:max_bytes(150000):strip_icc():format(webp)/10OptionsStrategiesToKnow-02_2-8c2ed26c672f48daaea4185edd149332.png)

Choices can be utilized to make directional bets on a market, to hedge a protracted or brief place within the underlying asset and to make bets on modifications in implied volatility. Choices can be used to generate earnings.

One of many largest makes use of of choices is to mitigate threat on a protracted place in a inventory or different asset.

Description of the Protecting Put Technique

The protecting put is a comparatively easy buying and selling or investing technique designed to attempt to hedge the danger related to a protracted place.

:max_bytes(150000):strip_icc():format(webp)/10OptionsStrategiesToKnow-02_2-8c2ed26c672f48daaea4185edd149332.png)

For instance, if a dealer or investor is lengthy 100 shares of inventory ABC, then she or he could search for methods to guard towards a decline within the inventory worth.

The protecting put technique merely entails the acquisition of a protracted put possibility which will probably achieve in worth if the inventory worth declines. Right here is an easy instance:

Protecting Put Instance

Dealer Joe is bullish on inventory ABC and owns 100 shares at a median buy worth of $40 per share.

The corporate has a serious earnings announcement developing in a couple of weeks, and Joe needs to hedge his draw back threat within the inventory utilizing protecting places.

With the inventory presently buying and selling at $45 per share, Joe decides to buy the 2 month $40 put possibility (ie the strike worth is $42) for a premium of $4.

Protecting Put Instance

If the earnings announcement is taken into account bullish and the inventory worth rises, the put possibility can both be bought again to the market at a loss or may be held till expiration.

If the inventory worth is above the choice strike worth of $40 at expiration, then the choice merely expires nugatory and Joe is out the $4 premium paid for the put.

If the inventory worth have been to plummet, nonetheless, Joe’s put may probably achieve in worth and presumably offset some and even the entire losses on the inventory.

If the inventory worth is under the choice strike worth of $40 at expiration, then Joe has the best to promote his shares at $40 no matter how low the inventory worth goes.

For instance, if the inventory worth declined all the best way to $35 per share, Joe’s losses can be restricted to the $4 possibility premium paid per share.

When To Put It On

The protecting put is used to attempt to mitigate draw back threat on a protracted place, and can be utilized below a wide range of circumstances. Within the instance used above, the dealer needed to attempt to hedge the draw back threat that might come from a serious earnings announcement.

In one other state of affairs, a long-term investor would possibly frequently buy lengthy places on a inventory place that he believes may see a pointy rise in volatility. Lengthy places are additionally lengthy vega.

In one more case, a dealer or investor may buy a put if implied volatility ranges are very low, thus making the choices comparatively cheaper.

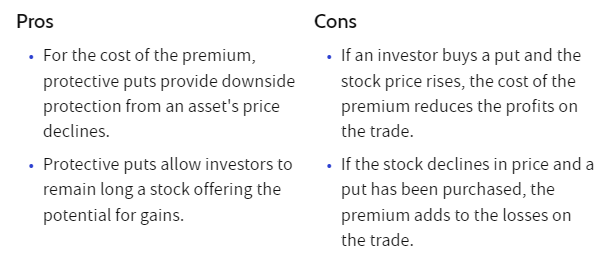

Professionals of Technique

The protecting put’s main goal is to hedge draw back threat of a protracted place within the underlying asset.

Choices can present a level of safety for a protracted place as may probably produce a revenue if the shares drop or if there’s a important enhance in implied volatility ranges.

As a result of the put possibility is bought, the danger on the put place is restricted to the premium paid for the choice.

Cons of Technique

The technique does include some cons as effectively. As a result of choices have an expiration date, the possibility will lose worth as time passes with all different inputs remaining fixed.

Choices which can be near the present share worth may be prohibitively costly, forcing the dealer or investor to buy places which can be additional away from the cash.

Though places which can be additional away from the cash could present a hedge towards a serious sell-off, the dealer or investor continues to be uncovered to a level on the inventory.

A put that could be a few {dollars} out of the cash could not achieve sufficient worth to offer a hedge towards a minor to average decline within the inventory.

Threat Administration

Threat administration for a protecting put may be completed in numerous methods.

If one is hedging a protracted place, she or he could also be keen to easily maintain the choice till it expires understanding that they may lose your complete premium paid.

One other strategy to handle threat could also be to promote the put again to the market if it loses a specific amount of worth. Some merchants could resolve, for instance, to promote a put again to the market if it loses half of its worth.

One other methodology of threat administration may embody rolling the put out to a later expiration date.

Attainable Changes

There are a number of methods to regulate a protracted put place. The dealer or investor may initially purchase a put that’s farther from the cash, and roll it nearer to the inventory worth as expiration will get nearer and the choices turn out to be cheaper.

One other methodology could possibly be to roll the lengthy put out to a later expiration date utilizing the identical or perhaps a totally different strike worth. The dealer or investor may even resolve to unfold the lengthy possibility by promoting an out-of-the-money put towards it to decrease the associated fee foundation.

Utilizing a put to guard a protracted place within the underlying is a comparatively easy place, however it does include its personal set of dangers.

Merchants and traders should resolve how a lot threat they’re keen to imagine on the inventory worth, and should additionally resolve what they’re keen to pay for the hedge.

Used below the best circumstances, the lengthy put can present a level of safety for a protracted place, however that potential safety does come at a price.

Backside Line

Protecting places restrict potential losses from proudly owning shares and don’t influence most beneficial properties from proudly owning shares. Nevertheless, like different varieties of insurance coverage, you need to pay a premium to purchase protecting places. Over the long run, shopping for protecting places can drag down your funding returns.

Merchants and traders should resolve how a lot threat they’re keen to imagine on the inventory worth, and should additionally resolve what they’re keen to pay for the hedge.

Used below the best circumstances, the lengthy put can present a level of safety for a protracted place, however that potential safety does come at a price.

Concerning the Creator: Chris Younger has a arithmetic diploma and 18 years finance expertise. Chris is British by background however has labored within the US and currently in Australia. His curiosity in choices was first aroused by the ‘Trading Options’ part of the Monetary Occasions (of London). He determined to convey this data to a wider viewers and based Epsilon Choices in 2012.

Subscribe to SteadyOptions now and expertise the complete energy of choices buying and selling at your fingertips. Click on the button under to get began!