @ $8.06

-

BUY 1 396 Name @ 9.31

-

Theta: -0.34

- Whole commerce value: $17.37 (internet debit)

Lengthy Straddle: Market View

Why Matching Your Market View to Choices Commerce Construction is Essential

One factor we’re making an attempt to nail house on this reverse straddle primer is the significance of matching your market view to the right choices unfold. As an choices dealer, you are a carpenter, and choice spreads are your instruments. If you should tighten a screw, you will not use a hammer however a screwdriver.

So earlier than you add a brand new unfold to your toolbox, it is essential to know the market view it expresses. One of many worst issues you are able to do as an choices dealer is construction a commerce that’s out of concord together with your market outlook.

This mismatch is usually on show with novice merchants. Maybe a meme inventory like GameStop went from $10 to $400 in just a few weeks. You are assured the worth will revert to some historic imply, and also you wish to use choices to precise this view. Novice merchants steadily solely have outright put and name choices of their toolbox. Therefore, they’ll use the proverbial hammer to tighten a screw on this scenario.

On this hypothetical, a extra skilled choices dealer would possibly use a bear name unfold, because it expresses a bearish directional view whereas additionally offering short-volatility publicity. However this dealer might be infinitely artistic along with his commerce structuring as a result of he understands use choices to precise his market view appropriately.

The nuances of his view would possibly drive him so as to add skew to the unfold, flip it right into a ratio unfold, and so forth.

What Market Outlook Does a Lengthy Straddle Categorical?

A dealer utilizing a protracted straddle expects a big enhance in IV and/or a big worth motion and has a impartial directional view.

Considerably, a dealer who buys a straddle ought to have a bullish view of volatility. Shopping for each an at-the-money (ATM) put and name choice is a substantial premium outlay, so having the view that volatility is reasonable is not sufficient to justify shopping for a straddle. You should count on an enormous worth transfer.

Moreover, it is important to view volatility in relative phrases. Whereas 50% IV may be very excessive for a inventory like Philip Morris (PM), that may be traditionally low for a inventory like Tesla (TSLA).

When To Use a Lengthy Straddle

Whereas there’s an infinite variety of situations the place a complicated choices dealer can profitably purchase a straddle, there are two primary situations the place it is sensible to purchase a straddle.

The primary is when IV is on the backside of its historic vary as measured by one thing like IV Rank or one thing related.

The second is when there’s an upcoming catalyst that you just assume the choices market is underpricing the volatility of.

Nonetheless, in terms of occasion volatility, we discover that it is too exhausting to foretell. We would relatively exploit how choices markets have a tendency to cost occasion volatility over time relatively than predict how the market will react to a blockbuster information launch. We’ll exhibit this level by discussing how we commerce pre-earnings straddles.

Shopping for Pre-Earnings Straddles

Earnings releases are the commonest type of straddle buying and selling. Corporations report earnings 4 occasions per 12 months. A easy look at a inventory chart exhibits that these one-day information releases are sometimes accountable for a big portion of the inventory’s annual worth vary.

The standard manner choices merchants play earnings is to establish shares with constantly underpriced earnings volatility. These shares change over time, because the market finally adapts and market makers appropriately worth volatility.

Nonetheless, the obvious difficulty with earnings straddles is IV crush. As quickly because the market digests the earnings report, IV plummets as there’s not lingering uncertainty a few doubtlessly horrible or blockbuster report.

Moreover, there’s a heavy tendency for the market to considerably overprice earnings volatility.

That is why we at SteadyOptions choose to commerce pre-earnings straddles. As a result of IV (and, in flip, choice costs) tends to rise within the lead-up to earnings, we choose to purchase straddles 2-15 days earlier than an earnings launch and promote earlier than earnings are even launched. Pre-earnings straddles additionally considerably scale back the primary threat of the straddle technique which is damaging theta.

Quite than having a bet on earnings, we’re combining momentum buying and selling and the tendency for implied volatility to rise within the lead-up to earnings. We’re merely exploiting a repeatable tendency within the choices market. This is not theoretical. You possibly can see the efficiency of our pre-earnings straddles on our efficiency web page right here.

We first described the technique in our article Exploiting Earnings Related Rising Volatility.

