For an investor that wishes to wager on a market decline, one of many easiest methods to take action is with a bear put unfold.

Description of the Technique

A bear put unfold consists of two choices: a protracted put and a brief put. The 2 choices mixed kind the “spread.” The thought behind such a put unfold is to revenue on the lengthy put choice whereas shedding on the quick put choice. As a result of the quick put is roofed by the lengthy put, the lengthy put choice could have extra intrinsic worth at expiration than the quick put, producing a revenue.

Right here is an easy instance: Suppose you will have been watching inventory XXX, which is at present buying and selling at $25 per share. You consider that an upcoming earnings announcement will fall wanting expectations, and the inventory may see a big decline. You determine that one of the best ways to play such a possible transfer is with a bearish put unfold.

With the inventory worth at $25, you have chose to provoke a bearish put unfold utilizing the $24 and $21 strike costs. Due to this fact, you concurrently purchase the $24 put and promote the $21 put for a web premium of $.50. The choices have 60 days till expiration. The utmost revenue potential on this unfold is calculated because the unfold between strike costs ($24 minus $21 equals a $3.00 unfold) minus the premium paid of $.50 for a most revenue of $2.50.

The utmost threat on the place is the premium paid plus any commissions and costs. Within the above instance, subsequently, the utmost threat is simply $.50.

To provide the utmost revenue, the inventory worth should decline to $21 or much less at expiration. If the market declines, however not all the way in which to $21 or beneath, break-even could also be calculated because the lengthy choice strike worth of $24 minus the premium paid of $.50 for a break-even stage of $23.50. Any motion between the break-even stage of $23.50 and $21 would equal a point-for-point revenue. If the inventory was at $22 at expiration, for instance, the revenue can be calculated as break-even of $23.50 minus $22 for a $1.50 revenue.

After all, not each commerce will go as deliberate. Now suppose for a second that your forecast for the inventory was fully off-base, and the inventory does not fall however climbs. On this case, if the inventory worth is above the lengthy strike worth of $24 at expiration, you’d stand to lose your entire premium paid of $.50.

Bear Put Unfold Revenue & Loss Diagram

When to place Bear Put Unfold

A bear put unfold can be utilized for both a bearish forecast on the inventory or extraordinarily low ranges of implied volatility. For those who consider {that a} inventory or different asset class is because of fall, the bearish put unfold may be a good way to play that opinion with restricted threat and respectable revenue potential.

As a result of choices are additionally affected by ranges of implied volatility, a bearish put unfold will also be used to precise an opinion on IV ranges. On this case, the market doesn’t essentially even have to maneuver decrease to provide a revenue. The commerce doubtlessly income from a rise in IV, which might result in rising choice values.

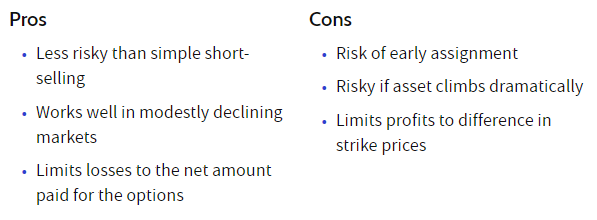

Professionals of the Bear Put Unfold Technique

The bearish put unfold has a variety of potential benefits. Maybe the largest benefit to this sort of unfold is its outlined threat. No matter what the market does, the investor can’t lose greater than the premium paid for the place.

Promoting the put choice with the decrease strike worth helps offset the price of buying the put choice with the upper strike worth. Due to this fact, the web outlay of capital is decrease than shopping for a single put outright.

This kind of unfold can also doubtlessly produce a better return on funding, or ROI, in comparison with buying and selling the underlying inventory or contract. It’s because promoting inventory quick requires margin, and the investor might should put up considerably extra capital to promote quick in comparison with shopping for an choice unfold.

Cons of the Bear Put Unfold Technique

As a result of the unfold makes use of choices, it’s uncovered to the quite a few dangers that include a long-options place. As a consequence of the truth that choices have a restricted lifespan and expiration date, they are going to lose worth as time passes with all different inputs remaining fixed. A bearish put unfold also can lose cash even when the market does decline attributable to a pointy drop in implied volatility ranges.

Choices are affected by a number of key elements, together with IV ranges, time and worth. Which means that not solely does the dealer should be appropriate concerning the market route, however additionally they should be proper concerning the timing and different elements as effectively.

Danger Administration

There are numerous totally different colleges of thought in relation to managing a bearish put unfold. The chance administration methods used may be primarily based on worth, time and worth. For instance, a easy methodology for managing threat is to shut the place if it declines in worth by half. Utilizing the earlier instance above, for those who purchased a put unfold for $.50 and it declined to $.25, you’d shut the place and transfer on.

One other methodology includes time till expiration. For those who purchased a put unfold with 90 days till expiration, you would possibly elect to shut the place win, lose or draw as soon as it has solely 30 days left.

Acceptable threat administration methods might rely on the investor’s threat tolerance, market situations and different elements. No matter methodology is chosen, a very powerful factor is to have a plan after which follow it.

Doable Changes

A bearish put unfold can also be adjusted because the commerce unfolds. For instance, if the market has began to maneuver favorably, however the choices solely have a brief period of time left till they expire, you may elect to “roll” the place out. This includes promoting the present unfold and shopping for the identical unfold and even utilizing totally different strikes for a later expiration date.

When you have seen a big proportion revenue on a selection that also has plenty of time left, you possibly can elect to take income and purchase a brand new unfold that’s additional away (even decrease strikes).

The bearish put unfold is an easy, but very highly effective technique that even novice choice merchants can use. With its outlined threat and strong revenue potential traits, it must be an necessary device in any dealer’s toolbox.

The Backside Line

The bear put unfold provides an excellent various to promoting quick inventory or shopping for places in these situations when a dealer or investor desires to invest on decrease costs, however doesn’t need to commit quite a lot of capital to a commerce or doesn’t essentially count on a large decline in worth.

In both of those instances, a dealer might give him or herself a bonus by buying and selling a bear put unfold, slightly than merely shopping for a put choice.

In regards to the Creator: Chris Younger has a arithmetic diploma and 18 years finance expertise. Chris is British by background however has labored within the US and recently in Australia. His curiosity in choices was first aroused by the ‘Trading Options’ part of the Monetary Instances (of London). He determined to deliver this data to a wider viewers and based Epsilon Choices in 2012.

Subscribe to SteadyOptions now and expertise the total energy of choices buying and selling at your fingertips. Click on the button beneath to get began!