Utilizing Straddles to Commerce Volatility Imply Reversion

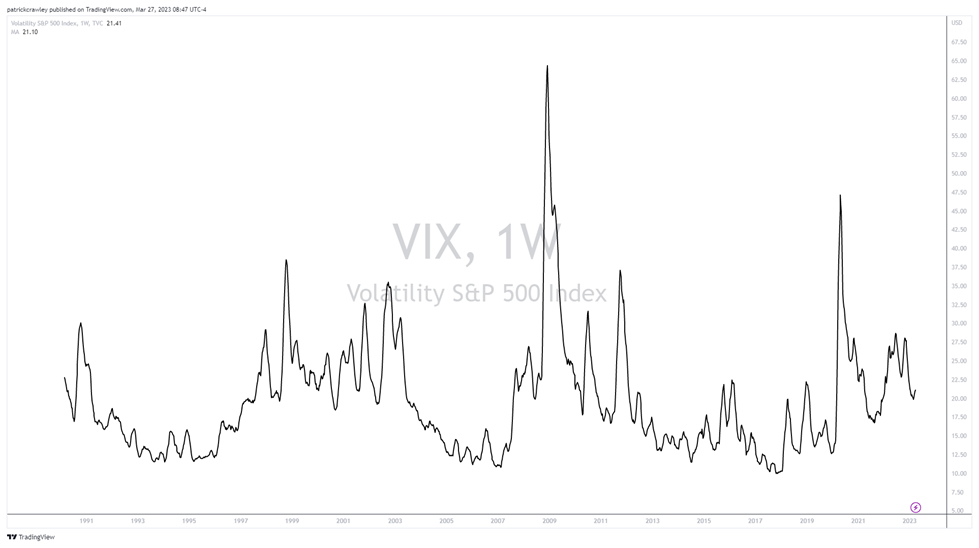

Volatility expands and contracts. In the event you have a look at a chart of volatility, you will notice that it appears extra like an EKG or sine wave than a inventory chart. For example, as an indication level, let’s take a look at the long-term shifting common of the S&P 500 Volatility Index (VIX).

The next is a 10-week shifting common of the VIX going again to its formulation in 1990:

Fairly apparent mean-reverting habits too. And as we talked about earlier on this article, this phenomenon is supported by well-liked quantitative finance educational literature.

A technique choices merchants would possibly exploit this phenomenon is to opportunistically await durations the place volatility could be very low in comparison with its historic common. There are a number of methods to measure this, with IV Rank being one well-liked measure.

To reinforce the good points, merchants may additionally take into account gamma scalping.

Lengthy Straddle Choices Unfold Instance

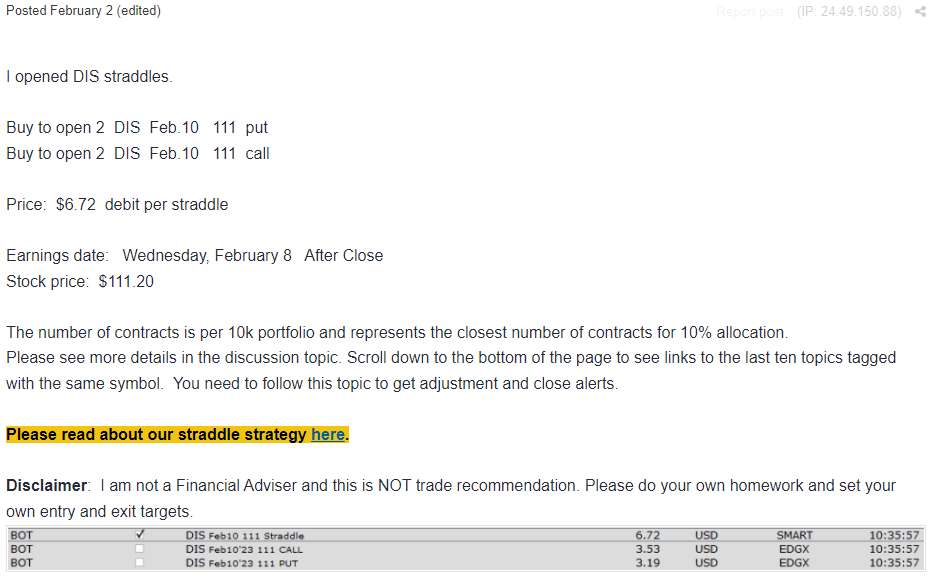

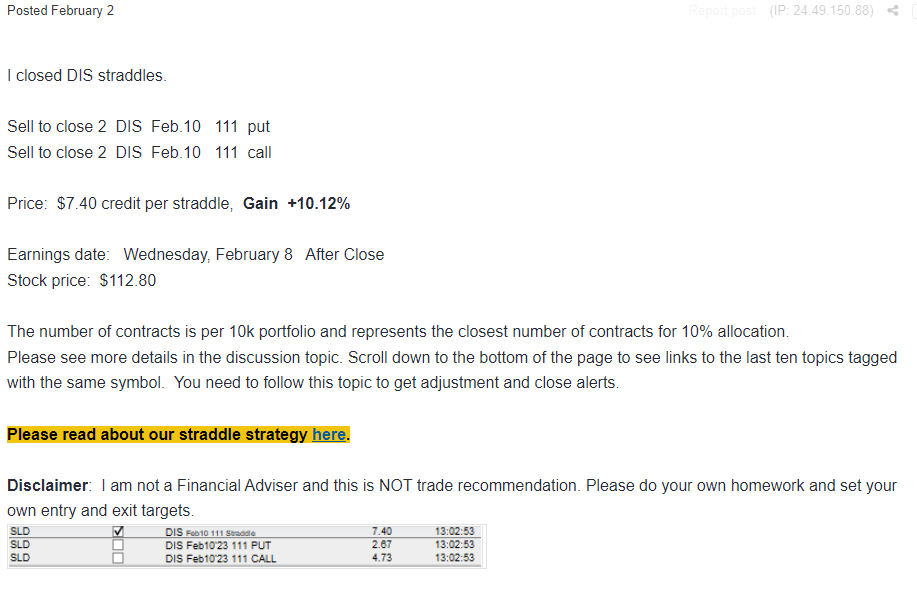

Here’s a current instance of our straddle technique.

DIS was scheduled to announce earnings on February eighth. We positioned the next commerce on February 2th:

We paid $6.72 for the 111 straddle utilizing choices expiring on Feb.10 (2 days after earnings).

3 hours later we had been in a position to shut the commerce at $7.40 for 10.12% achieve.

The commerce benefited from the inventory motion and IV enhance.

Straddles Can Be A Low-cost Black Swan Insurance coverage

We prefer to commerce pre-earnings straddles/strangles in our SteadyOptions portfolio as a result of very interesting threat/reward. There are three doable situations:

-

State of affairs 1: The IV enhance isn’t sufficient to offset the damaging theta and the inventory would not transfer. On this case the commerce will in all probability be a small loser. Nonetheless, for the reason that theta will probably be a minimum of partially offset by the rising IV, the loss is more likely to be within the 7-10% vary. It is rather unlikely to lose greater than 10-15% on these trades if held 2-5 days.

-

State of affairs 2: The IV enhance offsets the damaging theta and the inventory would not transfer. On this case, relying on the scale of the IV enhance, the good points are more likely to be within the 5-20% vary. In some uncommon instances, the IV enhance will probably be dramatic sufficient to supply 30-40% good points.

- State of affairs 3: The IV goes up adopted by the inventory worth motion. That is the place the technique actually shines. It may deliver few very important winners.

The Largest Threat When Shopping for a Lengthy Straddle

Most individuals purchase straddles to take part in occasion volatility. They’re betting that the choices market is underpricing the danger of a big worth transfer in both course.

However everybody available in the market is aware of that this occasion is coming. As a result of the occasion is a supply of appreciable uncertainty, implied volatilities within the post-event expirations are likely to rise considerably as we get nearer to the occasion.

Nonetheless, IV tends to plummet as soon as the occasion is behind us and the market has digested the results. That is IV Crush, an impact we have already mentioned on this article.

But it surely’s some extent that deserves to be pushed house. A number of backtests present that, on common, holding straddles by way of earnings (the preferred type of occasion volatility) is an unprofitable technique. Whereas there isn’t any doubt that some merchants can decide and select their straddles correctly sufficient to create a worthwhile technique for themselves, we choose to play the possibilities.

As a substitute, we exploit the tendency for earnings volatility to get dearer within the lead-up to the occasion. Nonetheless, as a substitute of holding by way of the earnings launch, we select to promote earlier than it.

The technique of shopping for straddles 2-15 days earlier than earnings and promoting earlier than the occasion is our bread and butter technique. It may produce 5-10% achieve in a brief time frame with a really restricted threat and in addition function a black swan safety as a result of the good points will probably be very giant in case of a black swan occasion.

Backside Line

The lengthy straddle is an easy choice unfold. You purchase a put and name on the similar strike worth and expiration. However easy doesn’t imply simple.

The underside line is that the straddle is a wager on important change. A dealer shopping for a protracted straddle is betting on the inventory’s worth making a sizeable directional worth transfer or that the choices market will considerably increase the worth of volatility.

A protracted straddle choice is usually a good technique beneath sure circumstances. Nonetheless, bear in mind that if nothing occurs in time period of inventory worth motion or IV change, the straddle will bleed cash as you method expiration. It ought to be used fastidiously, however when used appropriately, it may be very worthwhile, with out guessing the course.

The next Webinar discusses completely different features of buying and selling straddles.

Like this text? Go to our Choices Training Heart and Choices Trading Weblog for extra.

Associated articles

Subscribe to SteadyOptions now and expertise the total energy of choices buying and selling at your fingertips. Click on the button under to get began!